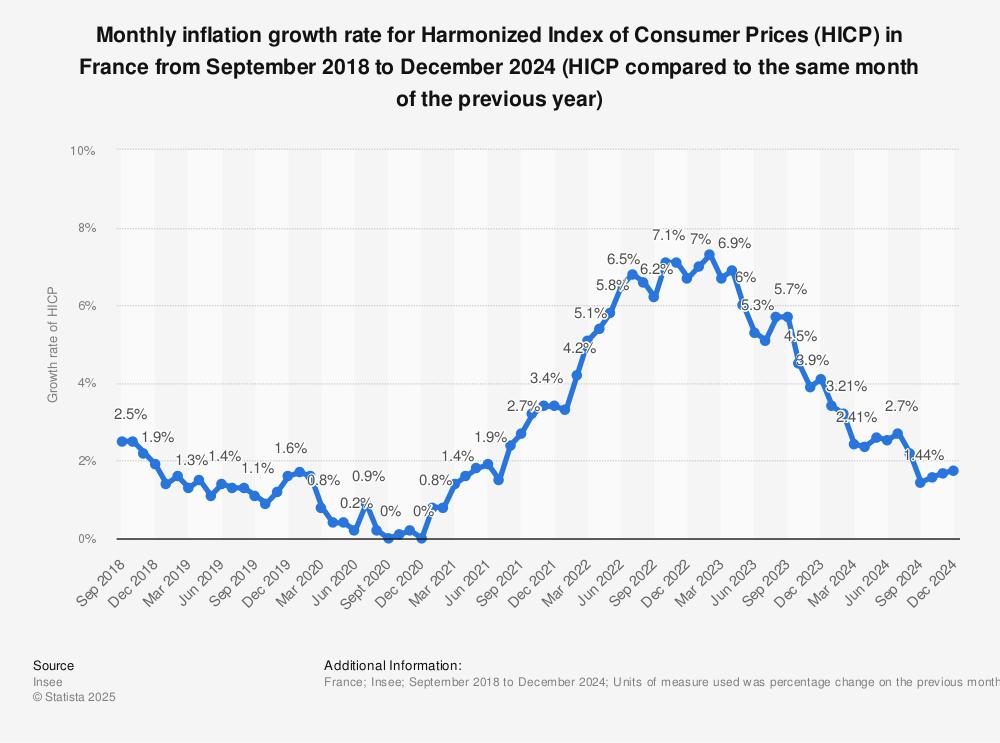

In a surprising turn of events, recent economic data reveals a significant decline in inflation rates across France, offering a glimmer of hope for consumers and policymakers alike.As inflation falls sharply,the French economy navigates a complex landscape characterized by shifting consumer behavior and tightening spending.this juxtaposition raises critical questions about the underlying drivers of economic activity and the potential implications for future growth. In this article, we delve into the factors contributing to the recent drop in inflation, examine the concurrent contraction in consumer spending, and explore what these trends mean for the broader economic outlook in France. With a detailed analysis, we aim to unpack the nuances of these developments and their potential impacts on both the French economy and its citizens.

Inflation Trends: Understanding the Recent Shift in Frances Economic Landscape

The recent decline in inflation rates across France marks a significant turnaround in the nation’s economic climate.Following a prolonged period of increased prices, consumers are now experiencing some relief as inflation sharply decreases. Factors contributing to this shift include:

- Global Supply Chain Recovery: Improved logistics and reduced shipping delays have helped stabilize prices.

- Decrease in Energy costs: A dip in global oil prices has eased the burden on household budgets.

- Government Interventions: Various fiscal measures have been implemented to control inflation, providing both short-term and long-term relief.

