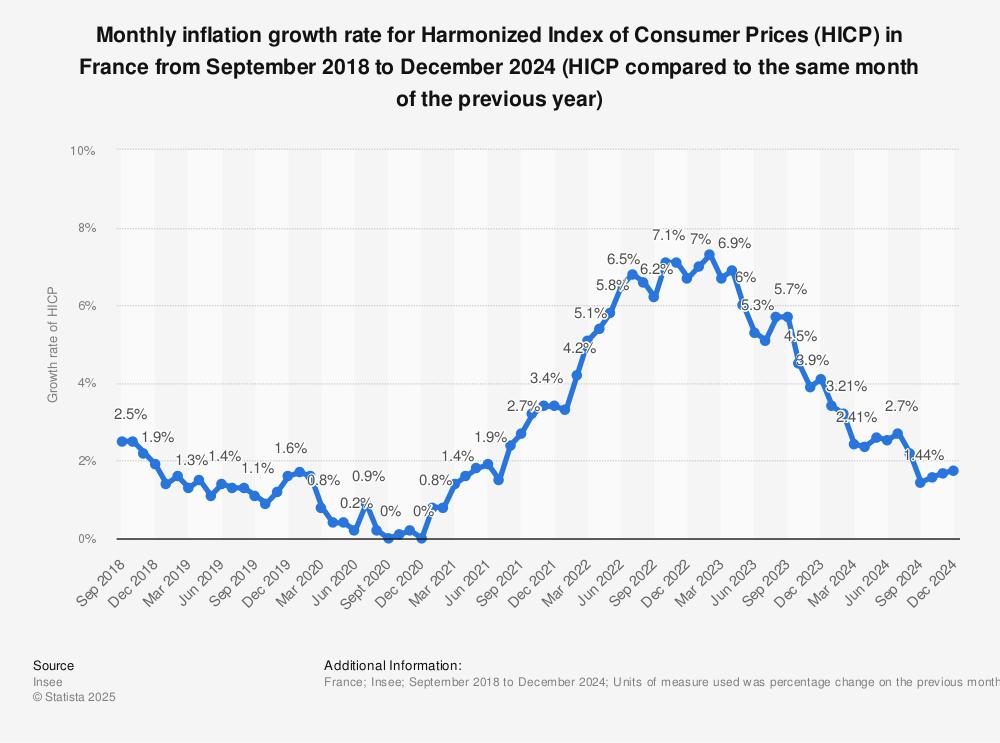

In a ŌüósurprisingŌüż turn of events, recent economic ŌüżdataŌĆŗ reveals a significant decline inŌüŻ inflation rates across ŌüŻFrance, offering aŌüż glimmer ofŌüŻ hope for consumersŌüó and policymakers alike.As inflationŌüż fallsŌüż sharply,the ŌüżFrench economyŌĆŹ navigates a complex landscapeŌüŻ characterized byŌüż shifting consumer behavior ŌĆŹandŌüó tightening ŌĆŗspending.thisŌĆī juxtaposition raises critical questions about the ŌüóunderlyingŌĆŹ driversŌĆŹ of economic activity and the potential implications for future growth. InŌüó this article, weŌĆŹ delve into theŌĆŗ factors contributing to the recent drop inŌĆī inflation, examine the concurrent contraction Ōüżin consumer spending, and explore what theseŌüż trends mean for the broader ŌüŻeconomic outlook in France. With Ōüża detailed analysis, we aim to ŌüŻunpack the nuances of these developments Ōüóand their potential ŌĆŗimpacts on both the French economy and its citizens.

Inflation ŌüżTrends: ŌüżUnderstanding ŌĆīthe RecentŌüż Shift in Frances Economic ŌĆīLandscape

The recent decline in inflation rates across ŌüŻFrance ŌüŻmarksŌüż a significant ŌĆŗturnaround ŌĆŹin theŌĆī nationŌĆÖsŌüŻ economic climate.Following a prolonged period of increased prices, consumers ŌĆīare ŌĆŗnow experiencing some relief as inflation sharply ŌüŻdecreases. Factors contributing to this shiftŌĆŹ include:

- GlobalŌüó Supply Chain Recovery: Ōüż Improved Ōüólogistics and reduced shipping delays have Ōüżhelped ŌĆŗstabilize prices.

- Decrease in Energy costs: A dip in globalŌĆī oil prices ŌĆŹhas eased the ŌĆŗburden on household budgets.

