in a positive turn for the Norwegian equity market, stocks concluded trading on a high note as the Oslo OBX index surged by 0.83%. This upward momentum reflects a robust sentiment among investors,buoyed by various contributing factors including favorable economic indicators and strong performance from key sectors. As traders navigated through the complexities of the market, the day’s trading activity highlighted an optimistic outlook for Norway’s financial landscape, signaling resilience amidst broader economic challenges. In this article, we delve into the key players driving this upward trend and explore the implications for investors as they position themselves in an evolving market.

Norwegian Market Surges as OBX Index Sees Notable Gains

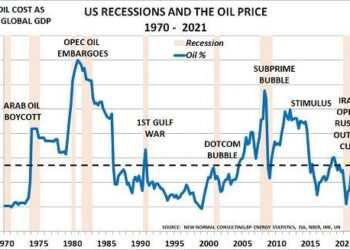

the Norwegian stock market experienced a robust rally today, with the Oslo OBX Index closing at a notable increase of 0.83%.This upward momentum reflects positive trends across several key sectors, especially in energy and materials, which have been buoyed by a combination of favorable economic indicators and global market trends. Investors showed renewed confidence,likely influenced by rising oil prices and strong earnings reports from Norway’s leading companies. These gains indicate a resilient market that continues to thrive despite broader economic challenges.

Noteworthy contributors to the OBX gains included major players such as Equinor, which surged on the back of increasing oil demand forecasts, and Aker BP, which also benefited from favorable production updates.Additionally, DNB ASA and Kahoot! saw critically important upticks owing to investor optimism about financial services and tech innovations, respectively. the table below highlights some of the day’s top performers and their corresponding percentage changes:

| Company | Percentage Change |

|---|---|

| Equinor | +2.45% |

| Aker BP | +1.78% |

| DNB ASA | +1.50% |

| Kahoot! | +1.20% |

Key Drivers Behind the Increased Investor Confidence in Oslo

Several factors have converged to enhance investor confidence in Oslo’s stock market, propelling the OBX index to noteworthy gains. Key among these is the stability of Norway’s economy, buoyed by strong commodity prices and a resilient labor market.Investors are increasingly attracted to the predictable return on investment within sectors such as energy and technology, where Norway has established itself as a leader. Additionally, government policies encouraging foreign direct investment and supporting innovation have created a favorable environment for both domestic and international investors.

Moreover, the recent performances of major Norwegian companies have played a critical role in shaping market sentiment. Financial reports from leading firms reveal strong earnings growth, primarily driven by the energy sector, including oil and gas exploration. moreover, the low-interest-rate environment continues to stimulate corporate investment, which instills greater confidence among investors. As the global economy shows signs of recovery, foreign investors are increasingly willing to pour capital into Oslo. Notable factors contributing to this trend include:

- Robust commodity prices: Norway’s vast natural resources drive profitability.

- Solid corporate earnings: Many top firms exceed market expectations.

- Low inflation rates: Maintaining consumer purchasing power aids economic stability.

Sector Performances Highlighted in Today’s Trading Activity

The trading landscape today was marked by notable gains across various sectors, as investors responded positively to recent economic developments. The energy sector emerged as a standout performer,driven by fluctuating oil prices and increased demand forecasts. Key components in this sector,such as Equinor ASA and Aker BP ASA,saw their stock prices climb,reflecting investor optimism. Other sectors also contributed to the upward trend, notably the financials and materials sectors, where strong quarterly earnings reports prompted buying activity.

Among the specific performances recorded,the healthcare sector showed resilience,supported by advancements in biotechnology and pharmaceutical developments. Telecommunications also exhibited strength, buoyed by a focus on enhancing network infrastructure and expanding service capabilities. The following table highlights the top-performing sectors and their respective gains for the day:

| Sector | Performance (%) |

|---|---|

| Energy | +1.20% |

| Financials | +0.95% |

| Materials | +0.85% |

| Healthcare | +0.75% |

| Telecommunications | +0.70% |

Expert Insights on Investment Opportunities in Norway’s Market

As Norway’s equities demonstrate a positive trajectory with the Oslo OBX index climbing by 0.83%,investors are becoming increasingly interested in the underlying factors contributing to this uplift. Analysts are closely watching several key sectors that have shown resilience and potential for further growth,notably:

- Energy Sector: Norway’s significant natural gas reserves position the country favorably in the global energy market,especially amid Europe’s ongoing transition to enduring energy sources.

