Tata AutoComp to Acquire IAC Sweden: A Strategic Move in the Automotive Sector

In a meaningful growth that underscores the increasingly global ambitions of Indian automotive suppliers, Tata AutoComp has announced its decision to acquire IAC Sweden, a leading player in the interior components sector.This strategic acquisition marks a pivotal step for Tata AutoComp as it seeks to expand its footprint in the european market, enhancing its product offerings and technological capabilities. The move comes at a time when the automotive industry is undergoing rapid conversion,with a growing emphasis on innovative design and sustainability. As the integration of electric vehicles and advanced materials gains traction, Tata AutoComp’s acquisition of IAC Sweden positions the company to leverage new opportunities and strengthen its competitive edge on the international stage. This article delves into the implications of this acquisition, examining its potential impact on both companies and the broader automotive landscape.

Tata AutoComp expands Global Footprint with IAC Sweden Acquisition

Tata AutoComp’s strategic acquisition of IAC Sweden marks a significant milestone in its journey towards becoming a global leader in the automotive components industry.This move is expected to bolster Tata AutoComp’s production capabilities across various regions, allowing the company to leverage IAC’s advanced technological expertise in automotive interiors. By integrating IAC Sweden’s innovative solutions and talented workforce, Tata AutoComp aims to enhance its product offerings and meet the increasingly demanding requirements of its customers worldwide.The synergy created through this acquisition promises to unlock new growth avenues.

As the automotive landscape continues to evolve rapidly, Tata AutoComp recognizes the importance of expanding its strategic footprint. The acquisition will not only expand its market presence in Europe but will also facilitate knowledge transfer that can drive the development of cutting-edge solutions. Key benefits of the acquisition include:

- Enhanced Product portfolio: Introduction of innovative designs and technologies in automotive interiors.

- Increased Market Penetration: Strengthening presence in European markets.

- Operational Synergies: Streamlining operations through shared best practices.

- Collaboration Opportunities: Possibilities for joint ventures and partnerships.

Strategic Implications of the Acquisition for Tata AutoComp

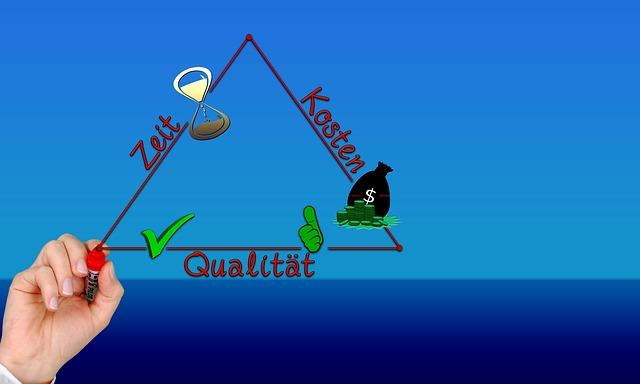

The acquisition of IAC Sweden marks a significant step forward for Tata AutoComp, signaling its intent to expand its footprint in the automotive interior solutions market. This strategic move offers the company immediate access to advanced technologies and innovation capabilities. By integrating IAC’s expertise in automotive comfort and design, Tata autocomp can enhance its product offerings and overall competitiveness. The synergies to be gained from this acquisition are manifold, including:

- access to new markets: Leveraging IAC’s established presence in Europe and an expanded customer base.

- Enhanced product portfolio: Incorporating cutting-edge interior technologies to meet diverse customer needs.

- Cost efficiencies: Streamlining operations and reducing manufacturing costs through shared resources.

Moreover, this acquisition positions Tata AutoComp as a formidable player on the global stage, as it aligns with the company’s long-term vision to innovate and lead in the industry. By tapping into IAC’s R&D capabilities, Tata AutoComp can accelerate the development of sustainable and eco-amiable interior solutions.The implications for market positioning are significant, as indicated in the table below:

| Impact Area | Before Acquisition | After Acquisition |

|---|---|---|

| Market Reach | Primarily Asia | Global, with European presence |

| Product Innovation | Traditional interiors | Advanced, technology-driven solutions |

| Cost Structure | Higher manufacturing costs | Optimized through economies of scale |

Insights into IAC Swedens Market Position and Technological Expertise

IAC Sweden stands out in the competitive automotive supply landscape, thanks to its robust market position characterized by strong partnerships and a diverse product portfolio. The company has established itself as a leading supplier of innovative interior and exterior components, effectively meeting the evolving needs of major automotive manufacturers across Europe. With a focus on sustainability and advanced manufacturing techniques,IAC Sweden integrates cutting-edge technology into its processes,ensuring high-quality production while minimizing environmental impact. This strategic alignment with global automotive trends places IAC Sweden on a growth trajectory, welcoming the advancements brought about by Tata AutoComp’s acquisition.