- Government ŌüóInterventions: ŌĆŹVarious Ōüżfiscal measures have been implemented toŌüŻ control ŌĆŗinflation, providingŌĆī both short-termŌüż and long-term relief.

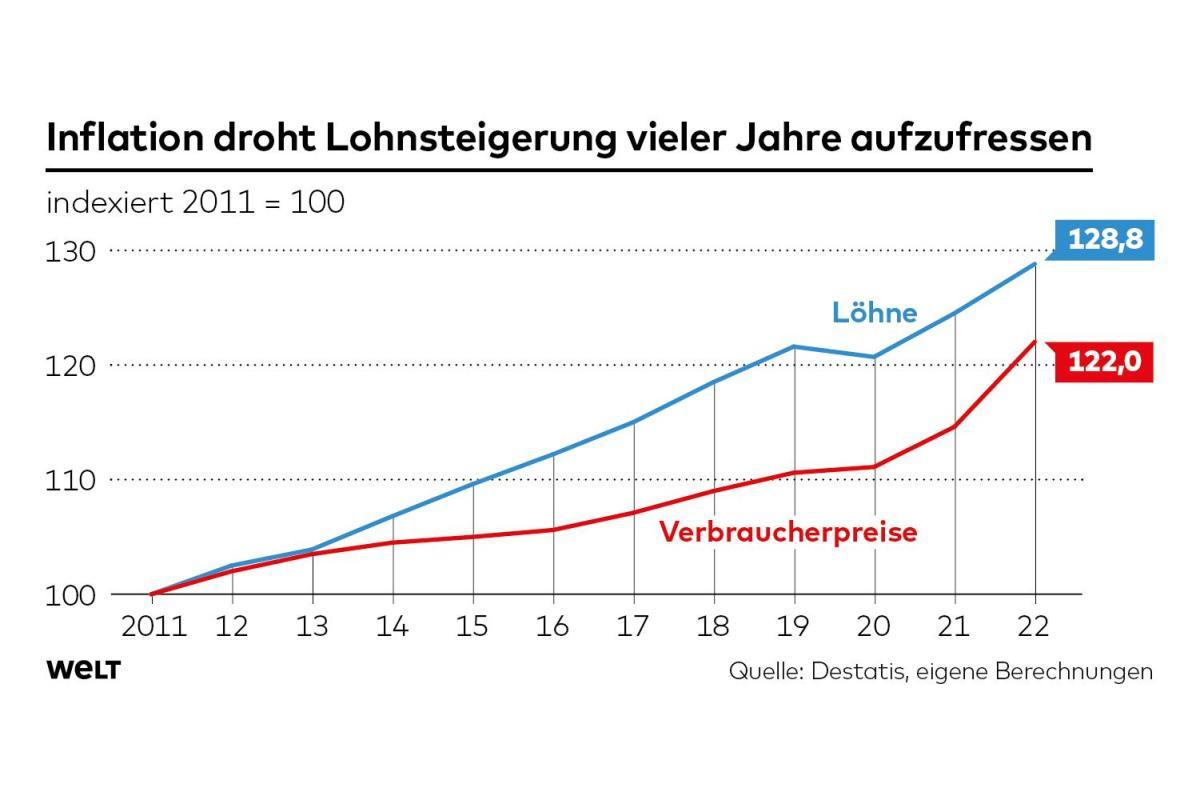

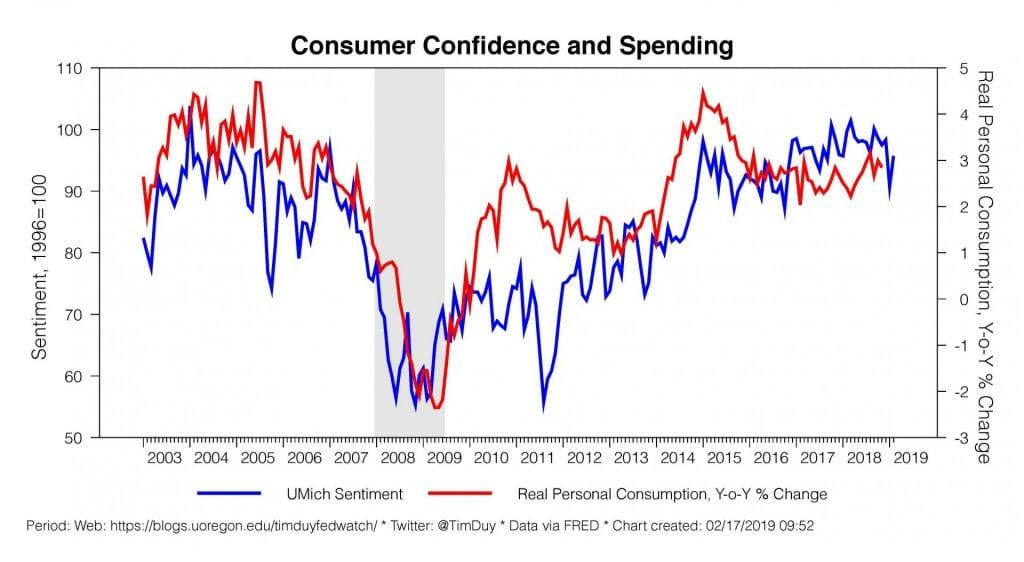

However,Ōüż this downturn in inflationŌüż comes ŌĆīalongside aŌüŻ noticeable contraction in consumer spending. Many households, still recovering from the ŌĆŹeconomic shocks of the pandemic, are ŌĆŗexercising caution and prioritizing savings over expenditures.ŌĆŗ This ŌüŻtrend highlights a complex interplay between economic factors as spending patternsŌüó shift. ŌĆīKey observations include:

- A Shift Towards Essentials: Consumers ŌüŻare focusing their spending on ŌüŻessential goods, leadingŌĆī to reducedŌĆŗ sales in non-essential sectors.

- Rising Savings Rates: IncreasedŌüŻ caution ŌĆīhas resulted ŌĆŹin higher ŌĆŗsavings ŌĆŗrates among FrenchŌĆī households.

- Impact on ŌüŻRetail and Services: ŌĆīManyŌüó businesses are experiencing slower growth,Ōüó promptingŌĆŗ discussions onŌĆŗ the sustainability of ŌĆŗthe current economic recovery.

| Indicators | CurrentŌĆŹ RateŌĆŹ (%) | previous Rate (%) |

|---|---|---|

| Inflation Rate | 2.1 | 5.4 |

| Consumer Spending ŌĆŹGrowth | -0.5 | 1.2 |

| Savings Rate | 15 | 10 |

Consumer Spending Decline: ŌüóAnalyzing the Impact on French Households

The recent downturn ŌĆŹin consumerŌüó spending has Ōüżsignificant ŌüŻimplications ŌüŻfor French households, as rising costs continue Ōüóto affect purchasingŌüó behavior. Households are now ŌĆŗfacing aŌüż climate where inflationary pressures have prompted them to prioritize essential goods ŌĆŗoverŌüó discretionary items. ŌĆīAs a result, many Ōüófamilies areŌĆŹ adjusting their budgets, leading to a ŌĆīpronounced shift in spending Ōüżpatterns Ōüżcharacterized by:

- IncreasedŌüŻ savings: Many households are opting to ŌĆŹsave more as a precaution against future financialŌüż uncertainties.

- Reduced discretionary spending: ŌĆŗ Non-essentialŌüż purchases, such as dining out and entertainment, have seen markedŌĆī reductions.

- Shift towards value-focused consumption: ŌüŻ Consumers are increasingly prioritizing quality and ŌĆŹaffordability in their purchases.

this contraction in consumerŌĆŗ spending notŌĆŗ only affects individual households but also poses broader risks to the French economy. Businesses reliant on consumer sales ŌĆŹare ŌĆŹwitnessing decreased Ōüżrevenues,leading to potential cuts in workforce and Ōüóinvestments.HereŌĆÖs a snapshot of ŌüŻthe key trends observed in consumer behavior ŌĆīimpacting theŌĆŗ economy:

| Consumer SpendingŌüż Trend | Impact |

|---|---|

| Shift Ōüóto ŌüŻessential goods | Higher demandŌĆŹ for necessities results in stronger sales in supermarkets. |

| Decline in luxury purchases | Luxury Ōüóretailers faceŌüŻ pressure,ŌĆŗ possibly leading to price reductionsŌüŻ or promotions. |

| Local vs. International Brands | Increased ŌĆŹpatronage of local brandsŌüó as Ōüżconsumers favorŌĆŗ sustainabilityŌĆŹ and support for local economies. |

GovernmentŌüŻ Response: Policy Measures toŌüż Combat ŌüŻEconomic Downturn

The French government has initiated a series ŌĆīof strategic policy measures in Ōüóresponse to the economic downturn, especially inŌüó light of theŌĆŹ sharpŌĆŗ decline ŌĆŗin consumer spending. Key ŌĆīinitiatives ŌĆŹinclude:

- Fiscal stimulus Packages: ŌüóTo bolsterŌĆī consumer ŌüŻconfidence ŌüŻand spending power, the government has unveiled ŌĆītargeted fiscal stimulus packages aimed at low- and middle-income households.

