As digital transformation accelerates across the globe, Belgium stands at the forefront of revolutionizing its business-to-business (B2B) invoicing landscape. With the anticipated implementation of mandatory e-invoicing in 2026,Belgian businesses are preparing for a critically important shift that aims to streamline operations,enhance compliance,and boost efficiency. Coupled with this initiative is the scheduled update on real-time electronic reporting set for 2028, which promises to reshape how VAT (value-added tax) is managed within the country. In this article,we will delve into the implications of these forthcoming regulatory changes,explore the benefits of e-invoicing and real-time reporting,and assess the readiness of Belgian businesses for this digital pivot in the face of evolving fiscal landscapes. With insights from industry experts and key stakeholders, we aim to provide a extensive overview of what lies ahead for businesses navigating the complex world of VAT compliance in Belgium.

Belgiums Shift Towards E-Invoicing: What Businesses Need to Know

As Belgium transitions towards mandatory e-invoicing in B2B transactions by 2026, businesses must understand the implications of this digital shift. E-invoicing not only streamlines billing processes but also enhances compliance with tax regulations.the need for companies to adapt is critical, given that e-invoicing can minimize errors, reduce processing time, and cut operational costs. To successfully navigate this shift, businesses should focus on the following aspects:

- Technology Adoption: invest in e-invoicing software that integrates smoothly with existing accounting systems.

- Compliance Readiness: Stay updated on Belgian regulations and ensure adherence to the e-invoicing specifications set by the government.

- Training and Support: Provide necessary training for staff to handle new systems and processes effectively.

Furthermore, the impending rollout of real-time e-reporting by 2028 adds another layer of complexity. This initiative aims to improve tax transparency and fraud prevention, compelling businesses to report transactions in real time. To prepare for this growth, companies should:

- enhance Data Accuracy: Implement robust data management practices to ensure accuracy in reporting.

- Understand Reporting Requirements: Familiarize themselves with the types of transactions that will require real-time reporting.

- Engage with Service Providers: Collaborate with invoicing and reporting service providers for seamless integration and support.

| Key Dates | Event | Business Action |

|---|---|---|

| 2026 | Mandatory B2B E-Invoicing | Implement e-invoicing systems |

| 2028 | Real-Time E-Reporting | prepare for real-time transaction reporting |

Understanding the 2026 B2B E-Invoicing Regulations in Belgium

With the growth of digitalization in the business landscape, the Belgian government is set to implement new e-invoicing regulations in 2026, which will revolutionize the way businesses manage their invoicing processes. As part of a broader initiative to streamline operations and enhance VAT compliance, these regulations aim to introduce a standardized format for B2B invoices. Businesses will need to ensure they are equipped with the right tools to generate,send,and receive e-invoices that comply with these new standards. Key aspects of the regulations include:

- Mandatory e-invoicing: All B2B transactions will require digital invoices, moving away from paper billing.

- Standardized formats: Invoices must adhere to specific electronic formats, such as XML, to facilitate easier processing and integration.

- Real-time reporting obligations: Companies will be expected to report invoice data to the tax authorities in real time, enhancing transparency and compliance.

In planning for these changes, businesses should consider investing in robust e-invoicing solutions that not only comply with the upcoming regulations but also improve efficiency and reduce errors in financial reporting. Additionally,the implementation of real-time e-reporting by 2028 requires companies to modernize their IT infrastructure and ensure data accuracy. The following table summarizes the key dates and milestones businesses should be aware of:

| Year | milestone | Action Required |

|---|---|---|

| 2026 | Mandatory B2B e-invoicing | Implement e-invoicing systems |

| 2028 | Real-time e-reporting | Ensure data reporting compliance |

The Implications of Real-Time E-Reporting for Businesses by 2028

The move towards real-time e-reporting is poised to revolutionize how businesses operate,especially in the context of compliance and financial operations. By 2028, companies will need to adapt to enhanced regulatory requirements that will streamline reporting processes and reduce lead times significantly. This shift not only demands a re-evaluation of current accounting systems but also emphasizes the need for robust data management and security practices.Key implications include:

- increased Efficiency: Automating tax compliance and reporting minimizes manual work and accelerates the invoicing cycle.

- Real-Time Analytics: Businesses can leverage data insights instantly, allowing for proactive decision-making.

- Enhanced Compliance: With automated checks and balances, the risk of non-compliance decreases substantially.

