The landscape of regulation is undergoing a notable conversion as governments across the UK,EU,and the Middle East grapple with the implications of deregulation and simplification.In an era were economic agility is paramount, policymakers are reevaluating the regulatory frameworks that govern industries ranging from finance to technology, seeking to strike a balance between fostering innovation and ensuring consumer protection. This article delves into the current regulatory outlook, examining how legislative shifts toward deregulation are reshaping the role of regulators in these regions. By exploring the motivations behind these changes, as well as the potential benefits and challenges they present, we aim to provide a extensive understanding of how these trends may redefine the regulatory landscape in the years to come. Join us as we dissect the nuances of this evolving surroundings, shedding light on the implications for businesses, consumers, and the future of governance.

Impact of Deregulation on Compliance Frameworks in the UK and EU

The trend towards deregulation in both the UK and EU has substantially influenced compliance frameworks, prompting organizations to reevaluate their operational blueprints. Deregulation can lead to a reduction in compliance costs, fostering an environment where businesses can innovate and expand. However, the risk of diluting standards poses challenges, as entities grapple with maintaining ethical practices while adapting to the quicker pace of business. Key impacts include:

- Increased Adaptability: Companies may find it easier to navigate regulatory requirements, enabling them to respond rapidly to market changes.

- Risk Management Challenges: A lack of stringent regulations could result in heightened vulnerability to compliance breaches, necessitating robust self-regulation measures.

- Shift in Oversight: Regulators may focus on high-risk areas while continuing to promote innovation and competitive advantage in various sectors.

The evolving compliance landscape necessitates a proactive approach to governance, as organizations are encouraged to engage in self-regulation and best practices. The role of technology has become paramount in this transition, with many firms investing in compliance software and systems that capitalize on real-time data analytics. This shift leads to a growing dependence on internal mechanisms to ensure adherence to ethical standards and legal requirements, highlighting the importance of transparency and accountability. Notable trends include:

| Trend | Description |

|---|---|

| Automation in Compliance | Leveraging software for regulatory monitoring and reporting. |

| enhanced Reporting Standards | Fostering a culture of transparency among stakeholders. |

| Collaborative Approaches | Engaging with regulators to shape future frameworks. |

Navigating the New landscape: Strategies for Regulators in a Simplified Environment

As regulatory bodies across the UK, EU, and Middle East grapple with the implications of deregulation and simplification, striking a balance between market freedom and consumer protection has become increasingly critical. regulators must prioritize adaptive strategies that not only streamline processes but also maintain robustness in oversight. key components include:

- Stakeholder engagement: Regular consultations with industry representatives and the public can foster collaboration and transparency.

- Data-Driven Decision Making: Utilizing analytics and real-time data can enhance proactive responses to market changes and consumer needs.

- Flexibility in Rules: Creating adaptable regulatory frameworks allows for adjustments as markets evolve and new technologies emerge.

Moreover, an emphasis on education and compliance is vital for ensuring that businesses understand and adhere to new regulatory norms. Effective training programs and outreach initiatives can demystify regulations, leading to better compliance and innovation. Additionally,regulators need to be attentive to global trends and harmonization efforts to avoid fragmentation in the regulatory landscape. A strategic approach may include:

| Strategy | Description |

|---|---|

| International Collaboration | Engaging with foreign regulatory bodies to share best practices and align standards. |

| Risk-Based Frameworks | Focusing resources on areas of higher risk rather than applying a one-size-fits-all approach. |

| Technology Utilization | Implementing advanced technologies like AI to streamline compliance processes. |

Understanding Stakeholder Perspectives: Balancing Business Needs and Regulatory Oversight

In the evolving landscape of regulatory frameworks, understanding the perspectives of various stakeholders has become imperative for ensuring a harmonious balance between organizational objectives and compliance mandates. Businesses often seek to innovate and grow, which can sometimes conflict with the stringent requirements set forth by regulatory agencies.Regulatory bodies must navigate this tension by evaluating stakeholder inputs, as well as their own accountability to the public. This involves engaging in meaningful dialog with businesses, consumer advocates, and othre interest groups to assess the potential impacts of proposed changes in regulations. the aim is to create an environment where business needs can be met without compromising safety, fairness, or environmental responsibilities.

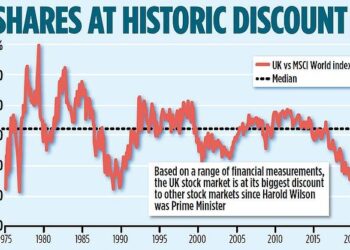

As regulators in the UK, EU, and middle East explore pathways for deregulation and simplification, they face the dual challenge of promoting economic growth while maintaining oversight efficacy. This becomes particularly complex when stakeholders advocate for transparency and ethical standards in compliance processes. Key factors driving this discussion include:

- Innovation Potential: Understanding how regulations can hinder or foster technological advancements.

- Compliance Costs: balancing the financial impact of regulatory frameworks on businesses, especially SMEs.

