in a pivotal discussion that could reshape Germany’s fiscal policy landscape, lawmakers are currently engaging in debates over potential adjustments to the country’s longstanding debt limits. As Europe grapples with economic challenges and the need for considerable public investment, the proposed changes aim to provide the government with greater financial flexibility. Advocates argue that loosening these constraints could spur growth and enhance the nation’s ability to respond to pressing societal needs, from infrastructure development to climate change initiatives. However, critics express concerns over the long-term implications for fiscal obligation and economic stability.This article delves into the complexities of the debate, examining the arguments on both sides and exploring what a shift in debt policy could mean for Germany’s future.

German Lawmakers Consider Implications of Relaxing Debt Restrictions

As Germany confronts a challenging economic landscape,lawmakers are weighing the potential effects of easing existing debt limits. Advocates argue that relaxing these fiscal constraints could enable the government to invest more in vital areas such as infrastructure, education, and healthcare, which are crucial for fostering long-term growth. They believe that increased public spending could stimulate consumer confidence and potentially lead to greater economic resilience. Key points of discussion include:

- economic Growth: Will higher public investment lead to sustainable growth?

- Fiscal Responsibility: Can the government maintain a balance between spending and economic stability?

- Debt Management: How will this affect Germany’s international obligations and credit ratings?

Conversely, opponents caution that loosening debt restrictions may lead to excessive borrowing and financial instability. Critics are especially concerned about the long-term implications for the country’s fiscal health and its ability to respond to future crises.They warn that increasing reliance on debt could undermine the confidence of investors and lead to higher interest rates. To analyze these arguments,a simple table comparing the views of both sides can clarify their positions:

| Perspective | Arguments For | Arguments Against |

|---|---|---|

| Supporters | Boosts public investment,stimulates economy | Risks long-term financial instability,encourages excessive borrowing |

| Critics | Maintains fiscal responsibility,safeguards debt levels | Restricts growth potential,reduces public welfare investment |

Economic Perspectives on Debt Flexibility and Fiscal Responsibility

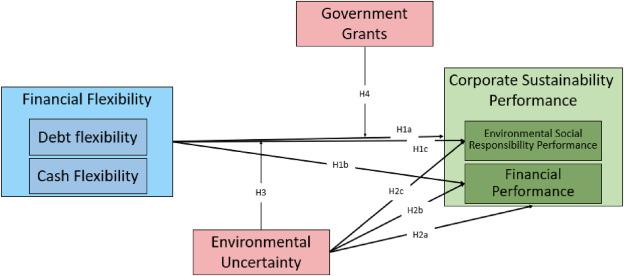

As German lawmakers engage in discussions regarding the potential loosening of debt limits, economic perspectives on flexibility and responsibility are coming to the forefront. Debt flexibility can serve as a vital tool in a nation’s economic strategy, particularly in times of crisis when immediate fiscal support is necessary. By allowing governments to adapt their financial frameworks, it becomes possible to stimulate growth and address pressing social needs. However, this flexibility comes with its own set of challenges, particularly in maintaining long-term fiscal responsibility and preventing unchecked borrowing that could undermine financial stability.

The ongoing debate highlights a delicate balance between enabling investments in infrastructure and social programs and ensuring that such measures do not lead to unsustainable debt levels. Key points in the discussion include:

- Economic Growth: Encouraging investments that enhance productivity and job creation.

- Stability: Ensuring that fiscal policies do not jeopardize the country’s credit ratings.

- public Services: Assessing the impact of debt on funding for essential public services.

In exploring these perspectives, a closer look at the implications is essential. The following table summarizes how different economists view debt flexibility and fiscal responsibility:

| Economist | Viewpoint on Debt flexibility | Viewpoint on Fiscal Responsibility |

|---|---|---|

| Dr. Anna schmidt | Supports flexibility for emergency spending | Advocates for stringent debt ceilings |

| Prof.Hans Müller | Believes in adaptive fiscal policies | Stresses long-term sustainability |

| Ms. Clara Becker | Champions smart investments through debt | Recommends cautious borrowing practices |

Balancing Growth and Sustainability in Germanys Financial Landscape

As Germany grapples with the challenge of stimulating economic growth amid important global uncertainties,the debate surrounding the relaxation of debt limits has become increasingly pertinent. Lawmakers are divided over the implications of such measures, weighing the potential benefits of increased public investment against the risk of fiscal irresponsibility. Proponents argue that loosening these constraints could enable vital funding for infrastructure projects, green energy initiatives, and digital conversion efforts, which are essential for keeping pace with other leading economies. They highlight that these investments not only drive immediate economic growth but also contribute to a sustainable and resilient financial landscape in the long run.

