Czech Republic: Taxation of Employee Share and Stock Option Plans Reverts to Pre-2024 Landscape

In a significant policy reversal, the Czech Republic has reinstated its pre-2024 taxation framework for employee share and stock option plans, marking a crucial shift for businesses and employees alike. This decision comes in response to ongoing discussions about the effectiveness and implications of recent tax reforms that aimed to enhance employee benefits and incentivize workforce retention. With insights from KPMG experts, this article delves into the ramifications of this policy change, exploring its potential impacts on employee compensation structures, corporate strategy, and overall economic activity in the region. As businesses navigate this evolving landscape, understanding the nuances of re-established tax regulations will be essential for maximizing both employee engagement and organizational growth.

Tax Changes Impacting Employee Share and Stock Option Plans in the Czech Republic

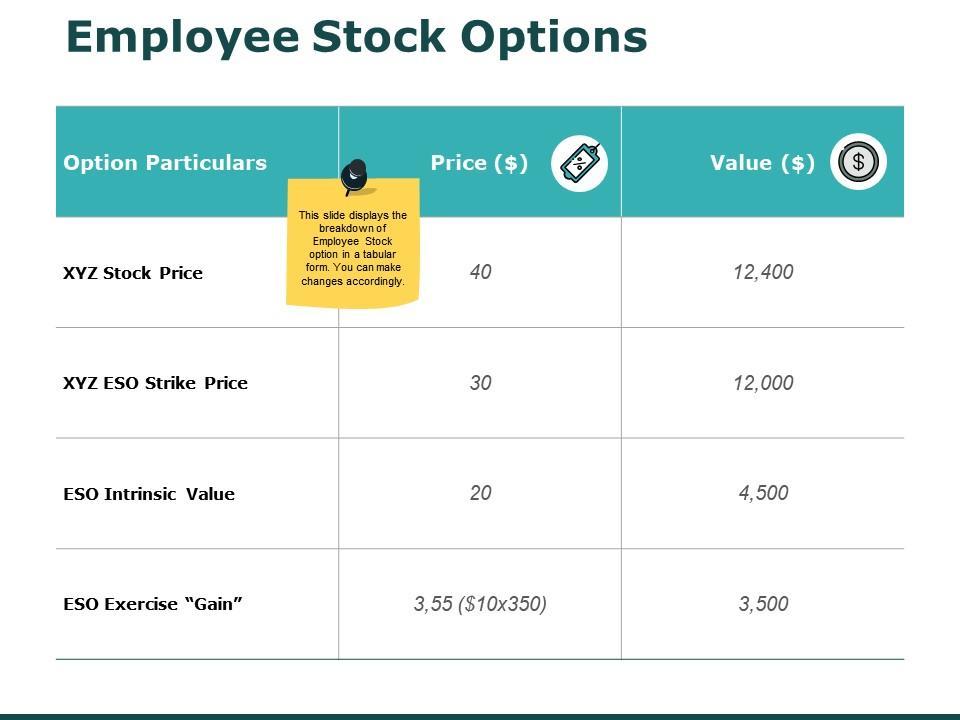

As of 2024, the Czech Republic has reverted to its pre-2024 taxation framework concerning employee share and stock option plans. This shift is significant for both employers and employees, as it reinstates previous tax obligations that had been temporarily altered. Under the updated regime, taxation criteria will include:

- Income Tax: Employees will now pay standard income tax on gains realized upon the vesting of shares or execution of stock options.

- Social Security Contributions: The contributions will again apply in situations where the shares or options are granted without a direct cash payment.

- Corporate Tax Deductions: Employers may only deduct expenses related to share distributions the moment employees recognise income.

This return to earlier practices brings clarity to the accounting procedures and compensation structures involved in these plans. However, it also poses potential implications for how companies design their incentive programs. Key considerations for organizations include:

- Plan Structure: Developing attractive yet compliant share and stock option plans tailored to the updated tax dynamics.

- Employee Interaction: Clearly informing employees about the tax implications of their shareholdings to ensure understanding and compliance.

- Tax Planning: Entities may need to consider revised financial strategies that accommodate increased tax liabilities.

Understanding the Return to Pre-2024 taxation Regime for Employee Benefits

The recent legislative shift in the Czech Republic has seen a significant return to the taxation rules that were in place prior to 2024 for employee share and stock option plans. This development affects numerous businesses and their employees,marking a crucial pivot back to a more predictable tax surroundings. Under the revised regime, companies may find themselves recalibrating their employee benefits strategies while adapting to the restoration of the previous tax rates and obligations.

Key features of the reinstated taxation regime include:

- Taxation on exercise date: Employees will be liable for tax on benefits obtained from stock options at the moment of exercise, aligning with the rules prior to the changes.