- Public Trust: Ensuring that regulatory changes maintain or improve public confidence in market practices.

| Region | Focus of Deregulation | Primary Stakeholders |

|---|---|---|

| UK | Financial Services | Businesses, Consumers, Policy Makers |

| EU | Environmental Regulations | NGOs, Corporations, Regulators |

| Middle East | Telecommunications | Investors, Government Entities, Users |

This multi-faceted approach underscores the need for ongoing dialogue and analysis of stakeholder positions, ultimately guiding regulatory bodies to develop frameworks that are both practical and equitable. Aligning business aspirations with societal expectations necessitates a obvious process, which can lead to a regulatory environment that is adaptable and responsive to the changing dynamics of the marketplace.

technological Innovations in Regulation: Harnessing Tools for Effective Monitoring

The landscape of regulatory practices is evolving rapidly, particularly with the advent of advanced technological tools.Regulatory bodies across the UK, EU, and Middle East are increasingly adopting innovations such as artificial intelligence, blockchain, and data analytics to bolster their monitoring capabilities.These tools not only enhance transparency but also streamline collaboration between regulators and the entities they oversee. By leveraging these technologies, regulators can undertake real-time compliance checks, manage risk assessments more effectively, and automate reporting processes, thus reducing the administrative burden on businesses while improving overall oversight.

Moreover, these technological advancements are reshaping the approach to deregulation and simplification initiatives. Regulators are now positioned to utilize predictive analytics to forecast compliance trends and identify potential regulatory breaches before they occur. This proactive stance allows for more dynamic regulatory frameworks that can adapt to changing market conditions without sacrificing oversight or consumer protection. The integration of these innovations can lead to a more agile and responsive regulatory environment, paving the way for a balance between fostering economic growth and maintaining robust regulatory safeguards.

Comparative Analysis: Regulatory Approaches in the Middle East Amid global Deregulation Trends

As countries across the globe grapple with the implications of deregulation, the middle East has adopted a path that blends innovation with tradition in its regulatory frameworks.The region’s approach is characterized by a commitment to fostering business environments that appeal to both domestic and international investors while maintaining a semblance of regulatory oversight. This often manifests in the following key areas:

- Sector-Specific Regulations: Instead of one-size-fits-all solutions, regulators are tailoring their approaches to specific industries such as technology, finance, and energy.

- Public-Private Partnerships: Enhanced collaboration between the state and private entities is becoming more common, allowing for a more agile response to rapid market changes.

- Innovation-Friendly Policies: Many Middle Eastern nations are adopting policies that prioritize innovation, especially in sectors like fintech and renewable energy.

In contrast to the trend toward deregulation seen in the UK and EU, Middle Eastern nations emphasize the importance of maintaining a robust regulatory framework to ensure market integrity and consumer protection. This is evident in their use of technology in regulatory systems, which streamlines processes and reduces the burden on businesses. The comparison of regulatory environments reveals a focus on:

| Region | Regulatory Approach | Key Focus Areas |

|---|---|---|

| Middle East | Adaptive and Innovation-driven | Sector-Specific,Public-private Partnerships |

| UK | Global Deregulation | Market Efficiency,Reduction of Red Tape |

| EU | Fragmented Deregulation | Consumer Protection,Digital Economy |

Recommendations for Future Regulatory Policies: Ensuring Robust Oversight without stifling Growth

To strike a balance between effective oversight and fostering innovation, future regulatory policies must embrace a proactive approach. Regulators should consider implementing adaptive regulatory frameworks that allow for flexibility and periodic reviews to respond to rapidly changing market dynamics. By utilizing mechanisms such as sandbox environments, regulators can enable businesses to experiment with new technologies while maintaining essential consumer protections. Additionally, engaging with stakeholders through collaborative forums can yield valuable insights, ensuring that regulations are both relevant and manageable for companies of all sizes.

Moreover, fostering a culture of transparency in regulatory processes is crucial. Clear interaction regarding the rationale behind regulations can build trust among businesses and consumers alike. Policymakers should prioritize data-driven approaches, utilizing evidence and analytics to inform regulatory decisions and minimize unintended consequences.establishing regular dialogues among regulators across the UK, EU, and the Middle east can facilitate the sharing of best practices and harmonization of standards, ultimately promoting a competitive marketplace without sacrificing oversight.

| Key Considerations | Recommendations |

|---|---|

| Flexibility | Implement adaptive regulatory frameworks for evolving markets |

| Stakeholder Engagement | Create collaborative forums for ongoing dialogue |

| Transparency | Enhance communication on regulatory intentions and impacts |

| Data Utilization | Adopt data-driven approaches for informed decision-making |

| International Cooperation | Establish dialogues for best practices across regions |

In Summary

As we navigate the dynamic landscape of regulatory reform, the implications of deregulation and simplification for policymakers in the UK, EU, and Middle East become increasingly critical. The shift towards streamlined regulations presents both opportunities and challenges, underscoring the need for a balanced approach that fosters innovation while ensuring essential safeguards are in place.

Regulators must remain vigilant, adapting to the evolving needs of their respective economies while addressing concerns around consumer protection, environmental sustainability, and market integrity. As jurisdictions experiment with different regulatory frameworks, the global community will be watching closely to assess the outcomes of these changes, which could set precedents for future governance models.

In this era of transformation, collaboration and knowledge-sharing among regulators across borders will be paramount. By learning from each other’s successes and missteps,they can build a more resilient regulatory environment that not only promotes growth but also protects the interests of citizens and businesses alike. The path forward will require deliberation and foresight, but with the right strategies in place, the promise of a more efficient regulatory landscape is within reach.