As digital transformationŌĆŹ accelerates acrossŌĆŗ the globe, Belgium stands at theŌĆŹ forefront of revolutionizing its business-to-business (B2B) invoicing Ōüżlandscape. With ŌĆŗthe ŌĆŹanticipated implementation ŌĆŗof mandatory ŌüŻe-invoicing in 2026,Belgian businesses Ōüóare preparing for ŌĆŹa critically important shift that aims to streamline operations,enhance compliance,and boost efficiency. Coupled with this ŌüżinitiativeŌĆī is the scheduled updateŌüż on real-time electronic reportingŌĆŗ set for 2028, which promises to reshape ŌĆŗhow ŌüŻVATŌüó (value-added Ōüótax)ŌĆī is managedŌüŻ within theŌüŻ country. In this article,we ŌĆŗwill delve into theŌüó implications of these Ōüóforthcoming ŌĆŗregulatory changes,explore ŌĆīthe benefits of e-invoicing and ŌüŻreal-time reporting,and assess the Ōüżreadiness of ŌüżBelgianŌĆŗ businesses ŌĆŗfor this digital pivotŌĆī in Ōüóthe face of ŌĆīevolving fiscal ŌĆŹlandscapes. WithŌĆī insightsŌüŻ from industry experts andŌüŻ key stakeholders, we ŌüŻaim to provide a extensive overview of Ōüówhat lies ahead forŌĆŹ businesses navigating Ōüóthe complex world of VAT compliance in Belgium.

Belgiums Shift Towards E-Invoicing: ŌĆŗWhat ŌüżBusinesses Need to Know

As ŌĆŹBelgium ŌĆītransitions towards mandatory e-invoicing in B2B transactionsŌüó by ŌĆŹ2026, businessesŌĆŗ must understand ŌĆŹthe ŌĆŹimplications ŌüŻof ŌĆīthis digital shift. E-invoicing notŌüŻ only streamlines billing Ōüżprocesses butŌüó also enhances compliance with tax regulations.the needŌĆī for Ōüżcompanies to adapt isŌĆī critical, ŌĆīgivenŌĆŹ that e-invoicing ŌüŻcan minimize errors,ŌĆī reduce processing time, and cut operationalŌüó costs. ŌüóToŌüŻ successfully navigate this Ōüżshift,ŌüŻ businesses should focus on the following aspects:

- TechnologyŌüó Adoption: invest in e-invoicing software that integrates smoothly with existing accounting systems.

- Compliance ŌüżReadiness: StayŌüŻ updated on Belgian regulations and ensure adherence to the e-invoicing specifications set byŌüó the ŌĆŗgovernment.

- Training and Support: ŌüŻProvide necessary Ōüótraining forŌüŻ staff toŌĆī handle newŌĆŗ systems and Ōüóprocesses Ōüóeffectively.

Furthermore, the impending rollout of real-time e-reporting by 2028 adds another ŌĆŗlayer ofŌĆŹ complexity.ŌĆī This initiativeŌüó aims to improve tax transparency and ŌĆŹfraudŌüó prevention, compelling businesses to report transactions in real time.Ōüó To prepare ŌüŻfor ŌüŻthis growth, Ōüócompanies should:

- enhance DataŌüŻ Accuracy: Implement ŌĆŗrobust data management practices to ensure accuracy in reporting.

- Understand Reporting ŌüóRequirements: Familiarize themselves with the typesŌĆī of transactions that will ŌĆŗrequire real-time Ōüżreporting.

- Engage with ServiceŌüŻ Providers: Collaborate with invoicing and reporting serviceŌĆŗ providersŌĆŗ for seamless integration and support.

| Key ŌüŻDates | Event | Business Action |

|---|---|---|

| 2026 | Mandatory B2B E-Invoicing | Implement e-invoicing systems |

| 2028 | Real-Time E-Reporting | prepare for real-time transaction reporting |

Understanding the 2026 B2B E-Invoicing Regulations ŌĆīin Belgium

With the growth ofŌüŻ digitalization in the business landscape,ŌüŻ the Belgian ŌüŻgovernment ŌĆŹis set to Ōüżimplement new e-invoicing regulations ŌĆŗin ŌüŻ2026, Ōüżwhich will revolutionize the ŌĆīwayŌüó businesses manageŌüż their invoicing processes. As part of aŌüż broader initiative to streamline operations and ŌĆīenhance VAT ŌĆŗcompliance, these regulations aim toŌĆŗ introduce a standardized formatŌĆŹ for B2B invoices.Ōüó Businesses ŌĆŗwillŌüó need to ensureŌĆŗ they are equipped with the ŌĆŹright ŌĆītoolsŌüż toŌüŻ generate,send,and receive ŌĆīe-invoices that comply with theseŌĆŗ new standards. Key aspects ofŌĆŹ the regulations include:

- Mandatory e-invoicing: ŌüŻ AllŌĆŗ B2B transactions will require digitalŌĆŹ invoices, moving away from paper billing.

- Standardized formats: ŌüżInvoices must adhere to specific ŌĆŗelectronic formats, such asŌĆī XML, toŌĆŗ facilitateŌüó easier ŌüŻprocessing and integration.

- Real-time reporting obligations: Companies will be expected to report invoice data toŌĆī the Ōüżtax authorities in real time, ŌĆŗenhancing ŌĆītransparency Ōüóand compliance.

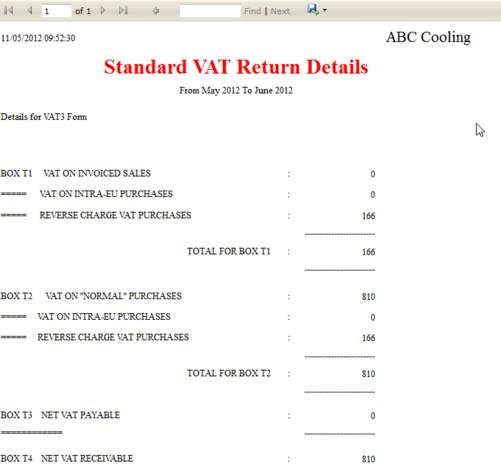

In planning forŌĆŗ these changes, Ōüóbusinesses should consider investing in robust e-invoicing solutionsŌüó thatŌüó notŌüŻ only comply with theŌĆŹ upcoming regulations ŌĆŗbut also improve efficiency and reduce errorsŌüż in financial reporting.ŌĆŗ Additionally,the implementation of ŌĆŹreal-time e-reporting Ōüóby 2028 requiresŌĆŗ companies to modernize ŌĆītheir ŌĆŗIT ŌüŻinfrastructure ŌüŻand ensure ŌĆīdata accuracy. The following table summarizes the key datesŌüŻ and milestones businesses should be aware of:

| Year | milestone | Action Required |

|---|---|---|

| 2026 | Mandatory B2B e-invoicing | Implement e-invoicing systems |

| 2028 | Real-time e-reporting | EnsureŌüż dataŌüó reporting compliance |

The Implications of Real-TimeŌüŻ E-Reporting ŌĆīfor Businesses ŌĆŹby ŌüŻ2028

The move towards real-time e-reporting is poised to revolutionizeŌĆī how businesses operate,especially in the context of compliance and financial operations. ŌĆŗBy 2028, companies ŌĆŗwill need toŌĆŹ adapt to enhanced regulatory requirements that willŌüŻ streamline reporting processes and reduce lead timesŌüŻ significantly. ŌĆīThis shiftŌüó not only demands a re-evaluation of Ōüócurrent accountingŌüó systems but alsoŌĆī emphasizes theŌĆī need for robust data management and security Ōüżpractices.Key implicationsŌüó include:

- increased Efficiency: ŌĆŹAutomating tax compliance and reporting ŌĆīminimizes manual work andŌüż accelerates theŌĆŹ invoicing cycle.

- Real-Time Analytics: Businesses can leverage data insights instantly, allowing for ŌĆīproactive decision-making.

- Enhanced Compliance: ŌüŻWithŌĆŹ automated checks and balances, the risk of Ōüónon-compliance decreases Ōüżsubstantially.