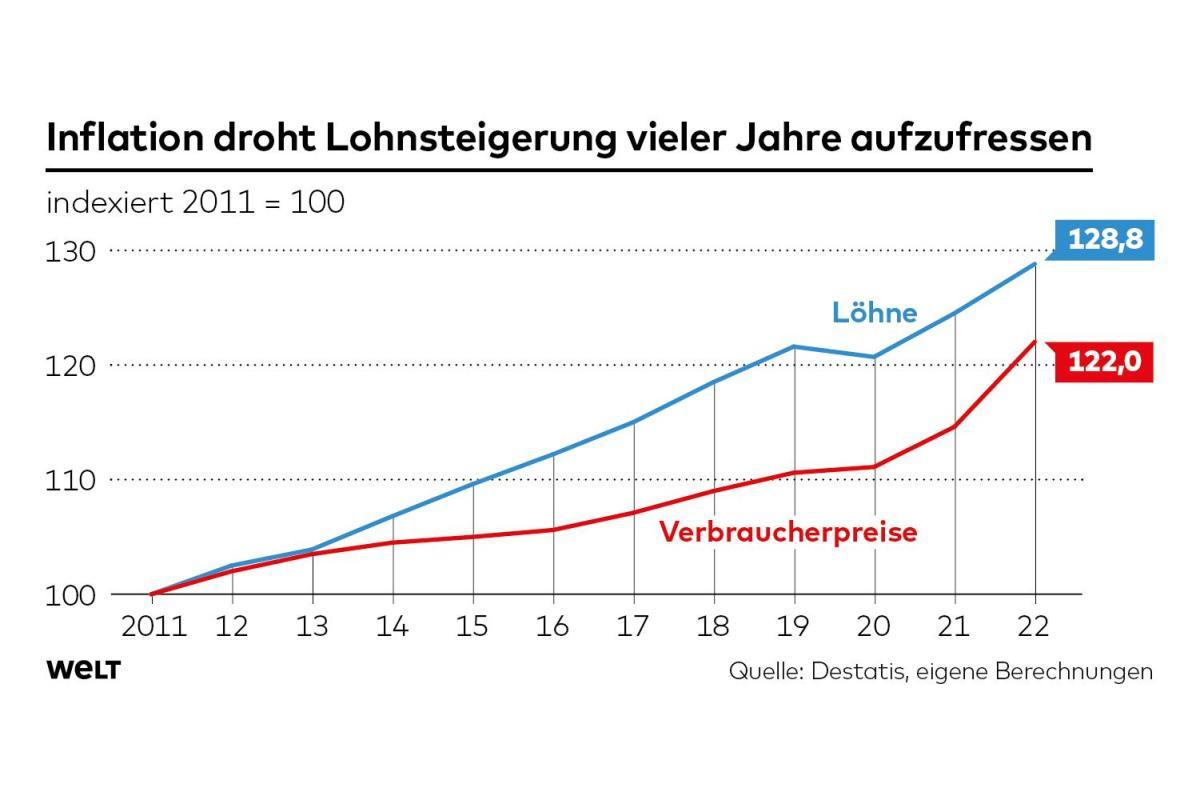

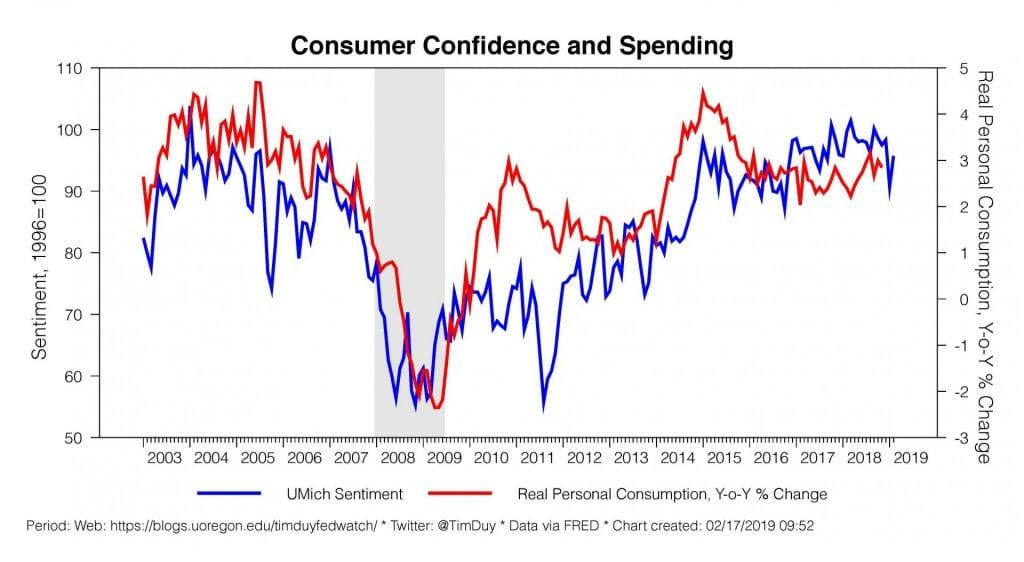

However, this downturn in inflation comes alongside a noticeable contraction in consumer spending. Many households, still recovering from the economic shocks of the pandemic, are exercising caution and prioritizing savings over expenditures. This trend highlights a complex interplay between economic factors as spending patterns shift. Key observations include:

- A Shift Towards Essentials: Consumers are focusing their spending on essential goods, leading to reduced sales in non-essential sectors.

- Rising Savings Rates: Increased caution has resulted in higher savings rates among French households.

- Impact on Retail and Services: Many businesses are experiencing slower growth, prompting discussions on the sustainability of the current economic recovery.

| Indicators | Current Rate (%) | previous Rate (%) |

|---|---|---|

| Inflation Rate | 2.1 | 5.4 |

| Consumer Spending Growth | -0.5 | 1.2 |

| Savings Rate | 15 | 10 |

Consumer Spending Decline: Analyzing the Impact on French Households

The recent downturn in consumer spending has significant implications for French households, as rising costs continue to affect purchasing behavior. Households are now facing a climate where inflationary pressures have prompted them to prioritize essential goods over discretionary items. As a result, many families are adjusting their budgets, leading to a pronounced shift in spending patterns characterized by:

- Increased savings: Many households are opting to save more as a precaution against future financial uncertainties.

- Reduced discretionary spending: Non-essential purchases, such as dining out and entertainment, have seen marked reductions.

- Shift towards value-focused consumption: Consumers are increasingly prioritizing quality and affordability in their purchases.

this contraction in consumer spending not only affects individual households but also poses broader risks to the French economy. Businesses reliant on consumer sales are witnessing decreased revenues,leading to potential cuts in workforce and investments.Here’s a snapshot of the key trends observed in consumer behavior impacting the economy:

| Consumer Spending Trend | Impact |

|---|---|

| Shift to essential goods | Higher demand for necessities results in stronger sales in supermarkets. |

| Decline in luxury purchases | Luxury retailers face pressure, possibly leading to price reductions or promotions. |

