In a pivotal economic development, Norway’s central bank has decided to postpone its anticipated first rate cut of the current monetary cycle, citing a recent uptick in inflation as a critical factor. This decision, reported by Bloomberg, underscores the complexity of navigating economic recovery amidst fluctuating price levels and ongoing global uncertainties. As central banks around the world grapple with the dual challenge of fostering growth while managing inflationary pressures, Norway’s action signals a cautious approach, reflecting a broader trend among policymakers to prioritize price stability over immediate stimulus measures.This article delves into the implications of Norway’s decision, the current state of its economy, and the potential impacts on the broader financial landscape.

Norwegian Central Bank Responds to Inflation pressure with Rate Cut Postponement

The Norwegian Central Bank’s recent decision to delay an anticipated cut in interest rates has sparked discussions among economists and market analysts. The bank’s move comes in response to a noticeable uptick in inflation, which has raised concerns that the previous monetary policy framework may need to be recalibrated. Officials cited a range of factors influencing this inflationary pressure, including robust domestic demand and higher prices for imported goods. Key indicators suggest that inflation is outpacing expectations, leading policymakers to reassess their strategy before initiating any rate reductions.

as the central bank navigates this complex economic landscape, several critical factors will shape its future decisions:

- Inflation Trends: Continuing to monitor both core and headline inflation rates.

- Global Economic Conditions: Evaluating international factors that could impact Norway’s economy.

- labor Market Dynamics: Observing unemployment rates and wage growth trends.

- Consumer Spending: Analyzing changes in consumer behavior in response to price fluctuations.

in the context of these developments, the central bank has emphasized its commitment to maintaining price stability as it proceeds cautiously. Investors and analysts will be keenly watching for further signals regarding the timing and nature of any future shifts in monetary policy.

Economic Indicators Show Unexpected Rise in Inflation Rates

The recent surge in inflation rates has taken economists and policymakers by surprise, signaling a need for a reevaluation of monetary policy strategies. Key indicators such as the Consumer Price index (CPI) and producer prices have shown significant increases, prompting central banks, including that of Norway, to reassess their approach to interest rates. As inflation continues to outpace previous forecasts, analysts are speculating whether this trend will persist or stabilize. The rise has led to discussions surrounding the potential implications for consumer spending, wage growth, and overall economic stability.

In particular, the Norwegian central bank is facing a delicate balancing act as it navigates these unexpected economic pressures. The decision to delay a rate cut suggests a cautious approach, prioritizing inflation control over stimulating growth through lower borrowing costs. Stakeholders are closely monitoring metrics such as:

- Core Inflation Rates: Excluding volatile items like food and energy, the core inflation has shown signs of persistent strength.

- Consumer confidence: Recent surveys indicate that rising prices may be eroding consumer sentiment, possibly impacting future spending.

- Employment Figures: Tight labor markets may contribute to wage inflation, further adding pressure on prices.

| Indicator | Current Rate | Change from Last Month |

|---|---|---|

| CPI Growth | 3.5% | +0.4% |

| Core Inflation | 2.8% | +0.3% |

| Unemployment rate | 4.2% | Stable |

implications of Delayed Rate Cut for Norways Economic Stability

The recent decision by Norway’s monetary authority to postpone the rate cut raises significant concerns regarding the nation’s economic trajectory. With inflation unexpectedly accelerating,the central bank is compelled to navigate a complex maze of economic indicators. The prolonged high rates may lead to a variety of consequences, including:

- Increased Borrowing Costs: Consumers and businesses may face steeper interest rates, dampening spending and investment.

- Consumer Confidence: Delayed rate cuts might trigger uncertainty among consumers, leading to a potential decline in economic activities.

- Currency Stability: Strong interest rates may bolster the Norwegian krone initially, but prolonged high rates could make exports less competitive.

Moreover, the impact of this delay will ripple through various sectors of the economy. As credit becomes more expensive, small to medium-sized enterprises may struggle, potentially hindering job creation and stalling innovation. The following table outlines potential sectoral impacts:

| Sector | Impact of Delayed Rate Cut |

|---|---|

| Real Estate | Cooling demand for housing due to elevated mortgage rates. |

| Manufacturing | Reduced investment in expansion and technology upgrades. |

| Retail | Lower spending as consumers tighten budgets amid rising costs. |

Market Reactions to the Central Banks Decision and Future Projections

The recent decision by Norway’s central bank to postpone the first rate cut of this economic cycle has elicited a range of reactions across financial markets. Investors had largely anticipated a shift towards easing due to signs of weakening economic growth; though, the unexpected uptick in inflation prompted the bank to maintain its current stance. In response, there has been noticeable volatility in the currency markets, especially impacting the Norwegian krone (NOK), which has strengthened against major currencies. Analysts suggest several factors influence these market reactions, including:

- Inflation Metrics: Rising consumer prices have raised concerns about prolonged cost pressures.