Moreover, businesses may also face challenges related to implementation and technology adoption. Achieving seamless integration of real-time e-reporting solutions with existing ERP systems may require considerable investments and employee training.To navigate these complexities, organizations should consider the following strategies:

| Strategy | Description |

|---|---|

| Invest in Technology | Allocate resources for the latest e-reporting tools that facilitate real-time data transmission and analytics. |

| Upskill Employees | Provide training on new systems to ensure that staff can efficiently manage the transition. |

| Consult Experts | Engage with consultants to tailor solutions that fit specific business needs and compliance standards. |

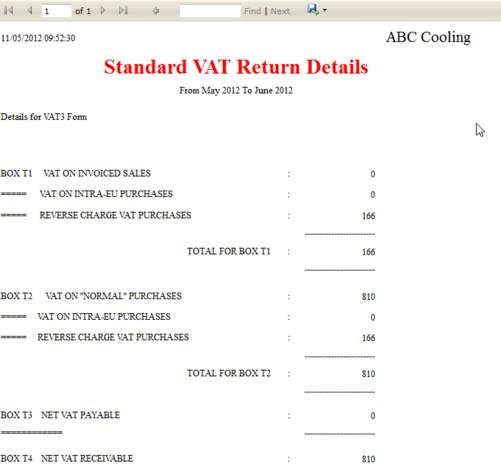

Navigating compliance: Best Practices for VATCalc Users

As businesses prepare for the upcoming B2B e-invoicing mandated by the Belgian government in 2026, it’s crucial for VATCalc users to adopt robust compliance practices. Familiarizing yourself with the e-invoicing standards set forth by authorities will not only streamline invoicing processes but also minimize errors that can lead to significant fines. Key action points include:

- Understanding E-invoicing Requirements: Stay informed about the specific formats and protocols required for e-invoices, including data elements and transmission methods.

- Integrating with VATCalc: Ensure your VATCalc system is set up to handle e-invoicing functions seamlessly, including validations and error-checking capabilities.

- Regular Training: Conduct training sessions for staff to ensure everyone is aware of compliance standards and the technology involved.

Looking ahead to 2028, businesses will need to adapt to real-time e-reporting, a significant shift that requires efficient data handling and reporting practices. VATCalc users should prioritize the following strategies:

- Automating Reporting Processes: Leverage VATCalc’s automation features to eliminate manual data entry and reduce reporting errors.

- Monitoring Legislative Changes: Keep abreast of updates in legislation regarding e-reporting to ensure ongoing compliance.

- Establishing Data Integrity Protocols: Implement systems to regularly audit and verify the data generated by VATCalc for accuracy and completeness.

| Year | Compliance Requirement | Action Item |

|---|---|---|

| 2026 | B2B E-invoicing | understand and implement e-invoicing standards. |

| 2028 | Real-time E-reporting | Automate reporting processes to ensure compliance. |