| Local vs. International Brands | Increased patronage of local brands as consumers favor sustainability and support for local economies. |

Government Response: Policy Measures to Combat Economic Downturn

The French government has initiated a series of strategic policy measures in response to the economic downturn, especially in light of the sharp decline in consumer spending. Key initiatives include:

- Fiscal stimulus Packages: To bolster consumer confidence and spending power, the government has unveiled targeted fiscal stimulus packages aimed at low- and middle-income households.

- Infrastructure Investments: Significant investments in infrastructure projects are being prioritized to create jobs, enhance public services, and stimulate economic activity in various sectors.

- Support for Small Businesses: Financial aid and grants are being extended to small and medium-sized enterprises (SMEs) to ease cash-flow challenges and foster economic resilience.

In an effort to mitigate inflationary pressures while stimulating growth, the government has also implemented monetary policy adjustments in collaboration with the central bank. These adjustments are characterized by:

- Interest Rate Management: A careful review of interest rates is being conducted to encourage borrowing and investment.

- Quantitative Easing Programs: The central bank may engage in expanded asset purchase programs to inject liquidity into the economy.

- Regulatory adaptability: Regulatory frameworks are being reassessed to remove barriers for businesses and enhance their ability to respond to changing market conditions.

| Policy Measure | Description | Expected Outcome |

|---|---|---|

| Fiscal Stimulus | targeted financial support for households | Increased consumer spending |

| Infrastructure Investment | Funding for public projects | Job creation, economic activity |

| Support for SMEs | Grants and loans for small businesses | Economic resilience |

Investment Strategies: Navigating Market opportunities Amid changing Conditions

As the latest data unveils a significant drop in inflation rates in France, investors are faced with a pivotal moment that requires astute navigation through shifting economic conditions. The contraction in consumer spending, a direct result of heightened cost-of-living pressures, raises questions about the resilience of various market sectors.Investors should carefully consider the implications for sectors such as consumer discretionary, wich may face headwinds due to reduced household spending power, while areas like utilities and essentials may present more stable investment prospects.