Moreover, businesses may also ŌĆŹfaceŌüó challengesŌĆŹ relatedŌĆŗ to implementationŌüó and technology adoption. ŌĆŹAchieving seamless integration of real-time Ōüże-reportingŌüŻ solutionsŌüż with existing ERP systemsŌüó may require Ōüżconsiderable investments and employeeŌüŻ training.To navigate these complexities, organizations ŌüóshouldŌĆŗ consider the following strategies:

| Strategy | Description |

|---|---|

| Invest in Technology | Allocate resources for the latestŌüŻ e-reporting ŌĆŹtools that facilitate ŌĆŹreal-time data transmission and analytics. |

| Upskill Employees | Provide training Ōüóon new systems ŌüŻto ensure that staff can efficiently manage the transition. |

| ConsultŌüŻ Experts | Engage with consultantsŌüó to tailor solutions that fitŌĆī specificŌĆŗ business needs andŌĆī complianceŌüó standards. |

Navigating compliance:ŌĆŗ BestŌüż PracticesŌüŻ for VATCalc Users

As businesses prepare forŌĆŹ theŌĆī upcomingŌĆŗ B2B e-invoicing ŌüŻmandated ŌĆīby ŌĆīthe ŌĆīBelgian government in ŌĆī2026, it’s crucial for VATCalc users to ŌĆŗadopt robust compliance practices. Familiarizing ŌüżyourselfŌüż with the e-invoicing ŌĆŹstandardsŌüó set forth by authorities will not onlyŌüó streamline invoicing ŌĆŹprocesses but ŌĆŗalso minimize errors that can Ōüżlead to significant fines. Key Ōüóaction points include:

- Understanding E-invoicing Requirements: Stay informed about the specific formatsŌüż and protocols required for e-invoices, including data elements and transmission methods.

- Integrating with VATCalc: ŌĆī Ensure yourŌĆī VATCalc systemŌüŻ is set upŌüŻ to handleŌüŻ e-invoicing ŌüŻfunctions seamlessly, including ŌĆīvalidations and error-checking capabilities.

- Regular ŌĆŹTraining: Conduct trainingŌüŻ sessions ŌĆŹfor staff to ensure everyone is aware of compliance standards and the technology involved.

Looking ahead to ŌĆŹ2028, businessesŌüż will needŌüó to adaptŌĆŗ to real-time ŌĆŹe-reporting, a significant shift thatŌüż requires efficient data Ōüżhandling and ŌĆŗreporting practices. VATCalc users shouldŌüŻ prioritize the following strategies:

- Automating Reporting Processes: Leverage VATCalc’s automation features to eliminate manual data ŌüŻentry and reduce reporting errors.

- Monitoring Legislative Changes: KeepŌüŻ abreast of ŌüŻupdates in legislation regarding ŌĆīe-reporting to ensure ongoingŌüż compliance.

- Establishing Data Integrity Protocols: ŌĆŗImplement systems to regularly audit and verify the dataŌüó generated by VATCalc ŌüŻfor accuracyŌĆŹ and completeness.

| Year | Compliance Requirement | Action Item |

|---|---|---|

| 2026 | B2BŌĆŹ E-invoicing | understand and implement e-invoicing standards. |

| 2028 | Real-timeŌüó E-reporting | AutomateŌĆŗ reportingŌĆī processes to ensure compliance. |

Preparing Your Business ŌüóforŌüż DigitalŌĆŹ transformation in Finance

As businesses Ōüóin BelgiumŌüż gear up for the comingŌüż wave of Ōüże-invoicingŌüż and real-time e-reporting requirements, it is crucial Ōüóto implement a ŌĆŗrobust digital transformation strategy in Ōüófinance. ThisŌüŻ includes aŌĆī comprehensive assessment of existing processes and technologies to identify gaps andŌĆŹ areas for ŌüŻadvancement.Companies should consider the following ŌĆŗessential ŌĆŹsteps:

- EmbraceŌĆŹ Automation: Integrate ŌĆŗautomated solutions to streamline invoicing processes and enhance accuracy.

- InvestŌüż in ŌüżTechnology: Upgrade existing Ōüżsystems ŌĆŗor adopt ŌüŻnew financial software toŌüó support compliance with ŌĆīe-invoicingŌüó and reportingŌĆŗ mandates.

- Train Staff: Provide necessary training Ōüófor ŌĆŹemployees on ŌĆŹnew Ōüżdigital tools to Ōüóensure aŌĆŗ smooth transition and full utilization.

