In a day marked by volatility and investor caution, the Copenhagen stock market faced a downward trend, with the OMX Copenhagen 20 index closing at a decline of 0.96%. On [date], trading on the Danish exchange reflected broader economic uncertainties and evolving market dynamics that have been influencing investor sentiment. As various sectors navigated challenges, traders remained attentive to both local and international developments impacting stock performance. This article delves into the key factors that contributed to the dip in Denmark’s market, providing insights into the performance of major stocks and potential implications for investors moving forward.

Denmark Market overview Reflects Investor Caution Amid Economic Uncertainty

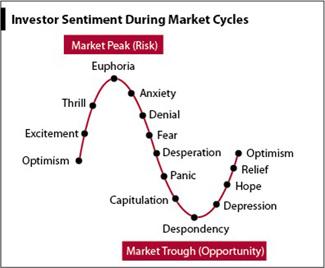

The recent performance of Denmark’s stock market highlights a prevailing sense of caution among investors in light of ongoing economic uncertainty.The OMX Copenhagen 20 index closed down by 0.96%, with several key sectors feeling the impact of rising interest rates and geopolitical tensions. Analysts have noted a marked decline in investor sentiment,as worries about inflation and sluggish growth weigh heavily on market dynamics. This cautious approach is further exacerbated by fluctuations in consumer confidence and potential shifts in government policy that may affect trade and investment.

Investors are pivoting towards a more defensive strategy, focusing on stability rather then growth as they navigate through these tumultuous waters. As an inevitable result, sectors traditionally viewed as safe havens, such as utilities and consumer staples, have gained traction. In comparison,more volatile sectors like technology and discretionary goods are experiencing heightened sell-offs. The following factors are contributing to the current climate:

- Interest Rate Hikes: central banks’ tightening policies are stirring anxiety over borrowing costs.

- Global Supply chain Issues: continuing disruptions are affecting production and delivery timelines.

- Geopolitical instability: Tensions in europe are prompting investors to reevaluate risk.

- Inflationary Pressures: Rising costs are impacting consumer spending behavior.

Sector Performance Analysis: Key Drivers Behind OMX Copenhagen 20 Decline

In the latest trading session, the OMX Copenhagen 20 experienced a notable dip, closing down by 0.96%.This decline can be attributed to several key factors that influenced the market’s overall performance. Firstly, escalating global economic concerns are weighing heavily on investor sentiment. As inflation rates remain stubbornly high, there is growing speculation regarding potential interest rate hikes from central banks, which tends to dampen market enthusiasm. Additionally, volatility in energy prices is creating uncertainty, notably for companies heavily reliant on these fluctuating costs.

Moreover, sector-specific issues played a important role in the downturn. The healthcare sector, often a stronghold for the index, faced downward pressure from disappointing earnings reports from major players. In contrast, the industrial sector has shown resilience; however, concerns about supply chain disruptions and labor shortages continue to linger. Key contributors to the decline include:

- Weak earnings reports from leading companies

- Rising inflation pressures impacting consumer spending

- Geopolitical tensions affecting investor confidence

| Company | Stock Movement | sector |

|---|---|---|

| Company A | -1.5% | Healthcare |

| Company B | -0.8% | Industry |

| Company C | -2.0% | Consumer Goods |

Investor Sentiment: Understanding the Factors Influencing Danish Stocks

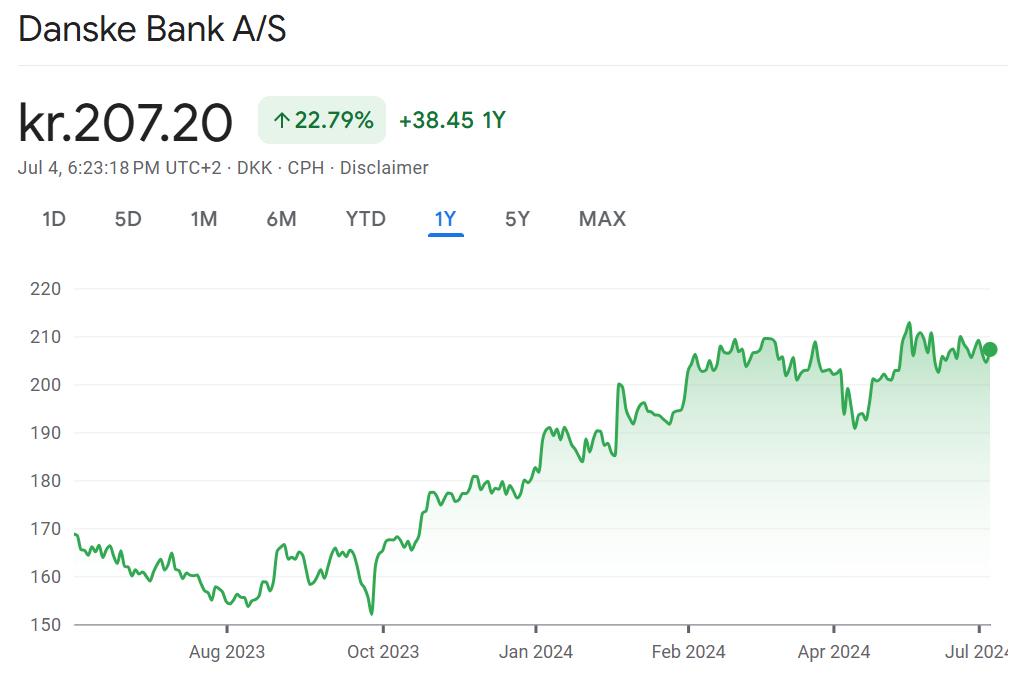

The decline in the OMX Copenhagen 20 index, which fell by 0.96% at the close of trade, reflects a complex interplay of investor sentiment and several underlying factors. fluctuations in global markets, particularly influenced by geopolitical tensions and changing economic indicators, have left investors cautious. The anticipation of interest rate hikes from central banks, along with inflationary pressures, continues to create unease among stakeholders in Denmark’s robust export-driven economy. Furthermore, sector-specific challenges, especially in the industrial and shipping segments, have added to the cautious outlook.

Key elements influencing investor sentiment in the Danish stock market include:

- Global Economic Trends: Changes in major economies, particularly in the EU and the US, critically impact exports.

- Consumer confidence: A decrease in consumer spending can adversely affect domestic companies.

- Currency Fluctuations: The strength of the Danish krone against other currencies affects profit margins for exporters.

- Regulatory Environment: Any anticipated changes in market regulations can lead to uncertainty.

| Factor | Impact on Stocks |

|---|---|

| Interest Rate Changes | Potential sell-off in equities as borrowing costs rise |

| Geopolitical Events | increased volatility, leading to cautious investing |

| Inflation Rates | Eroding purchasing power, impacting consumer spending |

| Global Supply Chain Issues | Higher operational costs for companies reliant on imports/exports |

Strategic Recommendations for Navigating a Volatile Market Environment

In light of the recent downturn reflected by the OMX Copenhagen 20 index, investors should consider adopting a multi-faceted strategy to mitigate risks in a volatile market environment. Diversification remains key; spreading investments across different sectors can shield portfolios from sector-specific downturns. Additionally, monitoring economic indicators such as inflation rates, interest rates, and manufacturing data can provide critical insights into market movements. Building a balanced portfolio with a mix of equities, bonds, and choice assets will enhance resilience against volatility.

Moreover, focusing on high-quality stocks with strong fundamentals is essential. Companies that have demonstrated consistent earnings and robust balance sheets are likely to withstand adverse market conditions better than those with high valuations yet unstable financial positions. Its also advisable to maintain a long-term investment horizon; knee-jerk reactions to short-term market fluctuations can lead to poor decision-making. Regular portfolio reviews and adjustments based on ongoing economic trends will ensure that investments remain aligned with market realities.

| Strategy | Description |

|---|---|

| diversification | Spreading investments across various sectors to reduce risk. |

| Quality Focus | Investing in companies with strong fundamentals and consistent earnings. |

| Long-Term Outlook | Staying invested for the long haul rather than reacting to market noise. |

Outlook for Denmark Stocks: Predictions and Potential recovery Signals

As Denmark’s stock market closes with the OMX Copenhagen 20 index down by 0.96%, investors are keenly analyzing the factors contributing to this downturn. while macroeconomic challenges persist, including global inflation pressures and potential shifts in monetary policy, there are signals that coudl indicate a potential recovery on the horizon. Analysts suggest that key sectors, particularly renewable energy and technology, may present opportunities for growth as Denmark continues to lead in innovations and sustainability initiatives.

Market sentiment remains cautious, yet there are signs that could pave the way for a rebound. Investors should keep an eye on:

- Corporate Earnings Reports: Upcoming earnings releases may provide insight into the resilience of Danish companies amidst current economic headwinds.

- Global Economic Trends: Monitoring international markets and economic indicators, particularly from the EU, will be critical.

- Government Stimulus Measures: any new fiscal policies aimed at supporting business growth and investment can boost market confidence.

| Sector | Recent Performance | Recovery Potential |

|---|---|---|

| Renewable Energy | +1.5% | High |

| Technology | -0.3% | Moderate |

| Consumer Goods | -2.0% | Low |

Wrapping Up

the trading session on the Copenhagen Stock Exchange closed on a negative note, with the OMX Copenhagen 20 index declining by 0.96%. This downturn reflects a broader trend observed in European markets, influenced by various economic factors and investor sentiment. As traders and analysts continue to monitor developments both domestically and internationally, the performance of danish stocks will remain a point of interest in the coming days. Investors are advised to stay informed and consider the potential implications of current market dynamics. For further updates on stock market trends and financial news,stay tuned to investing.com.