To effectively adjust strategies in response to these developments, stakeholders can explore a range of opportunities:

- diversification: Reassess portfolios, ensuring a blend of defensive stocks and growth opportunities.

- Sector Rotation: shift focus towards sectors poised for stability or recovery in a low-inflation habitat.

- Global Exposure: Consider investments in markets less impacted by local economic fluctuations.

| Sector | Growth Potential | Risk Assessment |

|---|---|---|

| Consumer Discretionary | Moderate | High |

| Utilities | Low | Low |

| Healthcare | Moderate | Moderate |

Future Outlook: Predictions for Frances Economy and Inflation Rate

As France navigates the aftermath of sharply falling inflation rates, a cautious optimism emerges regarding the economic landscape. Forecasting the future, several key indicators suggest a complex interplay between consumer confidence and spending habits. Experts predict that while inflation may stabilize, it is unlikely to rebound dramatically in the short term. The continuing impact of decreased consumer spending,influenced by rising living costs and cautious behavior,plays a pivotal role in shaping economic recovery. Factors to consider include:

- Unemployment Rates: Ongoing fluctuations may dictate consumer confidence and spending power.

- Government Policies: Fiscal measures aimed at stimulating growth could ease inflationary pressures.

- Global Economic Trends: The state of the international market will influence France’s economic rebound.

Looking ahead, projections indicate potential stabilization in inflation, settling at levels that could foster a more predictable economic environment. Analysts emphasize that innovations in sectors like technology and sustainability could catalyze growth, creating new job opportunities and enhancing productivity. Compelling data suggests a gradual increase in consumer spending as inflation moderates, fostering an atmosphere conducive to economic recovery. Key projections for the coming years include:

| Year | Projected Inflation Rate (%) | GDP Growth (%) |

|---|---|---|

| 2024 | 2.5 | 2.1 |

| 2025 | 2.0 | 2.5 |

| 2026 | 1.8 | 2.8 |

Expert Recommendations: How Consumers Can Adapt to the New economic Reality

As inflation rates decline in France, consumers must come to terms with shifting economic dynamics that impact their purchasing power and lifestyle. Adapting to these changes involves strategic planning and informed decision-making. Here are several recommendations that can help consumers navigate this new landscape:

- Prioritize Essential Purchases: Focus on buying necessities and limit discretionary spending to maintain financial stability.

- comparison Shop: utilize price comparison tools and apps to find the best deals, ensuring that every euro spent counts.

- Embrace Local Products: Support local economies by choosing locally-sourced goods, which can ofen be more affordable and fresher than imported items.

- Plan Meal Budgets: Create weekly meal plans and shopping lists to minimize impulsive purchases and reduce waste.

To further streamline financial management,consider examining essential expenses and identifying areas for potential savings. Keeping track of monthly budgets can illuminate spending habits and inform necesary adjustments. Below is a simplified example:

| Expense Category | Monthly Budget (€) | Actual Spending (€) | Variance (€) |

|---|---|---|---|

| Groceries | 300 | 280 | +20 |

| Utilities | 150 | 160 | -10 |

| Entertainment | 100 | 80 | +20 |

By continuously evaluating and adjusting their spending habits, consumers can better align their financial strategies with the current economic reality, fostering resilience and long-term stability.

The way Forward

the recent sharp decline in inflation rates in France marks a significant shift in the economic landscape of the nation. While this decrease may offer some relief to consumers, the accompanying contraction in consumer spending raises concerns about future growth prospects. Analysts suggest that the interplay between inflation trends and consumer behavior will be crucial in determining the trajectory of the French economy in the coming months. With policymakers and businesses closely monitoring these developments, the focus will remain on fostering a stable economic environment that balances inflation control with consumer confidence. As we continue to navigate these challenging economic times, the implications of these trends will undoubtedly resonate not only within France but across the broader European market. investors and economic stakeholders are encouraged to stay informed as the situation evolves.

Ryan Gravenberch withdraws from Netherlands squad with injury – BBC.com