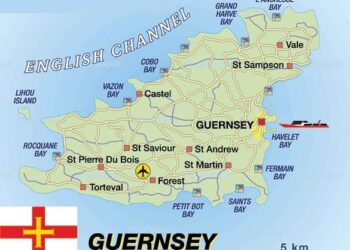

Guernsey Enacts Pillar Two Rules: A Critically important Step in Global Tax Reform

In a pivotal move aimed at aligning its tax regulations with evolving international standards, Guernsey has officially enacted the Pillar Two rules, a critical component of the OECD’s global tax reform initiative. This legislation, which seeks to establish a minimum corporate tax rate of 15% across multinational enterprises, marks a significant step for the island as it strives to enhance its regulatory framework and attract enduring investment. With the support of industry experts including PwC, Guernsey’s adoption of these rules reflects a commitment to fostering clarity and fairness in the global tax landscape. As the financial landscape continues to shift, stakeholders are keenly observing how this development will impact the island’s economy and its position within the broader international community. This article explores the implications of Guernsey’s Pillar Two implementation and its potential to reshape the future of corporate taxation on the island and beyond.

Guernsey Implements Pillar Two Regulations to Enhance Tax Transparency

In a significant move to bolster tax transparency, Guernsey has officially introduced regulations aligned with the OECD’s Pillar Two framework. This framework aims to ensure that multinational enterprises (MNEs) pay a minimum level of tax on incomes in each jurisdiction were they operate. The new rules signify Guernsey’s commitment to maintaining its competitive edge while adhering to global standards. As part of this initiative, the Island has integrated key provisions that impose a minimum tax rate on large entities, thereby enhancing its reputation as a responsible international financial center.

The regulation primarily focuses on large corporations with consolidated revenues exceeding €750 million, requiring them to comply with the following essential measures:

- Minimum Tax Rate: Implementation of a statutory minimum effective tax rate of 15%.

- Income Inclusion Rule: Inclusion of taxable income from subsidiaries in financial statements.

- Undertaxed Payment Rule: Addressing base erosion by ensuring that payments made to low-tax jurisdictions are taxed at a minimum level.

This regulatory framework not only enhances compliance but also fortifies Guernsey’s status as a transparent jurisdiction,aligning with global efforts to mitigate tax avoidance and ensuring fair competitive practices among all businesses.

Key Provisions of Guernseys Pillar Two Rules and Their Implications

The recently enacted Pillar Two rules in Guernsey reflect a significant shift in the island’s tax landscape, aiming to align with the international standards set by the OECD. These provisions introduce a global minimum tax rate for 2025 – Captive Insurance Times”>global minimum tax rate on multinational enterprises (MNEs) with the intent to curb base erosion and profit shifting. Key components of these rules include:

- Global Anti-Base Erosion (GloBE) Rules: Implementing a minimum tax rate of 15% for large MNEs across their global operations.

- Income Inclusion Rule (IIR): Ensuring that groups pay tax in any jurisdiction where their subsidiaries generate income below the minimum threshold.

- Treaty-Based Rule (TBR): Protecting revenue for countries where MNEs operate, preventing tax base erosion through tax treaties.

- Implementation Timelines: Firms are encouraged to prepare for compliance by 2024, with adjustments to their tax planning strategies as necessary.

The implications of these rules are multi-faceted. By establishing a robust framework, guernsey positions itself as a reputable jurisdiction for businesses while enhancing its attractiveness to foreign investments. Notable effects include:

| Implication | Description |

|---|---|

| Increased Compliance Requirements | Businesses must reevaluate their compliance processes to align with new tax obligations. |

| Potential Economic Impact | Change in location strategies for MNEs, leading to a possible shift in jobs and investment. |

| enhanced Regulation | Stricter oversight on tax planning, potentially deterring aggressive tax avoidance strategies. |

Impact Analysis: How Pillar Two Will Affect Businesses Operating in Guernsey

the introduction of Pillar Two rules in Guernsey marks a significant shift in the regulatory landscape, aimed at addressing issues of tax avoidance and ensuring that multinational corporations contribute a fair share to the jurisdictions in which they operate. Businesses in Guernsey will likely face new compliance challenges and requirements as they adjust to the framework imposed by the OECD guidelines. This could mean a thorough reassessment of their tax strategies, with an emphasis on transparency and the identification of their global revenue streams.The key implications include:

- Increased Reporting Obligations: Companies will need to maintain detailed records to demonstrate compliance, potentially increasing administrative burdens.

- Impact on transfer Pricing: Ther will be a heightened scrutiny on inter-company transactions, necessitating robust documentation to justify pricing decisions.

- Tax Rate Adjustments: Organizations may be required to rethink their tax planning strategies to align with the minimum tax rate stipulated by the new rules.

Moreover, the effects of these new regulations are anticipated to extend beyond compliance challenges—shaping the competitive landscape in Guernsey. Smaller businesses striving for growth may find themselves at a disadvantage if they lack the resources to meet these new requirements, while larger multinationals might allocate more resources to adjust operations and workflows accordingly. the potential for:

- Market consolidation: As compliance costs rise,smaller firms may merge with larger entities to share resources.