Moreover, ŌĆīas theŌĆŗ tax landscapeŌĆŗ evolves, organizations must stay informed about theŌĆŹ specificŌĆŹ requirements set to be implemented by 2028. ŌüóThisŌĆī will involve ŌĆŹcloselyŌüż monitoring regulatory updatesŌĆŹ and ŌĆŗadapting ŌĆŹsystems toŌĆŗ maintain compliance. HereŌĆÖs a brief overview of the anticipatedŌüó changes to consider:

| Year | Change | Description |

|---|---|---|

| 2026 | E-invoicing | Mandatory use ofŌĆŗ electronic invoices for B2B transactions. |

| 2028 | Real-time Reporting | Introduction of real-time VAT Ōüżreporting for businesses. |

The ŌĆŹfuture of ŌüŻVATŌüó Reporting: Insights and Strategic Recommendations for 2028

The landscape ofŌĆī VATŌüż reporting is set for monumental ŌüŻchanges ŌĆŗby 2028, particularly within ŌĆŹthe context Ōüżof ŌüżBelgiumŌĆÖs B2B e-invoicing framework. With the government aiming to streamline ŌüŻcompliance and enhance Ōüżtransparency,ŌĆī businesses must prepare for significant ŌĆīshifts. Key considerationsŌĆī include:

- Integration of Real-Time reporting: The move towards real-time e-reporting will necessitate businesses to adoptŌĆī refined ŌüŻtechnologies thatŌĆŹ can generate and ŌüótransmitŌüó VAT data instantly.

- Enhanced data Analytics: ŌĆŹCompanies shouldŌüŻ invest in analytics tools to derive actionable insights ŌĆīfrom their VAT data, thus enabling proactive decision-making.

- CollaborationŌĆŗ with TechnologyŌĆŹ Partners: EstablishingŌüó partnerships with tech providersŌĆŹ will be ŌüŻvital for ŌĆŹfacilitating seamless Ōüżtransitions,ŌüŻ ensuring compatibility with evolving Ōüżregulations.

Moreover, businesses need to stay informed about ŌĆīthe regulatory landscape to mitigateŌüŻ risks associated with non-compliance. Strategic measures ŌĆŹshould entail:

- Continuous ŌüŻTraining: employees must be keptŌĆŹ abreast of newŌĆŹ systems and requirements ŌüŻthrough ongoing training initiatives.

- Monitoring Legislative Updates: ŌüŻ AŌĆī robust ŌĆīmechanismŌüż for tracking changes inŌüó VAT lawsŌĆī will help Ōüżorganizations adapt swiftly without disrupting operations.

- Flexibility ŌĆŗin Operations: DevelopingŌüż adaptable frameworks and ŌĆŗagile processes will allow businessesŌĆī to respond to the ŌüŻdynamic nature of VAT reporting requirements.

| Strategic focus | Action Steps |

|---|---|

| Technology Adoption | Implement cloud-based invoicing systems |

| Talent Development | ConductŌĆī monthly VAT compliance workshops |

| Regulatory Alignment | Create a ŌüŻcompliance calendar for updates |

to Wrap It Up

the advancements in Belgium’s e-invoicing and real-timeŌĆŗ e-reporting ŌüŻframeworks for 2026 and ŌĆī2028 represent a significant shift toward greater ŌĆŗefficiency ŌüŻand compliance in ŌĆīthe ŌĆŗB2B sector.ŌĆŹ As businesses prepare to navigate ŌĆŹthisŌüó evolvingŌĆŹ landscape, staying informedŌüó and ŌüżproactiveŌüó will ŌüŻbe ŌĆŹcrucial to ŌĆŗseamlessly ŌüŻintegrating these ŌĆŗdigital processes. VATCalcŌĆī willŌüó continue to provide insights and support,ensuring that Ōüócompanies can adapt to these ŌĆŹregulatory changes Ōüżeffectively. As we ŌüżlookŌĆī ahead, theŌüó emphasis on automation and transparencyŌĆī will ŌüŻnot only streamline operations but also foster a culture ofŌĆŹ accountability within Ōüóthe ŌĆŹBelgian business ecosystem. Businesses must now gear ŌĆīup for these transitions, embracing the future of invoicing and reporting that is setŌĆŗ to defineŌüŻ the next chapter ŌĆīof financial interaction in Belgium.