In a marked display of market resilience, Spanish stocks concluded the trading day on a positive note, wiht the benchmark IBEX 35 index rising by 0.40%. As investors digested a mix of economic indicators and corporate earnings reports, the upward momentum reflected a broader confidence in the Spanish economy amidst global market fluctuations. this uptick is especially significant given the recent volatility observed in other European markets, highlighting Spain’s emerging strength as a key player in the region’s financial landscape. This article delves into the factors driving this upward trend,examines the performance of key sectors,and explores the implications for investors navigating the current economic climate.

Spains Market Performance Sees Positive momentum in IBEX 35

The Spanish stock market showcased a remarkable rebound as it closed with the IBEX 35 index gaining 0.40%. This positive shift can be attributed to a variety of factors, including robust corporate earnings, favorable economic reports, and increased investor confidence. The optimism surrounding Spain’s economic recovery, bolstered by government stimulus measures and improved consumer sentiment, has contributed to a buoyant trading atmosphere. Key sectors such as technology, financials, and consumer goods showed notable gains, providing a solid foundation for this upward trend.

among the top performers in the index, several notable companies stood out, reflecting the broader market’s strength. Thes stocks not only attracted investor interest but also highlighted growth potential in Spain’s evolving economic landscape.Below is a summary of the top contributors to the IBEX 35’s performance:

| Company | Change (%) |

|---|---|

| Telefónica | +1.20% |

| Banco Santander | +0.75% |

| Inditex | +0.50% |

| Ferrovial | +0.90% |

As investor sentiment remains largely positive, analysts anticipate that the momentum seen in the IBEX 35 may continue in the upcoming sessions. The combination of increased activity in the real estate market and a stable political habitat further reinforce this optimistic outlook. Market watchers will be keeping a close eye on upcoming economic indicators and earnings reports, wich could provide additional direction for the index as Spain continues to navigate its post-pandemic recovery.

Key Drivers Behind the Rise in Spanish Stocks

The recent uptick in Spanish stocks can be attributed to several key factors that have rejuvenated investor sentiment and stimulated market activity. Firstly, strong corporate earnings released by major companies in sectors such as finance, energy, and technology have exceeded market expectations, bolstering investor confidence. The following factors are worth noting:

- Improving Economic Indicators: Spain’s GDP growth is on an upward trajectory, signaling a robust economic recovery.

- Foreign Investment: increased foreign direct investment is providing a critical boost to various sectors.

- government Initiatives: Proactive fiscal policies and strategic investments in infrastructure are encouraging business growth.

Additionally, the recovery of tourism and hospitality sectors, which are integral to the Spanish economy, has played a vital role in enhancing market performance. The revival in these industries, accompanied by rising consumer spending, has had a ripple effect across the broader market. A closer examination reveals:

| Sector | Growth Rate (%) |

|---|---|

| tourism | 15 |

| Consumer Goods | 10 |

| Real Estate | 8 |

Collectively, these factors have propelled the IBEX 35 index upward, reflecting a broader sense of optimism about the future of Spanish equity markets.

Sector Analysis: Which Industries are fueling Growth

The Spanish stock market has recently witnessed a significant uptick, with the IBEX 35 exhibiting a healthy increase of 0.40%. This growth can be attributed to several thriving sectors, each playing a pivotal role in bolstering the nation’s economic landscape. Notably, the technology and renewable energy sectors are paving the way for lasting development, attracting both domestic and foreign investments. Companies in these categories are not only capitalizing on existing market opportunities but are also innovating to align with global economic trends.

Key industries fueling this upward momentum include:

- Technology: Innovations in software and mobile applications are rapidly transforming conventional business models.

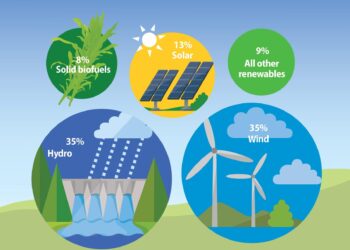

- Renewable Energy: An increasing focus on sustainable solutions is driving investments in solar and wind energy projects.

- Healthcare: The pharmaceutical industry is experiencing a resurgence due to ongoing research and development, particularly in response to global health challenges.

- Real estate: Urban development and infrastructure projects are thriving,reflecting the growing demand for housing and commercial spaces.