- Innovative Financing Structures: Businesses may seek new financing solutions or partnerships to manage tax liabilities effectively.

- Investments in Technology: Companies are likely to invest in tools and systems that enhance compliance efficiency.

Ultimately, while the immediate focus will be on meeting regulatory obligations, organizations that proactively develop strategies to adapt to these changes could emerge with a competitive edge in an increasingly complex tax habitat.

recommendations for Compliance: strategies for navigating Pillar Two Requirements

As jurisdictions implement Pillar two rules, organizations must adopt a proactive approach to ensure compliance.Effective strategies should include a thorough assessment of existing structures to identify potential gaps in the current tax framework. Companies should consider the following actions:

- Conduct complete impact assessments to understand how the new rules will affect profit allocation and overall tax liabilities.

- collaborate with tax advisors to develop a robust compliance strategy that addresses both local and global requirements.

- Invest in technology to streamline data collection processes and ensure accurate reporting of multinational activities.

- Engage in continuous training for key personnel to remain abreast of evolving regulations and compliance tactics.

Additionally, organizations need to consider the administrative implications of the new framework.It is crucial to establish clear communication channels among stakeholders, including finance, legal, and operational teams, to foster a cohesive approach to compliance.An effective governance model will encompass:

| Governance Model Component | Description |

|---|---|

| Policy Development | Create clear policies that outline compliance responsibilities at all levels. |

| Monitoring and Reporting | Implement processes for ongoing monitoring of compliance status and regular reporting to stakeholders. |

| Response Plans | Develop contingency plans to address potential compliance failures promptly. |

Future Outlook: The Role of Guernsey in Global Tax Reform Initiatives

As guernsey positions itself as a proactive player in the global tax landscape, the recent enactment of the Pillar Two rules marks a pivotal moment for the jurisdiction. By aligning with international standards set by the OECD, Guernsey is demonstrating its commitment to transparency and cooperation in tax matters. This alignment not only enhances the island’s reputation but also solidifies its role as a responsible international financial center. The introduction of these rules is expected to attract businesses seeking stability and certainty in their tax arrangements, promoting economic growth and investment in the region.

Looking ahead, several key factors will shape Guernsey’s involvement in global tax reform initiatives:

- Continued Collaboration: Engaging with international stakeholders will be essential for influencing future tax policies.

- Innovation in Compliance: Leveraging technology and regulatory expertise will streamline compliance processes for businesses.

- Focus on Sustainability: Emphasizing sustainable practices in tax strategies can position Guernsey as a leader in ethical finance.

- Adaptability to Change: The ability to swiftly adapt to evolving regulations will be critical for maintaining competitiveness.

| Aspect | Implication for Guernsey |

|---|---|

| Global Standards | Adopting rules enhances credibility. |

| Business Attraction | Increased foreign investment opportunities. |

| Tax Transparency | Improved relations with international bodies. |

Expert perspectives: Insights from PwC on the Implementation of Pillar Two

As Guernsey moves forward with the adoption of the OECD’s Pillar Two framework, industry experts from PwC shed light on the practical aspects of implementing these new rules.The introduction of a global minimum tax is designed to provide greater equity in the international tax system,ensuring that multinational enterprises (MNEs) contribute a fair share of tax wherever they operate. Key insights from PwC indicate that businesses will need to recalibrate their financial strategies in response to these changes.some of the critical considerations include:

- Understanding Local Compliance: multinational companies must navigate the specific compliance requirements set by Guernsey while aligning with global regulations.

- Data Management: The need for robust data collection processes is paramount, as accurate financial reporting will be essential for compliance and competitive advantage.

- Strategic Planning: Organizations should reevaluate their capital structuring and investment strategies in light of the new tax landscape to mitigate potential impacts.

PwC emphasizes the importance of proactive engagement with stakeholders and regulators throughout this transition period.Companies will benefit from establishing clear communication channels to discuss their specific challenges and expectations regarding the implementation of Pillar Two. Furthermore, organizations are encouraged to conduct thorough assessments of their current tax positions and potential adjustments that could arise from changes in global tax rules. A summary of potential impacts on various sectors can be found in the following table:

| Sector | Potential impact |

|---|---|

| Financial Services | Increased compliance costs, necessitating enhanced reporting mechanisms. |

| technology | Potential shifts in R&D incentives based on tax obligations. |

| Manufacturing | Re-evaluation of supply chain strategies to align with new tax criteria. |

In Retrospect

Guernsey’s enactment of the Pillar Two rules marks a significant step in aligning the island’s tax landscape with international standards aimed at ensuring fair and transparent taxation. As jurisdictions around the world adapt to the challenges presented by the digital economy and evolving fiscal needs, Guernsey’s commitment to implementing these regulations underscores its role as a responsible global financial center. stakeholders—ranging from policymakers to multinational corporations—will need to stay attuned to these developments as the island navigates its path in the ever-evolving compliance landscape. With guidance from experts such as PwC, businesses can better prepare for the implications of these new rules, ensuring they remain competitive while adhering to global norms. As the situation continues to unfold, Guernsey’s proactive measures will undoubtedly play a crucial role in shaping the future of international tax policy.