Conversely, critics warn that excessive borrowing could jeopardize Germany’s fiscal health and sustainability.They point out that irresponsibly high levels of debt may lead to elevated interest rates, reduced funding for essential public services, and a diminished capacity to respond to future economic crises. To navigate this delicate balance, key factors need careful consideration, including:

- Long-term economic stability: Ensuring that any new debt is utilized in a manner that promotes sustainable growth.

- environmental impact: Allocating funds toward green projects that align with Germany’s commitment to climate goals.

- Public opinion: Reflecting the views and concerns of citizens about fiscal responsibility and environmental sustainability.

| Factor | Pro Loosening Debt Limits | Con Loosening Debt Limits |

|---|---|---|

| Investment Potential | Increased infrastructure and innovation funding | Risk of excessive borrowing |

| Sustainability | Supporting green energy initiatives | Potential neglect of fiscal sustainability |

| Public Services | Funding for pressing social needs | Compromised funding for essential services |

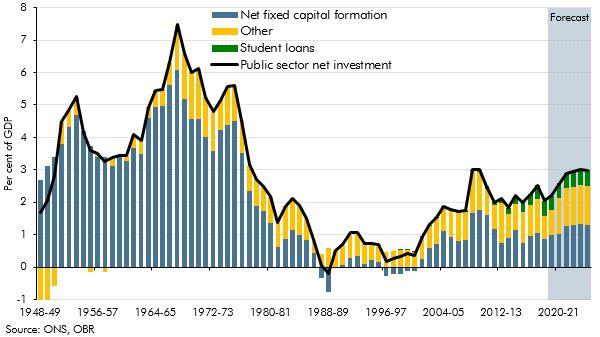

Potential Impact on Public Investment and Social Programs

The ongoing discussions among German lawmakers about relaxing debt limits could significantly reshape public investment strategies and the future of social programs across the nation. Proponents of loosening these constraints argue that increased borrowing would enable the government to funnel much-needed resources into vital sectors such as infrastructure, education, and healthcare. This, in turn, could lead to enhanced public services that aim to uplift economically disadvantaged communities and promote social cohesion.

Though, critics warn that the potential for increased public debt could jeopardize long-term fiscal stability, creating an habitat of uncertainty that may impact economic growth. Should lawmakers move forward with these proposed changes, the outcomes could include:

- Increased funding for social welfare programs: A focus on housing, healthcare, and unemployment benefits.

- Strengthened public infrastructure: Investments in transportation and green energy initiatives.

- Potential risks of inflation: The balance between stimulating the economy versus overspending could become critical.

Expert Recommendations for a Pragmatic Approach to debt Management

As the discussion around Germany’s debt limits unfolds, experts emphasize the importance of a pragmatic approach to managing national debt.Rather than seeking a one-size-fits-all solution, lawmakers are encouraged to consider tailored strategies that reflect the unique economic realities faced by the nation. Key recommendations include:

- Diversifying Funding Sources: Expanding beyond traditional bonds to include green investments and public-private partnerships.

- Implementing Fiscal Responsibility: Establishing transparent guidelines for spending that prioritize long-term growth over short-term gains.

- Prioritizing Economic Resilience: Fostering an economic climate that can withstand shocks, including building sufficient fiscal buffers.

moreover, experts suggest leveraging technology to enhance decision-making processes related to debt management. By utilizing advanced analytics and modeling tools, policymakers can better predict the implications of various debt scenarios. A holistic view of debt incorporating both macroeconomic indicators and public sentiment may prove essential in informing sustainable fiscal policies. Additional factors to consider include:

- Engagement with Stakeholders: Regular consultations with businesses, labor organizations, and citizens to gauge the impact of debt policies.

- Education and Awareness Initiatives: Implementing programs to promote understanding of debt implications among the public and policymakers alike.

- Monitoring and Evaluation: Establishing robust systems for assessing the effectiveness of debt management strategies over time.

Insights and Conclusions

As the debate on loosening Germany’s debt limits unfolds, lawmakers are grappling with the balance between fiscal responsibility and the need for investment in critical areas such as infrastructure, climate change, and social welfare. Opinions among political factions vary, reflecting broader concerns about economic stability and the nation’s financial future. The discussions are expected to continue, with implications not only for Germany’s fiscal policy but also for its role within the European Union.As the outcome of these deliberations becomes clearer, stakeholders from all sectors will be closely monitoring the potential shifts in policy that could redefine the country’s approach to public finances in the years to come. The path forward will require careful consideration of both immediate economic needs and long-term sustainability.