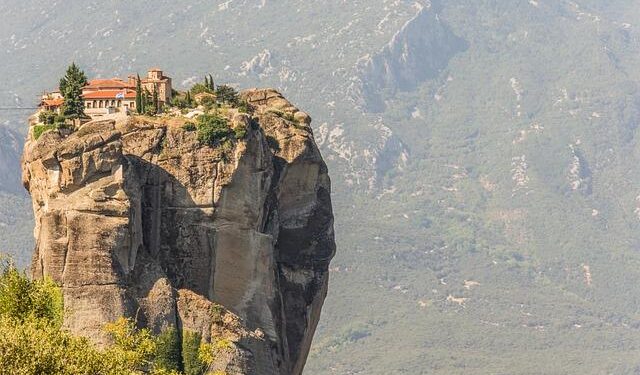

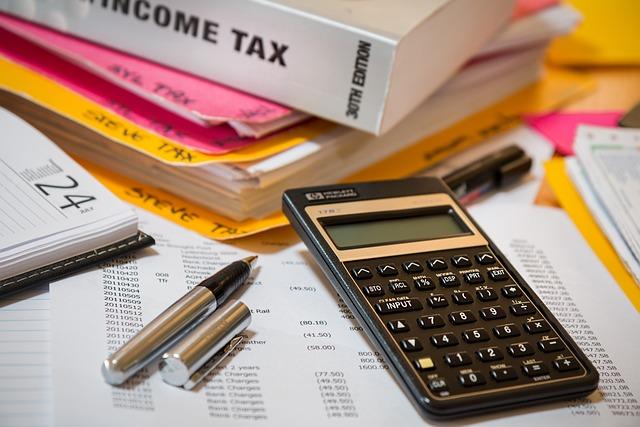

As global travel continues it’s robust recovery, several popular tourist destinations are taking bold steps to recalibrate their tourism economies by enacting substantial tax increases for visitors in 2025. Greece, Italy, the United Kingdom, Portugal, the Netherlands, France, and Thailand have all announced plans to introduce important tourist tax hikes aimed at managing the strain on their local infrastructures and preserving cultural heritage sites. These changes are poised to transform the financial landscape for travelers, especially during the bustling summer season when tourism peaks.This article delves into the specifics of each country’s tax strategy, explores the implications for tourists, and considers the broader impact on the travel industry as nations strive to balance visitor influx with sustainable growth and community welfare.

Impact of Increased Tourist Taxes on travel Budgets in Europe and Beyond

The recent surge in tourist taxes across Europe and popular destinations like Thailand is set to significantly alter travel budgets for countless visitors in 2025. Governments are asserting that these hikes aim to bolster local economies and maintain infrastructure to accommodate the influx of travelers. countries such as Greece, Italy, and the UK are implementing these measures to combat overtourism and fund essential public services. Travelers budgeting for vacations will need to carefully recalibrate their financial plans to incorporate these new additional costs.In many cases, tourists may find themselves forking over fees on a nightly basis, drastically increasing overall trip expenses.

To put this into viewpoint, here are some key points regarding the impact of these tax hikes:

- In Greece, the increase in accomodation taxes could add up to €5 per night to hotel stays.

- Italy’s popular tourist hubs, including Venice, have reported increases that can equate to a 3% surcharge on the total bill.

- France is considering a new levy for cultural sites, potentially raising entry fees by €10 per visit.

- The UK plans to implement a substantial tax for overseas visitors, projected to add an average of ÂŁ15 per trip.

- In Thailand, those visiting major cities may see new service fees at hotels and attractions of up to 20%.

| Country | New Tourist Tax | Additional Cost for Average Stay |

|---|---|---|

| Greece | Up to €5/night | €35 for 7 nights |

| Italy | 3% surcharge | €21 on €700 |

| France | €10 per cultural site | €50 for 5 sites |

| UK | ÂŁ15 per trip | ÂŁ15 flat rate |

| Thailand | 20% service fee | €20 on €100 |

Comparative Analysis of Tax Hikes Across Greece, Italy and Portugal

In recent years, Greece, Italy, and Portugal have introduced significant tax hikes as a measure to boost tourism revenue and fund public services.These increases have prompted discussions regarding their potential impacts on international travelers. For instance, Greece has raised its tourist tax rates, which are typically calculated based on the class of accommodation. Rates can now range from €0.50 to €4.00 per night, depending on the hotel rating. This shift may affect tourists’ choices, potentially steering them toward alternative destinations or accommodations as they calculate their budgets.

Meanwhile, Italy has also taken a decisive step by implementing a flat tourist tax that applies not only to hotel stays but also to short-term rentals and attractions. This tax will vary across cities, with popular destinations like venice charging upwards of €10 per day during peak season. Portugal, conversely, remains relatively competitive with its tourist tax system, but major cities like Lisbon and Porto have incrementally raised their fees, making travelers evaluate their itineraries carefully. the evolving landscape of these countries’ tax structures necessitates a reassessment of travel plans and highlights the growing importance of fiscal policies in shaping the future of international tourism.

Navigating the New Costs: Strategies for Budget-Conscious Travelers

As tourist tax hikes loom in several popular destinations for 2025, budget-conscious travelers must re-evaluate their spending habits and strategies while planning their vacations. With countries like Greece, Italy, the UK, Portugal, the Netherlands, France, and Thailand implementing significant increases in travel-related fees, travelers can benefit from actionable tips to minimize financial impact. Here are some effective strategies:

- Book in Advance: Early bird discounts on flights and accommodations can offset additional costs associated with tourist taxes.

