In a day marked by volatility and cautious sentiment among investors, the Danish stock market closed on a downward note, reflecting broader economic concerns and global market trends. The OMX Copenhagen 20 index, which tracks the performance of the largest companies listed on the Copenhagen Stock Exchange, saw a decline of 0.51% at the end of trading, signaling a potential shift in market dynamics. As investors navigate a complex landscape influenced by geopolitical developments, inflationary pressures, and monetary policy changes, the closing figures from today’s trading session offer crucial insights into the health of the Danish economy and its prospects moving forward. This article delves into the key factors contributing to today’s market performance and what it may meen for future investment strategies.

Denmarks Market Overview: A Closer Look at OMX Copenhagen 20s Decline

In the latest trading session, Denmark’s OMX Copenhagen 20 index experienced a noticeable drop, concluding the day down by 0.51%. This decline reflects a broader sentiment in the market, reflecting concerns over emerging economic factors that may impact investor confidence going forward.Several key sectors contributed to this downturn, including:

- Financials: Banks and investment firms faced pressure amidst regulatory scrutiny and shifting interest rates.

- Consumer Goods: Beverage and food manufacturers reported mixed earnings, causing volatility in their stock performance.

- Technology: A recent sell-off in tech shares contributed to the overall index decline as investors reassessed growth outlooks.

Amid these developments,market analysts are closely monitoring both domestic and global economic indicators that may influence the OMX Copenhagen 20’s trajectory. Stakeholders are notably focused on the upcoming earnings reports and any monetary policy adjustments that the central bank may consider considering inflationary pressures. A brief overview of the day’s fluctuations is illustrated in the table below:

| Company | Closing Price (DKK) | Change (%) |

|---|---|---|

| Maersk | 12,500 | -1.20 |

| Novo Nordisk | 600 | -0.45 |

| Carlsberg | 920 | -0.80 |

Key Factors Influencing the Drop in Danish Shares

The recent decline in Danish shares can be attributed to several interlinked factors, each weighing down on market sentiment. One notable aspect has been the economic uncertainty stemming from global inflationary pressures, which have caused investors to reassess their positions. As inflation persists, central banks worldwide are compelled to adjust interest rates, leading to concerns about slowed economic growth. Moreover, ongoing geopolitical tensions have added another layer of complexity, influencing investor confidence and contributing to the downward trend in the OMX Copenhagen 20 index.

In addition to external pressures, domestic factors have also played a crucial role. The performance of major Danish sectors, particularly energy and pharmaceuticals, has mirrored global trends, affecting overall stock performance. Companies in these sectors are facing rising operational costs and shifting consumer demand, which has been reflected in their stock valuations. The implications of recent earnings reports have further fueled investor skepticism, prompting a wave of selling. The following factors can be observed as critical influences:

- Global inflation impacts leading to adjustments in interest rates

- Geopolitical tensions dampening investor confidence

- Sector-specific challenges in energy and pharmaceuticals

- Recent earnings reports that missed market expectations

Sector Performance Analysis: Which Industries Were hit Hardest?

The Nordic market faced significant headwinds, particularly in industries that traditionally rely on consumer spending and global demand. Among the sectors most affected, consumer goods and hospitality experienced the steepest declines. Companies within these sectors saw their stocks tumble as economic uncertainties prompted consumers to tighten their purses. The ongoing global supply chain issues, coupled with rising inflation rates, only exacerbated the situation. Stakeholders are closely monitoring these trends, anticipating further impacts on profit margins and growth projections as market conditions evolve.

Conversely, some sectors managed to weather the storm better than others, maintaining relative stability amidst market fluctuations. Technology and healthcare industries demonstrated resilience, buoyed by consistent demand and an ongoing digital transformation across various sectors. Notably, a few leading firms in these areas reported robust quarterly performances, highlighting their ability to adapt and innovate during challenging times. Analysts suggest that the divergence in sector performance may continue as investors seek to identify safer havens for their capital amidst broader economic volatility.

Investor Sentiment: Implications of the Recent Market Movements

The recent downturn in the OMX Copenhagen 20,showing a decline of 0.51%, reflects a broader unease among investors in the Danish market. This negative sentiment can be attributed to various factors, including rising inflation rates and increasing geopolitical tensions which are causing concerns about economic stability. as a result, many investors are reconsidering their positions and shifting towards safer assets, fearing that the market’s volatility may intensify in the near future. Key indicators suggest a cautious approach as companies adjust forecasts amidst these economic pressures, leading to a general retrenchment of investment appetite.

