Bulgaria Producer Prices Climb to 2-Year High: An Analysis of the Latest economic Trends

In a significant growth for BulgariaS economy, producer prices have surged to their highest levels in two years, reflecting a complex interplay of global supply chain challenges, domestic demand, and inflationary pressures.According to recent data from TradingView, this upward trend in producer prices not onyl underscores the evolving landscape of the Bulgarian market but also poses implications for businesses, consumers, and economic policymakers. As the country grapples with these rising costs, analysts are closely examining the factors driving this increase and its potential impact on future economic stability and growth. in this article, we delve into the specifics behind the data, explore the sectors most affected, and consider what this trend could mean for bulgaria’s economic outlook in the months to come.

Bulgarias Producer price Surge Reflects Economic Trends

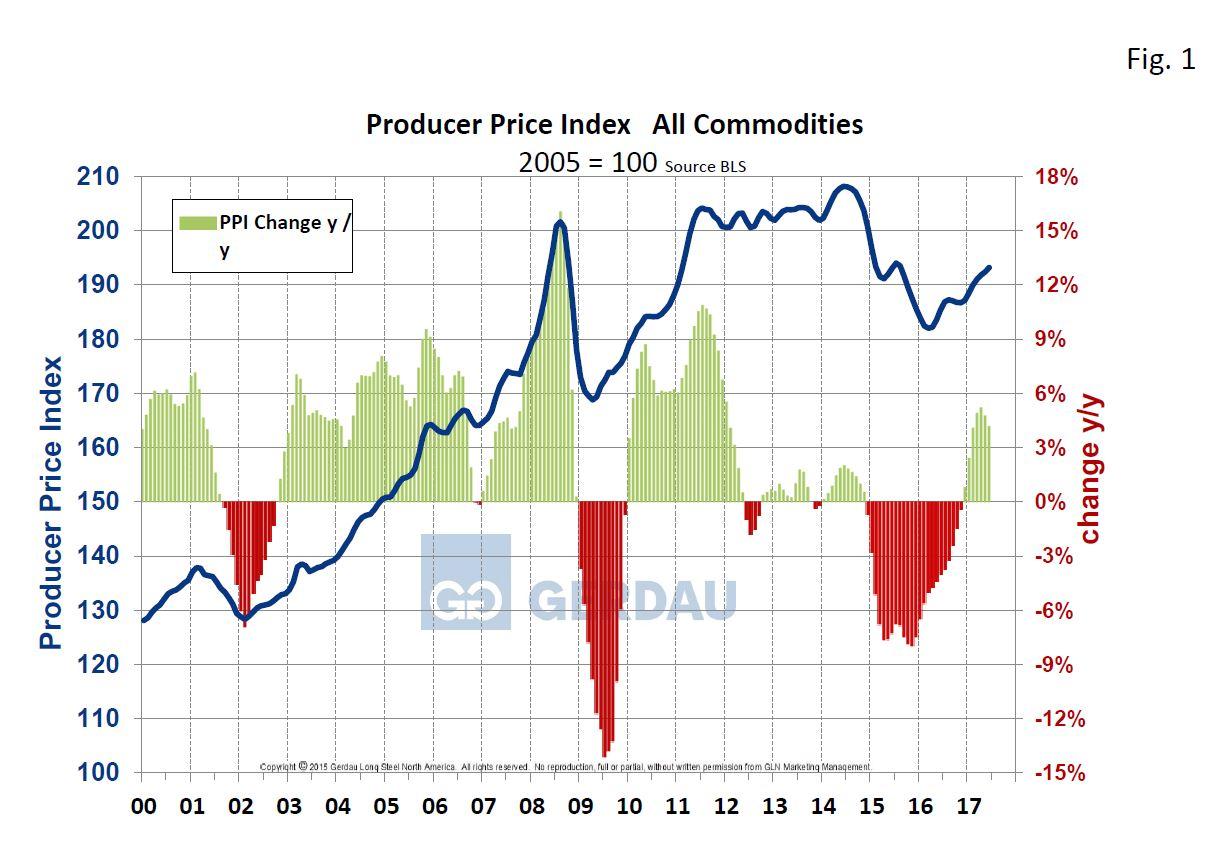

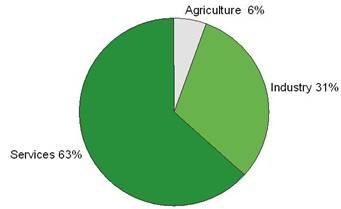

Bulgaria’s recent producer price surge serves as a bellwether for the country’s economic landscape, unveiling key insights into the nation’s manufacturing and commodity sectors. Over the past year, the rise in producer prices has been influenced by a confluence of factors, including fluctuations in raw material costs, supply chain disruptions, and increasing demand for locally produced goods. This trend mirrors broader European patterns, as inflation and production costs continue to strain various markets across the continent.

The implications of climbing producer prices are multifaceted, impacting everything from consumer goods to export competitiveness. businesses are grappling with the challenge of passing on increased costs to consumers while trying to maintain market share.Key areas that are experiencing notable price changes include:

- agricultural Products: Rising costs are impacting food prices, contributing to inflationary pressures.

- Manufactured Goods: A spike in demand has led to heightened material costs, with producers facing difficulties in sourcing materials.

- Energy Sector: Fluctuations in energy prices are considerably affecting operational costs for many industries.

| Sector | Price Change (%) | Impact |

|---|---|---|

| Agriculture | 7.5 | Increased food prices |

| Manufacturing | 5.2 | Rising material costs |

| Energy | 10.0 | Higher operational expenses |

Factors Driving the Rise in Producer Prices

The recent surge in producer prices in Bulgaria can be attributed to a confluence of factors impacting various sectors of the economy. One of the primary drivers is inflationary pressures that have surged globally, causing input costs for raw materials and production to rise steeply.This inflation is exacerbated by disruptions in supply chains and a significant increase in energy prices, which have hit manufacturers hard. Additionally, increased demand following the pandemic recovery has led to a competition for limited resources, further pushing up prices. Key areas contributing to this trend include:

- Rising Energy Costs: Fluctuating oil and gas prices have a direct impact on production expenses.

- Supply Chain Disruptions: Ongoing delays and shortages of essential materials continue to escalate costs.

- Labor Market Pressures: Tight labor markets have led to wage increases,further contributing to higher production costs.

Moreover, regulations and government policies aimed at environmental sustainability are leading to additional compliance costs for producers. Factors such as the transition to greener production methods and the implementation of stricter environmental laws create a burden for manufacturers who need to invest in new technologies. Additionally, global commodity prices remain volatile, heavily influencing domestic pricing strategies. A breakdown of the notable sectors affected can be illustrated in the table below:

| Sector | driver of Price Increases |

|---|---|

| Manufacturing | Raw Material costs |

| Energy | Fuel Prices |

| Construction | Labor and Supplies |

Impact on Consumer Goods and Inflation Rates

The recent surge in producer prices in Bulgaria, reaching a two-year high, signals a critical point in the landscape of consumer goods and inflation. As production costs escalate,manufacturers may opt to pass on these increases to consumers,which could lead to a ripple effect on retail prices. This situation raises several concerns for both consumers and retailers alike:

- Increased Prices: Higher production costs can directly translate to increased prices at the checkout, affecting essential goods such as food, household items, and personal care products.

- Consumer Spending: Rising prices might compel consumers to reconsider their spending habits, perhaps prioritizing necessities over discretionary spending.

- Supply chain Adjustments: Retailers may need to adjust their supply chain strategies to mitigate impacts from rising costs, leading to fewer product offerings or changes in availability.

Moreover, this pricing pressure could have broader economic implications, potentially impacting inflation rates across various sectors. As the cost of goods rises, inflation may not only accelerate but could also outpace wage growth, eroding purchasing power. A simplified overview of potential inflation impacts is illustrated below:

| Factor | Impact on Inflation |

|---|---|

| Producer Costs | ↑ |

| Consumer Demand | ↓ (if prices rise too quickly) |

| Wage Growth | ↑ (if it lags behind price increases) |

Sector-Specific Insights: Who Benefits and Who Suffers

Bulgaria’s recent spike in producer prices, reaching levels not seen in two years, has a ripple effect across various sectors, leading to a clear divergence between beneficiaries and those facing challenges. Manufacturing industries, particularly those focused on exports, are likely to experience a boost as the increased pricing allows for better profit margins. Key beneficiaries include businesses involved in the production of agricultural goods, construction materials, and textiles, all of which are enjoying rising demand amidst escalating costs.