The company’s technological expertise is underscored by its commitment to research and development, which enables the production of state-of-the-art automotive solutions. Key highlights of IAC Sweden’s technological capabilities include:

- Advanced materials: Utilization of lightweight composites to enhance fuel efficiency.

- Digital integration: Implementation of smart technologies in vehicle interiors for improved user experience.

- Modular design: Flexibility in production that caters to a variety of vehicle models.

| Aspect | Details |

|---|---|

| Market Share | Leading supplier in interior automotive components |

| Innovation Focus | Research in lightweight and sustainable materials |

| Key Partnerships | Multiple alliances with major automotive brands |

Evaluating the Financial Aspects of the Tata AutoComp and IAC Sweden Deal

The acquisition of IAC Sweden by Tata AutoComp represents a significant shift in the automotive component landscape, with numerous financial implications for both entities. Tata AutoComp’s strategy is bolstered by this investment, aimed at enhancing its product portfolio and increasing its market reach in Europe. the deal, estimated at approximately €150 million, reflects not only a consolidation of resources but also a calculated move into a market that is progressively favoring sustainable and innovative solutions. Financial analysts suggest that through this acquisition, Tata AutoComp expects to achieve a 15% increase in revenue within two years, attributed to cross-selling opportunities and operational synergies.

The financial health of both companies will be critical in determining the ultimate success of this merger. Key financial metrics to evaluate include:

- Debt-to-Equity Ratio: Analyzing IAC Sweden’s leverage before and after the acquisition will provide insights into financial stability post-deal.

- operating Margins: A comparison of current operating margins can reveal potential efficiencies gained from the merger.

- Cash flow Projections: Future cash flow statements will indicate the deal’s impact on liquidity and operational funding.

In addition, the following table highlights essential finance-driven aspects of both companies leading up to the acquisition:

| Metric | Tata AutoComp | IAC Sweden |

|---|---|---|

| Annual Revenue | €1.2 Billion | €300 Million |

| Current assets | €500 Million | €100 Million |

| Net Profit Margin | 10% | 8% |

Future Prospects: what This Deal Means for the Automotive Industry

The acquisition of IAC Sweden by Tata AutoComp marks a significant shift within the automotive sector, highlighting a growing trend of strategic mergers aimed at enhancing technological capabilities and market reach. As Tata AutoComp integrates IAC’s expertise in interior solutions and automotive components, we can expect an influx of innovative products that could redefine industry standards. This deal not only expands Tata’s portfolio but also positions the company as a more formidable player in the global automotive market by leveraging IAC’s established presence in Europe.

Furthermore, this collaboration is expected to catalyze advancements in sustainable manufacturing practices and smart technologies within automotive interiors. Key implications of this merger may include:

- Enhanced Product Offerings: Introduction of cutting-edge interior designs that align with consumer preferences.

- Access to European markets: Improved foothold in the highly competitive European automotive landscape.

- Innovation in Sustainability: A focus on eco-friendly materials and production methods.

These developments not only indicate Tata AutoComp’s intent to lead in design and efficiency but also suggest a broader trend within the automotive industry towards globalization and adaptability in an ever-evolving market.

Recommendations for Stakeholders in the Wake of the Acquisition

The recent acquisition of IAC Sweden by Tata AutoComp marks a pivotal shift in the automotive parts landscape. Stakeholders, including investors, suppliers, and customers, must adapt to this new reality by embracing collaborative synergies that this merger presents. Investors should focus on evaluating the performance metrics post-acquisition, assessing the integration strategy, and ensuring that the projected growth aligns with their expectations. It is critical that they remain engaged through regular updates and performance reviews. Meanwhile, suppliers must be proactive in optimizing their contracts and supply chains to cater to the enlarged operational capacities, ensuring seamless delivery and optimizing costs.

For customers, understanding the potential impact on product availability and service reliability will be key in navigating this transition. They should seek open dialog with tata AutoComp to clarify any questions about product lines and support services during this integration period. Moreover,employees at both firms will benefit from workshops that focus on cultural integration and change management strategies,fostering a unified corporate identity and reducing friction during the transition. Engaging in these practices will not only smooth the acquisition process but may also unveil new opportunities for innovation and market expansion.

Concluding Remarks

Tata AutoComp’s decision to acquire IAC Sweden marks a significant step forward in the company’s strategic expansion and diversification within the automotive sector. This acquisition not only enhances Tata AutoComp’s portfolio with advanced interior solutions but also strengthens its foothold in the global market. As the automotive industry continues to evolve with increasing demands for innovation and sustainability, this move positions Tata AutoComp to better address future challenges while leveraging IAC’s expertise in key technologies. Stakeholders will be keenly observing the developments that unfold as integration plans progress, with expectations that this collaboration will yield significant benefits for both companies and the broader automotive landscape.