Market participants are particularly focused on the following implications:

- Increased Volatility: Traders are likely to experience more erratic price movements as sentiment swings between fear and optimism.

- Sector Rotation: investors may pivot from cyclical stocks to defensive sectors, seeking stability in essentials amidst market turmoil.

- Cash Positions: An uptick in liquidity within portfolios may reflect a strategy to capitalize on future buying opportunities when market conditions stabilize.

| Market Influencer | Impact |

|---|---|

| Inflation Concerns | Negative |

| Geopolitical Tensions | negative |

| Economic Growth Forecasts | Moderate |

Strategies for Navigating the Danish Market Amidst Uncertainty

As businesses grapple with the fluctuations in the Danish market, adopting a proactive approach is essential. Companies looking to thrive must focus on the following strategies:

- Market Research: Invest in thorough market analysis to identify trends, consumer behavior, and competitor activities. Understanding the economic landscape can help businesses tailor their offerings accordingly.

- Diversification: Consider diversifying product lines or services to mitigate risks associated with downturns in specific sectors.

- Agility and Adaptation: Enhance operational versatility to quickly respond to market changes. This may involve adjusting supply chains, modifying pricing strategies, or pivoting marketing efforts.

- Local Partnerships: Collaborate with local businesses and stakeholders to strengthen market presence and build trust within communities.

additionally, maintaining a close watch on governmental policies and global economic indicators is crucial.Businesses shoudl keep an eye on:

| Indicator | Current value | Trend |

|---|---|---|

| GDP Growth Rate | 1.5% | ⬇️ |

| Consumer confidence Index | 95 | ⬇️ |

| Unemployment Rate | 5.7% | ⬆️ |

By leveraging these strategies and keeping an adaptive mindset, businesses can navigate the complexities of the market and position themselves competitively for the future.

Future Outlook: What Analysts Are Saying About Denmarks Economic Resilience

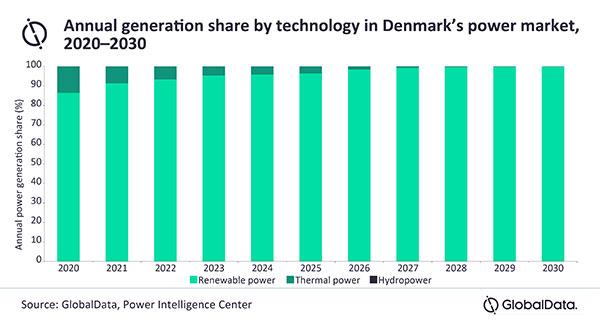

Analysts are cautiously optimistic about Denmark’s economic resilience amid recent market fluctuations. Despite a slight dip in the OMX Copenhagen 20 index, various economic indicators suggest that Denmark is well-positioned to weather potential global economic storms. The nation’s robust welfare system and strong commitment to green energy initiatives are seen as pivotal factors that could help sustain growth. Moreover, trends in consumer confidence and labor market stability reinforce the belief that Denmark can maintain a resilient economic posture in the short to medium term.Analysts highlight the following aspects:

- Diverse Economy: Denmark’s diversified sectors, ranging from pharmaceuticals to renewable energy, provide a buffer against sector-specific downturns.

- Strong Domestic Demand: Continued household consumption and investment signal health in the local economy.

- Proactive Government Policies: The Danish government’s fiscal measures are expected to further bolster economic stability.

Looking ahead, experts suggest that strategic investments in technology and sustainability could drive future growth. Additionally, with the eurozone recovering and trade relationships strengthening post-pandemic, Denmark might stand to gain from increased exports. However, uncertainties surrounding global supply chains and inflationary pressures could pose challenges. The following potential opportunities and risks have been identified:

| Opportunities | Risks |

|---|---|

| Investment in Green Technologies | Inflationary Pressures Affecting Costs |

| Export Growth to Emerging Markets | Global Supply Chain Disruptions |

| Strengthening of Trade Agreements | Potential Economic Slumps in Key Markets |

Final Thoughts

the session on the OMX Copenhagen 20 reflected a bearish sentiment, with the index closing down 0.51%.This decline highlights the cautious outlook among investors amid fluctuating market conditions. As Denmark’s financial landscape continues to evolve, investors will be closely monitoring key economic indicators and corporate performance to gauge future market movements. With rising global uncertainties and domestic challenges, the coming days may prove critical for market participants navigating these turbulent waters. Stay tuned for further updates and insights to keep you informed about the developments in the Danish market.