Conversely, sectors dependent on consumer spending, such as retail and hospitality, may encounter headwinds as rising production costs trickle down to pricing. These sectors could see a contraction in customer spending, impacting their profitability. Moreover, small enterprises that lack the financial cushioning to absorb increased costs are particularly vulnerable, potentially leading to job losses and business closures. To illustrate the varying impacts, consider the following table:

| Sector | Impact | Example |

|---|---|---|

| Manufacturing | Positive | Textile Production |

| Agriculture | Positive | Crop Processing |

| Retail | Negative | Clothing Stores |

| Hospitality | Negative | Restaurants |

Strategic Recommendations for Investors and Businesses

As Bulgaria’s producer prices reach a two-year high, investors should approach the market with a careful assessment of the economic landscape. The rising production costs can indicate a potential shift in consumer pricing, which could affect profit margins across various sectors. Thus, it is indeed essential for investors to closely monitor:

- The agricultural sector: Given the significance of food production in the country, changes in prices may directly impact both export opportunities and domestic consumption.

- manufacturing industries: Increased costs could lead to a reevaluation of pricing strategies, especially for goods that rely heavily on raw materials.

- Energy costs: With producer price increases often linked to energy, businesses should prepare for fluctuations that could alter operational expenditures.

For businesses navigating these dynamics, strategic adjustments are crucial. companies might consider implementing measures such as:

- Cost optimization: Streamlining operations to reduce waste and inefficiencies can help mitigate rising costs.

- Price strategy reevaluation: Analyzing pricing models in relation to market demand and cost structures will be essential for maintaining competitiveness.

- Diversification of suppliers: Broadening supplier bases can reduce dependence on any single source and help stabilize prices.

| Sector | Impact of Rising Prices |

|---|---|

| agriculture | Increased production costs may lead to higher food prices. |

| Manufacturing | Changing cost structures may squeeze profit margins. |

| Energy | Cascading effects on operational costs across sectors. |

Future Outlook: What This Means for Bulgarias Economy

As Bulgaria’s producer prices have hit a two-year peak, the implications for the national economy are profound and multi-faceted. An increase in producer prices typically signals escalating costs for manufacturers, which can lead to a ripple effect across various sectors. Businesses, faced with higher input costs, may pass these expenses onto consumers, leading to inflationary pressures. Consequently, this scenario could strain household budgets, affecting purchasing power and potentially dampening consumer spending, a critical driver of economic growth. Additionally,sectors heavily reliant on imported raw materials may find their profit margins squeezed,subsequently influencing their investment strategies and operational sustainability.

Moreover, the rise in producer prices may reveal a burgeoning demand for local goods, as companies prioritize domestic production to mitigate rising global logistics costs. This trend could encourage governmental initiatives that focus on boosting local industries, thereby strengthening economic resilience. Moreover, policymakers might need to evaluate monetary strategies to balance inflationary pressures while supporting economic expansion. The overall landscape suggests a pivotal moment for Bulgaria, where strategic decisions made today will shape its economic trajectory in the coming years. Ensuring a balance between maintaining competitive pricing and supporting local production will be essential for fostering a stable economic surroundings.

Concluding Remarks

the recent increase in Bulgaria’s producer prices to a two-year high reflects significant shifts within the nation’s economic landscape. This upward trend, driven by various factors including rising raw material costs and supply chain disruptions, has profound implications for businesses and consumers alike. As industries grapple with these changes, the potential for inflationary pressures looms, which may influence monetary policy decisions in the near future. Stakeholders will need to stay vigilant as they navigate this evolving economic environment,ensuring they are prepared to adapt to the challenges and opportunities that arise. Continued monitoring of the producer price index will be crucial for understanding the broader implications for Bulgaria’s economy and its position within the European market.

Posts Share Bogus Audio of Donald Trump Jr. Supporting Arms for Russia, Not Ukraine – FactCheck.org