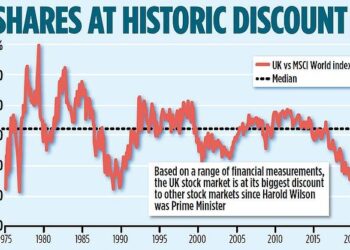

The UK stock market is facing a tumultuous landscape as rising yields and persistent tariff uncertainty weigh heavily on investor sentiment,leading to heightened volatility in the FTSE 100 index. As global economic shifts continue to reshape market dynamics,concerns over inflation and interest rates are prompting financial analysts to closely monitor the implications for the UK’s largest companies. This article explores the current pressures confronting the FTSE 100,examining the impact of escalating bond yields and the ongoing trade disputes that pose risks not only to profitability but also to broader economic stability. with the stakes increasingly high, investors and policymakers alike are bracing for a challenging period ahead.

Impact of Rising Yields on Investment Sentiment in the FTSE 100

The recent uptick in yields has introduced a notable shift in investment sentiment surrounding the FTSE 100.As bond yields rise, particularly in the U.S., investors often redirect their focus towards fixed-income assets, perceiving them as more attractive compared to equities.This trend can lead to a decrease in demand for stocks within the index, especially those dependent on consumer spending and economic growth. Additionally, higher yields generally signal expectations of rising interest rates, further exacerbating concerns about borrowing costs for UK businesses and consumers alike. The nervousness among investors is evident in the dramatic fluctuations seen in the market as they assess the implications of this financial climate.

Amidst these rising yields, several factors are influencing the outlook for the FTSE 100, creating a complex investment landscape. Key considerations include:

- Tariff Uncertainty: Ongoing trade tensions and the impact of tariffs can create volatility, making investors wary of potential earnings misses among large multinationals.

- Sector Sensitivity: Different sectors of the FTSE respond differently to rising yields; as an example, utilities and consumer staples may face decreased valuations compared to financials, which frequently enough benefit.

- Macroeconomic Indicators: Investors are keeping a close watch on inflation data and employment figures, as these will considerably influence further movements in yields.

To illustrate the shifting dynamics, consider the following table that outlines the recent performance of select FTSE 100 sectors in relation to rising yields:

| Sector | Performance (Last Month) | Yields Correlation |

|---|---|---|

| Financials | +3.5% | Positive |

| Consumer Goods | -2.1% | Negative |

| Technology | +1.2% | Neutral |

Navigating Tariff Uncertainty: Challenges for UK Exporters and Importers

In recent months, UK exporters and importers have faced significant challenges due to rising tariff uncertainty, which stems from a complex interplay of geopolitical tensions, changing trade agreements, and fluctuating market dynamics. The unpredictability surrounding tariffs creates a ripple effect for businesses, affecting pricing strategies, supply chain logistics, and ultimately, profitability. As companies navigate this treacherous terrain, many are grappling with the following obstacles:

- Ambiguity in Trade Agreements: Frequent updates and alterations complicate long-term planning.

- Cost Fluctuations: Tariff changes lead to sudden spikes in costs, impacting pricing models.

- supply Chain Disruptions: Adjustments required to comply with new tariffs can halt operations.

- Market Volatility: Uncertainty around tariffs affects consumer confidence and spending.

The challenge intensifies as businesses strive to remain competitive in a globalized economy. With many turning to hedging strategies or diversifying supply chains, it’s crucial to evaluate the risks associated with existing and potential changes in tariffs. Below is a simple illustration of the potential impacts on different sectors:

| sector | Impact of Tariff Uncertainty |

|---|---|

| Manufacturing | Increased production costs, potentially leading to lower profit margins. |

| Agriculture | Export challenges due to fluctuating market access and prices. |

| Technology | Disruption in supply chains affecting timely product releases. |

| Retail | Consumer prices may rise, impacting sales and customer loyalty. |

Sector Analysis: Which Industries are Most Affected by Market Volatility

Market volatility is frequently enough felt acutely across various sectors, with certain industries experiencing significant fluctuations in performance due to external pressures. In the current climate, financial services are feeling the heat as rising yields can lead to tighter margins and increased borrowing costs. Investors are also skittish about consumer discretionary sectors, which tend to thrive in stable economic conditions. Uncertainty regarding tariffs has heightened concerns for sectors like manufacturing and import/export businesses,making them vulnerable to supply chain disruptions and cost escalations.