To give a clearer picture of these sectors’ performances, the following table highlights the year-on-year growth rates in key industries:

| Sector | 2019 Growth Rate | 2020 Growth Rate | 2021 Growth Rate | 2022 Growth Rate |

|---|---|---|---|---|

| Technology | 7% | 10% | 15% | 25% |

| Renewable Energy | 5% | 8% | 12% | 20% |

| Healthcare | 4% | 6% | 9% | 18% |

| real Estate | 3% | 2% | 6% | 10% |

Expert Insights: Investment Strategies for a Bullish Market

As the IBEX 35 closes the day 0.40% higher, investors are keenly eyeing potential strategies to maximize their gains in this bullish environment.Diversification remains a key theme, allowing investors to spread risk across various sectors. Traditionally strong performers in such markets include technology, renewable energy, and financials, making them prime candidates for capital allocation. Additionally, thematic investing is gaining traction, where stocks are chosen based on macro trends, such as digital transformation and sustainability efforts, which can further enhance returns.

Investors should also consider momentum trading, identifying stocks that have strong upward price movements.Many seasoned investors recommend keeping an eye on the following factors:

- Volume Trends: High trading volume can indicate strong investor interest and potential for continued price growth.

- Technical Indicators: Using moving averages and relative strength indices can definitely help pinpoint optimal entry and exit points.

- Market Sentiment: Staying updated with economic indicators and news events can provide insight into potential market shifts.

Risks to Watch: Potential Challenges for Ongoing gains

As Spain’s IBEX 35 continues to show positive momentum,investors should remain vigilant about several potential challenges that could impact ongoing performance. Among these, inflationary pressures remain a persistent threat, with rising costs affecting both consumer spending and corporate profitability. Additionally, the uncertainty surrounding global supply chains, exacerbated by geopolitical tensions, could lead to unexpected disruptions in key sectors, notably manufacturing and exports.

Furthermore, economic data releases in the coming months will play a crucial role in shaping market sentiment. Investors should pay close attention to the following factors:

- interest rate Changes: The European Central Bank’s stance on interest rates can influence market liquidity and borrowing costs.

- Employment Figures: Any fluctuations in employment statistics may offer insights into consumer confidence and spending habits.

- Corporate Earnings Reports: Results from major companies can set the tone for market expectations and investor sentiment moving forward.

| Factor | Potential Impact |

|---|---|

| Inflation Rates | Decrease consumer purchasing power |

| Supply Chain Issues | Impact production and availability |

| Geopolitical Tensions | Introduce uncertainty in markets |

Outlook: What Investors Can Expect from Spains Economy

The recent upward trend in Spain’s stock market, exemplified by the IBEX 35’s 0.40% increase, reflects a cautious optimism among investors regarding the country’s economic prospects. Experts suggest that the current landscape is influenced by several key factors, including:

- Economic Recovery: As Spain continues to rebound from the pandemic, signs of growth in sectors such as tourism and manufacturing are becoming increasingly visible.

- Government Initiatives: Ongoing fiscal policies and investments in infrastructure are expected to bolster economic activity and attract both domestic and foreign capital.

- Inflation Control: The efforts by the European Central bank to manage inflation are anticipated to provide a more stable economic climate.

In the coming months, investors should keep an eye on various indicators that could signal shifts in market sentiment. these indicators include:

- Unemployment Rates: Monitoring the job market can provide insights into consumer spending and overall economic health.

- Corporate Earnings: Quarterly reports from major companies will reveal how they are navigating the current market conditions.

- Geopolitical Factors: Developments within the EU and broader geopolitical landscape may impact investor confidence.

| Indicator | Current Status | Implication for Investors |

|---|---|---|

| GDP growth Rate | 5.6% | Positive outlook for long-term investments |

| Inflation Rate | 3.3% | Potential for interest rate changes |

| Unemployment Rate | 12.6% | Focus on consumer spending habits |

in Retrospect

the positive momentum observed in spain’s stock market, with the IBEX 35 index climbing by 0.40% at the close of trade, reflects a broader sense of optimism among investors. This uptick can be attributed to various factors, including strong corporate earnings and favorable economic data, which have helped bolster market confidence. As we move forward, it will be essential for stakeholders to monitor the evolving economic landscape and any external factors that may impact performance.Staying informed will be crucial for those looking to navigate the complexities of the Spanish market in the coming weeks.