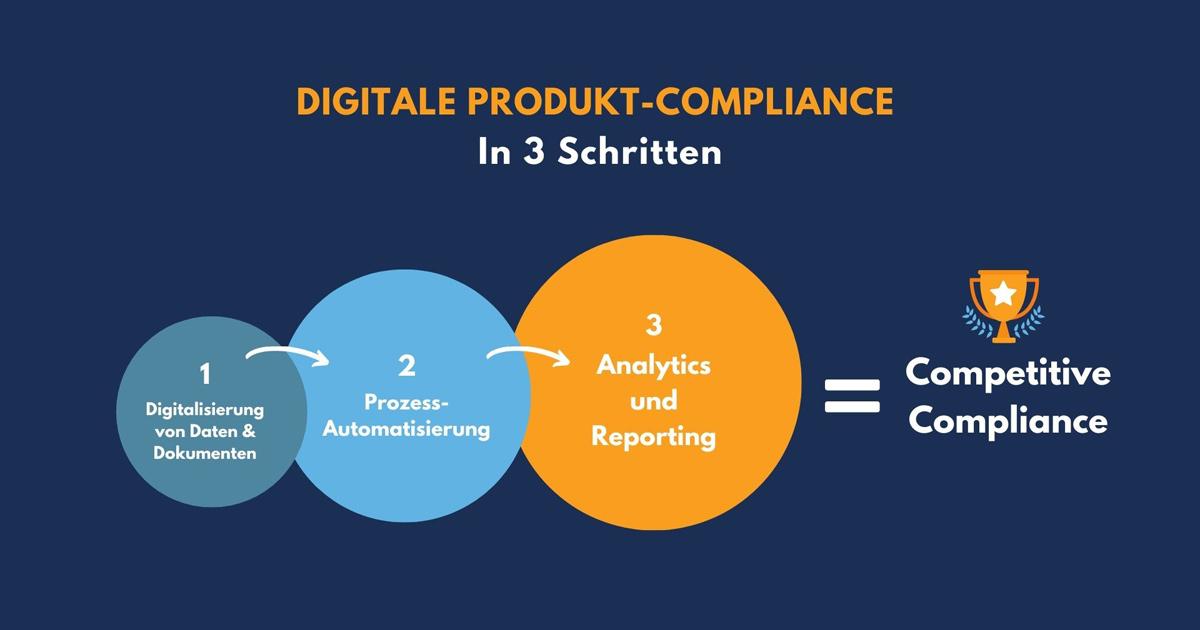

Preparing Your Business for Digital transformation in Finance

As businesses in Belgium gear up for the coming wave of e-invoicing and real-time e-reporting requirements, it is crucial to implement a robust digital transformation strategy in finance. This includes a comprehensive assessment of existing processes and technologies to identify gaps and areas for advancement.Companies should consider the following essential steps:

- Embrace Automation: Integrate automated solutions to streamline invoicing processes and enhance accuracy.

- Invest in Technology: Upgrade existing systems or adopt new financial software to support compliance with e-invoicing and reporting mandates.

- Train Staff: Provide necessary training for employees on new digital tools to ensure a smooth transition and full utilization.

Moreover, as the tax landscape evolves, organizations must stay informed about the specific requirements set to be implemented by 2028. This will involve closely monitoring regulatory updates and adapting systems to maintain compliance. Here’s a brief overview of the anticipated changes to consider:

| Year | Change | Description |

|---|---|---|

| 2026 | E-invoicing | Mandatory use of electronic invoices for B2B transactions. |

| 2028 | Real-time Reporting | Introduction of real-time VAT reporting for businesses. |

The future of VAT Reporting: Insights and Strategic Recommendations for 2028

The landscape of VAT reporting is set for monumental changes by 2028, particularly within the context of Belgium’s B2B e-invoicing framework. With the government aiming to streamline compliance and enhance transparency, businesses must prepare for significant shifts. Key considerations include:

- Integration of Real-Time reporting: The move towards real-time e-reporting will necessitate businesses to adopt refined technologies that can generate and transmit VAT data instantly.

- Enhanced data Analytics: Companies should invest in analytics tools to derive actionable insights from their VAT data, thus enabling proactive decision-making.

- Collaboration with Technology Partners: Establishing partnerships with tech providers will be vital for facilitating seamless transitions, ensuring compatibility with evolving regulations.

Moreover, businesses need to stay informed about the regulatory landscape to mitigate risks associated with non-compliance. Strategic measures should entail:

- Continuous Training: employees must be kept abreast of new systems and requirements through ongoing training initiatives.

- Monitoring Legislative Updates: A robust mechanism for tracking changes in VAT laws will help organizations adapt swiftly without disrupting operations.

- Flexibility in Operations: Developing adaptable frameworks and agile processes will allow businesses to respond to the dynamic nature of VAT reporting requirements.

| Strategic focus | Action Steps |

|---|---|

| Technology Adoption | Implement cloud-based invoicing systems |

| Talent Development | Conduct monthly VAT compliance workshops |

| Regulatory Alignment | Create a compliance calendar for updates |

to Wrap It Up

the advancements in Belgium’s e-invoicing and real-time e-reporting frameworks for 2026 and 2028 represent a significant shift toward greater efficiency and compliance in the B2B sector. As businesses prepare to navigate this evolving landscape, staying informed and proactive will be crucial to seamlessly integrating these digital processes. VATCalc will continue to provide insights and support,ensuring that companies can adapt to these regulatory changes effectively. As we look ahead, the emphasis on automation and transparency will not only streamline operations but also foster a culture of accountability within the Belgian business ecosystem. Businesses must now gear up for these transitions, embracing the future of invoicing and reporting that is set to define the next chapter of financial interaction in Belgium.