- Technology Innovation: Start-ups and established firms in the tech industry are harnessing advancements in AI and renewable technology, attracting both domestic and foreign investments.

- healthcare Investments: An aging population has spurred growth in healthcare services and biotech, making it a vital area for potential returns.

Moreover, geopolitical stability and a robust regulatory framework continue to enhance Norway’s attractiveness as an investment destination. with its strong fiscal position and commitment to sustainability, the Norwegian government is channeling investments into green technology and infrastructure, presenting further opportunities for investors. Key metrics to consider include:

| Sector | Growth Potential (%) | Investment Opportunities |

|---|---|---|

| Energy | 5-7 | Renewable Projects |

| Technology | 8-10 | Start-ups & innovation Hubs |

| Healthcare | 6-8 | Biotech Firms |

Outlook for Norwegian Stocks Amid Global Economic Trends

As Norwegian stocks continue to show resilience amidst fluctuating global economic trends, investors are closely monitoring several key factors that could influence market performance. The recent climb in the Oslo OBX index reflects a growing optimism, driven by strong earnings in the energy and maritime sectors. Analysts observe that a revival in oil prices, paired with robust export demand, has positioned norway favorably compared to other economies grappling with inflationary pressures and supply chain disruptions.

Despite potential headwinds from geopolitical tensions and interest rate fluctuations, several indicators suggest that Norwegian stocks may remain buoyant. Factors to watch include:

- Energy Sector Performance: Continued investments in renewable energy are likely to enhance long-term growth.

- Market sentiment: Enthusiasm around tech and innovation may drive new investments into emerging companies.

- Global Trade Relations: As Norway strengthens trade ties, particularly with the EU, export opportunities may expand.

Investors are advised to stay informed on these trends, as the interplay between local economic indicators and global market dynamics could substantially impact the trajectory of Norwegian stocks in the upcoming months.

Recommended Strategies for Capitalizing on the Recent Market Upswing

The recent market upswing presents a noteworthy opportunity for investors looking to enhance their portfolios. As the Oslo OBX index climbs by 0.83%,strategies should focus on both resilience and growth potential. Consider diversifying investments across sectors that are trending upward. Energy, financials, and technology stocks have shown particular strength, supported by favorable economic indicators. Here are some recommended approaches:

- Invest in Renewable Energy: With Norway’s commitment to sustainability, companies in renewable energy are likely to prosper.

- Explore Financial Institutions: Norwegian banks are exhibiting solid performance metrics, making them attractive options for steady returns.

- Leverage Technology Firms: The growth of tech startups can present high-risk, high-reward opportunities, especially those in the digitalization space.

To maximize returns, investors should stay informed on market trends and adjust their investment strategies accordingly. Keeping an eye on global economic developments that could influence local markets can be particularly fruitful. Below is a comparison of several sectors’ performance metrics, which can guide your investment decisions:

| sector | Performance (%) | Market Sentiment |

|---|---|---|

| Energy | 3.5 | Bullish |

| Financials | 2.1 | Positive |

| Technology | 5.2 | Optimistic |

| Consumer Goods | 1.8 | Neutral |

wrapping Up

the close of trading on the Oslo Stock Exchange showcased a positive trend, with the OBX Index rising by 0.83%. This uptick reflects a broader sentiment of optimism among investors,driven by various market influences and economic indicators.As companies continue to navigate the complexities of both local and global markets, such upward movements can signal potential opportunities for growth and investment. As always, market participants are encouraged to remain vigilant and informed about the ongoing developments. Looking ahead,the performance of Norwegian equities will be closely monitored as investors seek to capitalize on emerging trends in a dynamic financial landscape.