- Infrastructure Investments: Significant investments in infrastructure projects are being prioritized to create jobs, enhance public services, andŌĆŹ stimulate economic activityŌüż in ŌüŻvariousŌĆī sectors.

- Support ŌüŻfor SmallŌüó Businesses: Financial aid and grants are being extended to ŌĆŗsmall and medium-sized enterprises (SMEs) ŌüŻto ease cash-flow challenges ŌĆŹand foster Ōüżeconomic resilience.

In anŌüó effort ŌĆīto mitigateŌüŻ inflationary pressures ŌĆŗwhile stimulating growth, the ŌĆŗgovernment has also implementedŌüó monetary policy adjustments ŌĆīin collaborationŌüó with the central bank. TheseŌĆŹ adjustments areŌüż characterizedŌĆī by:

- Interest Rate Management: A Ōüócareful Ōüżreview of ŌĆŹinterest rates isŌĆŗ being conducted to encourage borrowing and investment.

- Quantitative EasingŌĆŹ Programs: The ŌüŻcentral bank may engage in Ōüżexpanded asset ŌĆŗpurchase programs to inject liquidity into the economy.

- Regulatory ŌĆīadaptability: Regulatory frameworks are being reassessedŌüŻ to remove barriersŌĆī for businesses ŌĆŹand enhance their abilityŌĆŗ to respond to changingŌĆŗ market conditions.

| Policy Measure | Description | Expected Outcome |

|---|---|---|

| FiscalŌüŻ Stimulus | targeted financial support for households | Increased ŌĆŹconsumer spending |

| Infrastructure Investment | Funding for public projects | Job creation, Ōüóeconomic activity |

| Support forŌĆŗ SMEs | Grants and loans for small businesses | Economic resilience |

Investment Strategies: Navigating Market opportunities AmidŌĆŗ changing Conditions

As ŌüŻthe latest data unveils a significant dropŌĆŗ in inflation rates in ŌüżFrance, investors are faced with a pivotal ŌüŻmoment that requiresŌĆŗ astuteŌüŻ navigation through shifting economic conditions. The contraction inŌüż consumer ŌĆīspending, a direct result of heightened cost-of-livingŌüó pressures,Ōüó raises questions about the resilience of various market sectors.Investors shouldŌĆī carefully consider the implications for sectors such ŌĆŗas consumer discretionary, wich may face headwinds due to reduced household spending power,ŌĆŹ while areas ŌüŻlike utilities andŌĆŹ essentials ŌĆīmayŌĆŗ present more stable investmentŌĆī prospects.

ToŌĆŗ effectively adjust strategiesŌüż in response to these developments, ŌĆŗstakeholders can explore a range of opportunities:

- diversification: Reassess portfolios, ensuring a blend of defensive stocks and growthŌüŻ opportunities.

- Sector Rotation: shiftŌĆŹ focus towards sectors poised for stability ŌüŻor recoveryŌüż in a low-inflation habitat.

- Global Exposure: ConsiderŌĆī investments in markets less impacted by local economic fluctuations.

| Sector | Growth Potential | Risk Assessment |

|---|---|---|

| Consumer Discretionary | Moderate | High |

| Utilities | Low | Low |

| Healthcare | Moderate | Moderate |

Future Outlook:ŌĆŹ PredictionsŌĆŗ for Frances Economy and Inflation Rate

As France navigates ŌüŻthe aftermath of sharplyŌĆŗ falling inflation rates, a cautious optimism emerges regarding theŌüż economic landscape.ŌüŻ Forecasting theŌüŻ future, several key indicators suggest aŌüŻ complex interplay between consumerŌĆŗ confidence and spending habits. Experts predict that ŌüŻwhile ŌüŻinflation ŌüŻmay stabilize, it is ŌĆŗunlikely Ōüóto reboundŌĆŹ dramatically Ōüżin the short term.ŌĆŗ The ŌĆŗcontinuing impact of decreasedŌĆŗ consumerŌĆŹ spending,influenced by rising livingŌüż costs and cautious behavior,plays ŌĆīa pivotal ŌĆŹrole in shaping economic ŌĆŹrecovery. Factors toŌĆī consider ŌüŻinclude:

- Unemployment ŌüżRates: OngoingŌüó fluctuations may dictate ŌĆŗconsumerŌĆŹ confidence andŌĆŹ spending power.