- Applicable rates: The income from employee shares will be taxed at standard income tax rates, facilitating a clearer understanding of tax implications.

- Limitations on exemptions: Certain exemptions that were previously in place may no longer apply, which could lead to higher effective tax rates for some employees.

In this renewed landscape, companies should conduct a thorough review of their benefits plans to ensure compliance with the revised tax framework. Aligning employee compensation strategies with the re-established taxation approach will not only aid in compliance but will also enhance overall employee satisfaction and retention.

Key Insights into the Implications for Employers and Employees

The recent regulatory adjustments in the taxation of employee share and stock option plans in the Czech Republic bring several implications for both employers and employees. Employers must revisit their compensation strategies to align with the reinstated pre-2024 tax framework. Notably,the advantages of offering stock options as part of remuneration packages are once again attractive,allowing companies to enhance employee engagement and retention. Key factors for employers to consider include:

- Reviewing stock option structures to maximize tax efficiency.

- Communicating clearly with employees about the revised tax impacts on their take-home pay.

- Implementing training sessions to educate management on the benefits and nuances of the reinstated tax regime.

For employees, the implications are equally significant as the reality of their tax obligations shifts.With the changes returning to the previous climate, employees may find it beneficial to reassess their financial planning in light of the taxation of their stock options.Factors to consider include:

- Understanding the tax liabilities concerning stock options and how they impact overall compensation.

- Evaluating the timing of exercising options to optimize potential gains after tax considerations.

- Seeking financial advice to navigate the complexities of taxation on share plans effectively.

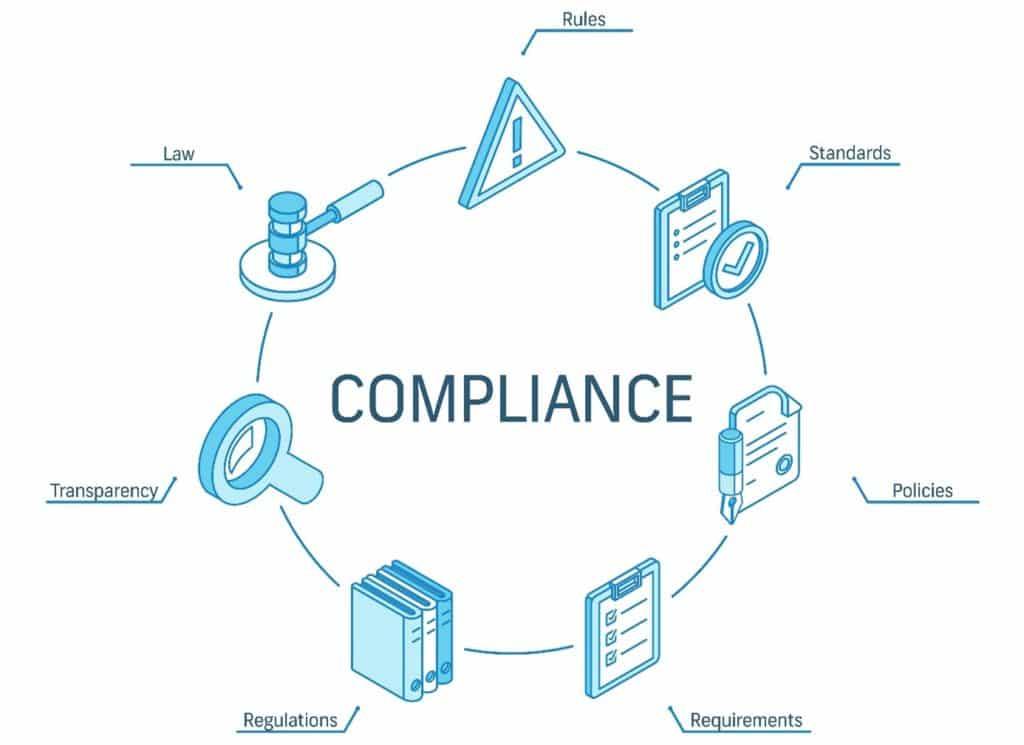

Navigating Compliance in the new Tax landscape: best Practices

As companies in the Czech Republic adjust to the reinstated tax framework for employee share and stock option plans, adherence to compliance standards has never been more vital. Organizations should prioritize a complete understanding of the regulatory requirements that govern these plans. Key best practices include:

- Regular Training: Provide ongoing education to HR and financial teams regarding the latest tax laws and compliance obligations.

- Documentation: Maintain detailed records of all share and stock option grants,including valuation reports and employee communications.

- Consultation with Experts: Engage tax advisors to ensure alignment with the current legal landscape and to navigate complex compliance issues.