Additionally, the technology sector faces its own set of challenges as interest rates climb, driving up the cost of capital and potentially slowing down innovation and investment in new projects.Similarly, hospitality and leisure industries, heavily reliant on consumer spending, find themselves on shaky ground with fluctuating market sentiment influencing consumer confidence. The table below highlights the key sectors and their current resilience ratings in the face of market volatility:

| Sector | Resilience Rating | Key Concerns |

|---|---|---|

| Financial Services | Moderate | Rising yields |

| Consumer Discretionary | Low | Spending uncertainty |

| Manufacturing | Low | Tariff instability |

| Technology | Moderate | Cost of capital |

| hospitality & Leisure | Low | Consumer confidence |

Investment Strategies in a Turbulent Market: Expert Recommendations

In the face of rising yields and tariff uncertainties,investors are advised to reassess their portfolios with a focus on diversification and risk management.Sector rotation may prove beneficial; investors should consider reallocating capital into sectors that traditionally perform well during periods of volatility. Key sectors to explore include:

- Utilities: Typically less sensitive to economic cycles, providing stability.

- Consumer Staples: Essential goods maintain demand irrespective of economic conditions.

- Healthcare: Robust demand and potential for steady returns makes this sector attractive.

Additionally, keeping abreast of macroeconomic indicators and central bank policies is crucial. Fixed-income securities are becoming intriguing as yields rise, which may lead to increased attractiveness in this asset class. Investors should consider a table of current yield trends and their ancient performance against equities to make informed decisions:

| Asset Class | Current Yield (%) | 1-Year Return (%) |

|---|---|---|

| Bonds | 3.5 | 5.0 |

| Equities (FTSE 100) | 2.2 | -3.1 |

| Real Estate | 4.0 | 7.5 |

Long-Term Outlook: The Future of the FTSE 100 Amid Global Economic Shifts

The long-term perspective for the FTSE 100 is becoming increasingly complex as global economic dynamics evolve. Rising yields across major economies are sending ripples through the UK market, making it essential for investors to reassess strategies. Central banks across the globe are tightening monetary policies to combat inflation, which could lead to a tightening of liquidity and a shift in investment preferences. This backdrop not only affects borrowing costs but also places pressure on equities, particularly in sectors heavily reliant on consumer spending. Analysts predict that sectors such as utilities, consumer goods, and financials may encounter volatility as investors navigate these yields and the potential impacts of recession fears.

Moreover, tariff uncertainties stemming from ongoing trade negotiations, particularly with key partners such as the EU and the United States, are adding layers of complexity to the market outlook. the potential for new tariffs or trade barriers could stifle growth opportunities for export-focused companies within the FTSE 100. It’s critical for stakeholders to monitor geopolitical developments and remain agile. To provide clarity, the following table illustrates the sectors within the FTSE 100 that could face the most significant challenges and their associated risks:

| sector | Potential Risk Factors |

|---|---|

| Consumer Goods | Reduced consumer spending due to inflation |

| Financials | Higher borrowing costs affecting profitability |

| Technology | Supply chain disruptions and tariff impacts |

| Utilities | Increased operational costs amid rising yields |

As these factors unfold, the FTSE 100’s trajectory will likely depend on its adaptability to a rapidly changing economic landscape, influencing industry performance and investor sentiment in the years to come.

Key Takeaways

the recent fluctuations in yields and ongoing tariff uncertainties have cast a shadow over the UK’s FTSE 100, reflecting broader economic concerns and market volatility. As investors navigate the complexities of global trade dynamics and domestic fiscal policies, the index faces both challenges and opportunities. The interplay between rising yields and potential shifts in trade agreements will likely continue to influence market sentiment in the upcoming weeks. Stakeholders will need to remain vigilant, adapting their strategies to a landscape that remains uncertain.As the situation evolves, keeping a close eye on these developments will be crucial for all market participants seeking to understand the future trajectory of the FTSE 100.