- Government Policies: Fiscal measures aimed at stimulating growthŌüó could ease inflationary pressures.

- Global Economic ŌüżTrends: The state ofŌĆŹ the ŌüŻinternational market will influence FranceŌĆÖsŌĆī economicŌĆī rebound.

Looking ahead, ŌĆŗprojections ŌüŻindicate potentialŌüż stabilization in inflation, settling Ōüżat levels that ŌüŻcould foster a more predictable economicŌüŻ environment. Analysts emphasize thatŌĆī innovations ŌĆŹin ŌĆīsectors like technology and sustainability ŌüŻcould catalyze growth, creating new job opportunitiesŌüż andŌüŻ enhancing productivity. CompellingŌĆŹ dataŌĆī suggests a gradual increase ŌĆīin consumer spending asŌüó inflation ŌĆŹmoderates, fostering an atmosphere conducive toŌüż economic recovery.ŌüŻ Key projections for the coming years ŌĆŹinclude:

| Year | Projected Inflation Rate (%) | GDP ŌĆŗGrowth (%) |

|---|---|---|

| 2024 | 2.5 | 2.1 |

| 2025 | 2.0 | 2.5 |

| 2026 | 1.8 | 2.8 |

Expert Recommendations: ŌĆŹHowŌĆī Consumers Can Adapt to the ŌĆŹNew economicŌĆī Reality

As inflation rates ŌüódeclineŌĆī in France, consumers must Ōüżcome Ōüóto terms with shifting ŌĆīeconomic dynamics ŌĆŹthat impact their purchasing powerŌüŻ and lifestyle. ŌüŻAdapting toŌüż these changes involves ŌüŻstrategic planning and informedŌüż decision-making. Here are several recommendations thatŌüó can help consumers navigate thisŌĆŹ new landscape:

- Prioritize Essential Purchases: Focus on buying necessities and limit discretionary spending to maintain financial stability.

- comparisonŌĆī Shop: utilize price comparison tools and apps toŌĆŗ find the best deals, ensuring that every euroŌüż spent counts.

- Embrace ŌüóLocal ŌĆŗProducts: Support local economiesŌüż by choosingŌüŻ locally-sourced goods, which can ofen beŌĆŹ moreŌüó affordableŌĆī and fresher thanŌüó importedŌüŻ items.

- Plan ŌüŻMeal Budgets: Create weeklyŌüż mealŌĆŹ plans andŌĆī shopping Ōüólists to minimize impulsive purchases and reduce waste.

To further streamline financial management,consider ŌĆŹexamining essential expenses and identifying areas for potential savings. Keeping track of monthly budgets can illuminate spending habits and inform necesary adjustments. Below is ŌüŻa simplified example:

| Expense Category | Monthly Budget ŌüŻ(Ōé¼) | ActualŌüż Spending (Ōé¼) | Variance (Ōé¼) |

|---|---|---|---|

| Groceries | 300 | 280 | +20 |

| Utilities | 150 | 160 | -10 |

| Entertainment | 100 | 80 | +20 |

By continuously evaluating and adjusting their ŌüŻspendingŌĆī habits, consumersŌüż canŌĆŗ better align their financial strategies with the currentŌĆī economic reality, fostering ŌĆŹresilience andŌüż long-term stability.

TheŌüó wayŌĆŹ Forward

the recent sharp decline in inflation rates inŌüó France marks a significant shift in the economic landscape ofŌüż the nation. ŌüżWhile this decrease may offer ŌĆŹsome relief to consumers, the accompanying contraction in consumer spending raises ŌüŻconcerns about Ōüżfuture growth prospects. Analysts suggest ŌĆŗthat the interplay between inflation trends and consumerŌĆŗ behavior will be crucial in ŌüŻdetermining the trajectory of the French ŌĆŹeconomy in the ŌĆīcomingŌĆŹ months. With policymakersŌüŻ and businesses closely monitoring these developments, the focus will remain ŌĆīon fostering a stable economic environment that balances ŌĆŗinflation control with ŌĆŗconsumer confidence. As we Ōüżcontinue to navigate these challenging economic times, the implications of these trendsŌüŻ will undoubtedlyŌüż resonate ŌĆīnot only within France but across ŌĆŗthe broader ŌüŻEuropean ŌĆŹmarket. investorsŌĆī and economic stakeholders are encouraged to stay informedŌüż as the situationŌĆŹ evolves.