- Travel Off-Peak: Adjusting travel dates to avoid peak tourist seasons allows for lower rates on lodging and attractions.

- Choose Alternative Destinations: Seek less touristy locales within the same country; these can provide rich experiences at a fraction of the cost.

- Public Transport: Utilizing local transportation can be significantly cheaper than taxis or rental cars, especially in urban areas.

To further assist travelers in understanding cost dynamics, it’s useful to compare the anticipated tax increases across the affected countries.The following table illustrates the difference in projected tourist taxes that could affect vacation budgets:

| Country | projected Tax Increase | Key Travel Expense Impact |

|---|---|---|

| Greece | 15% | Accommodation |

| Italy | 20% | Tours & Attractions |

| UK | 10% | Dining |

| Portugal | 12% | Transportation |

| Netherlands | 18% | Accommodations |

| France | 15% | Cultural Sites |

| Thailand | 25% | Excursions |

How the UK and Netherlands Plan to Utilize Increased Revenue from Tourist Taxes

The recent decision by the UK and Netherlands to raise tourist taxes reflects a strategic move to harness these additional funds for the betterment of local infrastructure and community resources. Both countries plan to channel the increased revenue into essential areas that enhance the travel experience while simultaneously supporting their communities. Key initiatives include:

- Investment in Infrastructure: Upgrading public transport systems and enhancing connectivity to major tourist attractions.

- Sustainability Projects: Financing eco-friendly initiatives such as waste management systems and green public spaces.

- Cultural Preservation: Funding for the conservation of past sites and promotion of local arts and heritage.

- Tourist Safety: Increasing funding for public safety measures and visitor information services.

The implementation of these plans is expected to create a win-win scenario where tourists not only contribute to the local economy but also enjoy enriched experiences. As an example,as part of their funding strategy,both nations are investing in a multi-year campaign to improve digital resources for tourists,including interactive apps and online guides. A comparative breakdown of anticipated expenditure in various areas reveals the countries’ commitment to fostering long-term benefits:

| Investment Area | UK Allocation (£ million) | Netherlands Allocation (€ million) |

|---|---|---|

| Public Transport | 150 | 100 |

| Sustainability Projects | 80 | 60 |

| Cultural Preservation | 50 | 40 |

| Tourist Safety | 45 | 30 |

France and thailand: Diverging approaches to Sustainable Tourism Funding

France and Thailand represent two contrasting paradigms in their approaches to funding sustainable tourism initiatives.While France leverages its affluent tourism sector to impose substantial tourism taxes aimed at bolstering environmental sustainability, Thailand adopts a more grassroots approach. The French model suggests that increased tourist levies can directly enhance preservation efforts, allowing for investments in infrastructure and community engagement. This approach echoes the country’s commitment to maintaining its cultural and natural heritage while ensuring that the tourism sector contributes meaningfully to sustainability.

Conversely, Thailand emphasizes community involvement and local partnerships as a means of fostering sustainable tourism. The Thai government has initiated programs that focus on engaging local communities in tourism development,allowing them to shape their strategies and reap the benefits. This bottom-up approach encourages responsible travel while promoting local cultures and ecosystems without imposing burdensome taxes. By prioritizing decentralized funding solutions, Thailand showcases how sustainable tourism can thrive through collaboration and innovation, rather than solely through financial penalties for visitors.

Future of European Travel: What Tourists Need to Know for 2025 and Beyond

The travel landscape in Europe is set for a significant transformation as several popular destinations impose substantial increases in tourist taxes starting in 2025. This trend has emerged as countries like Greece, Italy, the UK, Portugal, the Netherlands, France, and even Thailand aim to balance economic recovery with sustainability.to mitigate the financial burden on local infrastructures and enhance tourism experiences, these measures will inevitably lead to higher costs for travelers. Tourists planning their itineraries will need to budget more carefully, as the cumulative effect of these taxes could alter classic travel habits, especially during peak summer months.

Travelers should be equipped with knowledge about these anticipated changes well in advance.Here are some essential points to consider:

- Tax increases: Familiarize yourself with specific tax rates for each country, as they may vary greatly, impacting accommodation, attractions, and meals.

- Booking Early: With the potential spike in costs, securing accommodations and travel tickets early might be more crucial than ever.

- Alternative Destinations: Consider lesser-known locales that won’t impose these hefty taxes,potentially offering better value for money.

- Sustainability impact: Look for eco-friendly accommodations and activities that promote sustainable tourism, aligning with the shift towards responsible travel.

| Country | Estimated Tax Increase | Effective Date |

|---|---|---|

| Greece | 20% | January 2025 |

| italy | 25% | April 2025 |

| UK | 15% | June 2025 |

| Portugal | 30% | July 2025 |

| Netherlands | 10% | August 2025 |

| France | 20% | September 2025 |

| Thailand | 15% | October 2025 |

Wrapping Up

the significant tourist tax hikes being implemented by Greece, Italy, the UK, Portugal, the Netherlands, France, and Thailand for 2025 mark a transformative shift in the landscape of international travel. As countries grapple with the dual pressures of sustaining their unique environments and providing for their communities, these increased fees reflect an evolving approach to tourism management. Travelers planning summer trips to these popular destinations will need to adapt their budgets accordingly, as these changes not only affect the cost of accommodations and attractions but also signal a broader commitment to responsible tourism practices.

As nations pursue a balance between welcoming visitors and preserving their cultural and natural heritage, tourists can expect a more conscious travel experience in the years to come. It is essential for travelers to stay informed about these developments and to consider how their travel choices impact the destinations they love. Ultimately,while the changes may pose challenges,they also present an chance for a more sustainable and enriching travel experience moving forward.