Moreover, fostering transparency and communication with employees about the implications of these plans is essential. companies should consider implementing clear and accessible informational resources that outline how tax treatment impacts employees. To assist in this understanding, a summary table can illustrate the differences between recent and prior tax frameworks:

| Aspect | Pre-2024 Situation | Current Situation |

|---|---|---|

| Tax Rate on Gains | 20% | 15% |

| Employee Eligibility | Limited to senior management | Extended to all employees |

| Reporting Requirements | Annual declarations | Quarterly updates |

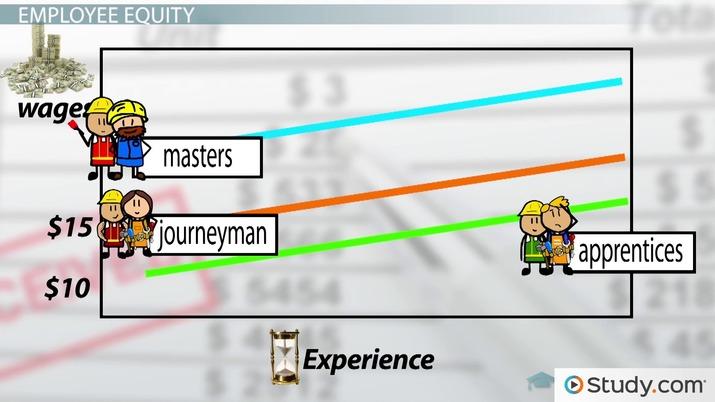

Recommendations for Optimizing Employee Equity Compensation Plans

To enhance the effectiveness of employee equity compensation plans in the wake of recent tax regulation changes, organizations should consider adopting several best practices.First, it is crucial to ensure clarity in communication regarding the plans, helping employees fully understand the benefits and implications of their participation. This could involve creating comprehensive educational materials that explain the mechanics of equity compensation,tax responsibilities,and potential future value. Second, tailoring the structure of equity awards to reflect both company performance and individual contributions can foster a stronger link between reward and performance. Options may include granting stock options at a more favorable rate during high-performance periods while utilizing restricted stock units (RSUs) during slower economic times.

Additionally, companies should consider implementing flexible vesting schedules that align with both personal and organizational milestones. A well-structured vesting framework can motivate employees to stay with the company longer while contributing to its success. Moreover, integrating tax-efficient strategies when granting equity can minimize tax burdens for employees, making the plans more attractive. To illustrate the potential impact of these strategies, the following table outlines key considerations and their potential benefits:

| Consideration | Potential Benefit |

|---|---|

| Clear Communication | Enhanced understanding and engagement |

| Performance-based Awards | Stronger motivation and alignment with company goals |

| Flexible Vesting Schedules | Increased retention and commitment |

| tax-efficient Granting | reduced financial burden on employees |

The Future of Employee Incentives: Adapting to the revised Tax Framework

As the Czech Republic reverts to the previous tax framework for employee share and stock option plans,companies must recalibrate their incentive strategies to align with this shift. This regulatory change presents an opportunity for organizations to rethink how they motivate their workforce while optimizing compliance and financial planning. Employers should consider new methods to enhance their employee incentive offerings, ensuring they remain competitive and attractive in the evolving labor market. Key aspects to evaluate include:

- Engagement Levels: Analyze how the recent changes impact employee engagement and morale.

- Cost implications: Assess the financial effects of the revised tax framework on the company’s bottom line.

- Incentive Communication: Develop clear communication strategies around the benefits and mechanisms of employee share plans.

Moreover, employers are encouraged to explore diverse incentive structures that leverage the advantages of the reinstated tax rules. Strategies may involve a blend of cash-based and equity-based incentives to maximize the potential of retaining top talent while mitigating the financial burden imposed by taxation. Organizations should also consider implementing performance-based equity plans, which align employee interests with business outcomes, fostering a shared commitment to success. A comparison of incentive structures might look like this:

| Incentive Type | Advantages | Challenges |

|---|---|---|

| Employee Stock Options | Encourages long-term loyalty, aligns with company performance | Potential tax liabilities upon exercise |

| Restricted Stock Units (RSUs) | Direct ownership with clear value | Impact on cash flow and dilution for existing shareholders |

| Cash Bonuses | Immediate gratification, easier to budget | May not drive long-term retention |

In Summary

the recent developments in the Czech Republic’s taxation landscape for employee share and stock option plans signal a significant shift back to pre-2024 regulations. As companies navigate this transition, understanding the implications of these changes will be crucial for both employers and employees alike. KPMG’s insights provide a comprehensive overview of the renewed tax structures, equipping businesses with the necessary knowledge to adapt their compensation strategies accordingly.As the landscape continues to evolve,staying informed and proactive will be essential for maximizing the benefits of such incentive schemes. Stakeholders are encouraged to consult with tax professionals to ensure compliance and to optimize their plans in alignment with the latest policies.