- Global Economic Trends: The interconnectedness of global markets means that investor sentiment is influenced by international economic health.

- Market speculation: Traders are recalibrating expectations based on new economic data and central bank signals.

Looking ahead, projections for Norway’s economic landscape hinge on several key indicators that could shape future monetary policy actions. While the central bank’s current stance reflects a cautionary approach, the evolution of inflation trends, labor market dynamics, and geopolitical events will be pivotal in determining the timing and magnitude of any forthcoming rate cuts. Financial experts are particularly attentive to:

- Inflation Trends: Sustained high inflation could pressure the central bank to adjust interest rates sooner.

- Growth Projections: Modest growth forecasts may justify a more accommodative monetary policy in the near term.

- Geopolitical Developments: Global uncertainties could influence Norway’s export-led economy and monetary strategy.

| Indicator | Current Status | Future Projection |

|---|---|---|

| Inflation Rate | 3.2% | Moderate but potential for increase |

| GDP growth | 1.5% | Possible slowdown |

| NOK Performance | Strengthened | Volatile with potential for further strengthening |

Expert Insights on Managing Inflation and Interest Rates in Norway

As inflationary trends take hold in Norway, experts are analyzing the potential impacts on interest rates and overall economic stability. The recent decision by the Norges Bank to delay the first rate cut of this monetary cycle highlights a cautious approach amidst rising prices. Economists beleive that while inflation is frequently enough viewed as a temporary challenge, current indicators suggest that it may persist longer than initially anticipated. Key factors influencing this inflationary pressure include:

- Supply Chain Disruptions: Ongoing global supply chain issues continue to affect the availability of goods, driving up prices.

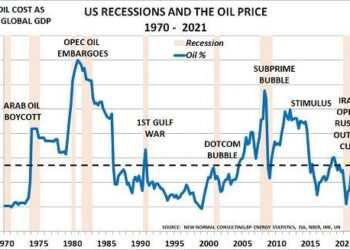

- Energy Costs: Fluctuations in energy prices are particularly acute in Norway, impacting both consumers and businesses.

- Labor Market Tightness: A low unemployment rate has led to wage growth, further complicating inflation dynamics.

To navigate this complex landscape, analysts suggest that policymakers must remain vigilant in their approach to monetary policy.They advocate for a balanced strategy that prioritizes inflation control while supporting economic growth. Considering the recent data, attention is turning towards future forecasts and potential scenarios, which can be outlined as follows:

| Scenario | Description | Likely action |

|---|---|---|

| Scenario A | Continued inflation rise due to external factors | Possible rate increase |

| Scenario B | Stabilization of prices with moderate growth | Maintain current rates |

| scenario C | Deflationary pressures leading to economic slowdown | Rate cuts implemented |

Strategic Recommendations for Investors Amid Shifting Monetary Policies

As global monetary policies continue to evolve, investors must remain nimble and adjust their strategies according to the shifting landscape. With Norway’s recent delay in rate cuts following an uptick in inflation, the broader implications for investment portfolios become apparent. maintaining exposure to sectors traditionally resilient to interest rate hikes is crucial, such as financials and consumer staples. Additionally, investors should consider reallocating resources towards inflation-protected assets like Treasury Inflation-Protected Securities (TIPS) or commodities, which can provide a hedge against rising prices.

Moreover,creating a diversified investment strategy that incorporates both domestic and international equities can mitigate risks associated with localized policy changes. Investors may also benefit from focusing on high-quality corporate bonds, which often can weather economic fluctuations better than their lower-rated counterparts. As rate cuts remain uncertain, it is essential to continuously monitor key economic indicators to assess the best opportunities for capitalizing on potential market shifts. Below is a summary of suggested focus areas for investors:

| Investment Focus | Description |

|---|---|

| Financial Sector | Potential beneficiaries of higher interest rates. |

| Commodities | Hedge against inflationary pressures. |

| High-Quality bonds | Stability in times of economic uncertainty. |

| International Equities | Diversification in response to localized policy changes. |

In Retrospect

Norway’s decision to delay its first interest rate cut reflects a cautious approach in response to rising inflationary pressures. As the central bank navigates a complex economic landscape marked by both global uncertainties and domestic challenges, officials must maintain a delicate balance between supporting growth and ensuring price stability. With inflationary trends bringing the urgency of monetary policy adjustments into sharper focus, stakeholders will be closely monitoring upcoming developments. The implications of this decision extend beyond Norway’s borders, as the ripple effects of monetary policy in one of Europe’s key economies could influence regional financial conditions and investor sentiment.As we move forward, it remains vital for analysts and market participants to stay attuned to the central bank’s signals, which will undoubtedly shape Norway’s economic trajectory in the months to come.