in a landscape where financial regulations are constantly evolving, teh luxembourg financial regulator has issued a stark warning regarding the phenomenon of “gold plating” in the implementation of the revamped European Long-Term Investment Funds (ELTIF) framework, known as Eltif 2.0. This term refers to the practice of member states enacting stricter rules than those mandated at the EU level, which can lead to meaningful inconsistencies and challenges for investment managers across the continent. The regulator’s concerns reflect broader issues of regulatory alignment and market accessibility, raising questions about the potential impact on the investment landscape. As stakeholders across Europe evaluate the implications of Eltif 2.0, the Luxembourg regulator’s insights serve as a critical reminder of the delicate balance between national interests and the need for a cohesive single market in capital investment.

Luxembourg Regulator Identifies Gold Plating as a Key Concern for Eltif 2.0

The Luxembourg financial regulator has raised significant concerns regarding the practice of gold plating in the implementation of eltif 2. regulations.Gold plating refers to the tendency of national authorities to impose additional requirements or stricter regulations than those established at a European level. This issue has the potential to create disparities and complications for managers and investors within the Eltif framework, leading to an uneven playing field across different jurisdictions. The regulator emphasizes that such practices coudl ultimately hinder the effectiveness of the Eltif regulation, which is designed to enhance cross-border investment in small and medium-sized enterprises (SMEs).

The following are key points highlighted by the regulator regarding the implications of gold plating on Eltif 2.:

- Increased compliance Costs: gold plating may lead to higher compliance costs for fund managers, which can deter investment.

- Market Fragmentation: Discrepancies in local regulations can fragment the EU market, adversely affecting investor confidence.

- Regulatory Uncertainty: Inconsistent application of regulations leads to confusion among fund managers and investors, complicating strategic planning.

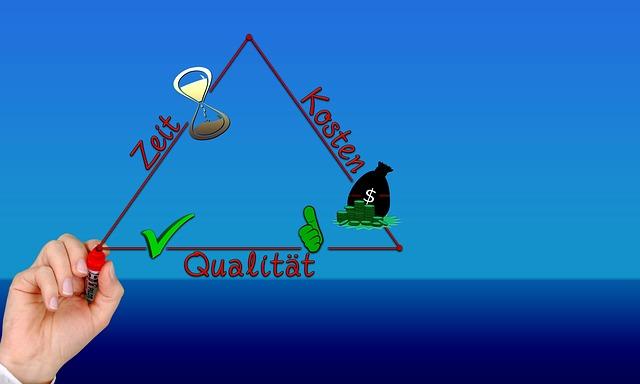

Implications of Excessive Regulation on Investment Strategies

Regulatory environments can significantly shape investment strategies, notably when excessive regulations create barriers to entry or complicate compliance. As highlighted by recent discussions around the Eltif 2.0 framework, “gold plating” ŌĆö the tendency of national regulators to impose additional requirements beyond European directives ŌĆö poses challenges that can stifle innovation and versatility in investment vehicles.This leads to potential disincentives for investors, who may find that the added burdens diminish the appeal of certain investment products.In an surroundings where clarity and efficiency are crucial for decision-making, excessive regulation can result in an unfavorable landscape that drives capital away from promising opportunities.

furthermore, the excessive regulatory burdens often require firms to allocate significant resources towards compliance rather than growth strategies. This diversion of resources can result in diminished returns on investment and curtails the ability to adapt to market trends swiftly. Key implications for investment strategies include:

- Increased operational costs: Compliance efforts may require firms to hire additional staff or invest in technology, leading to higher fees.

- Reduced competitiveness: Firms in heavily regulated environments may struggle to compete with those in more balanced regulatory territories.

- Market entry barriers: New firms may find it tough to enter the market, decreasing overall competition and innovation.

strategies to Mitigate Gold Plating Risks in Eltif 2.0

To reduce the risks associated with excessive regulatory requirements, known as gold plating, stakeholders in the ELTIF 2. ecosystem should consider adopting the following measures:

- Collaborative Engagement: Foster open dialog among industry participants, regulators, and policymakers to identify and address potential sources of unnecessary complexity.

- Clear Guidelines: Advocate for the establishment of unambiguous regulatory frameworks that delineate the boundaries of ELTIF 2. compliance and scope.

- Harmonized standards: Encourage the implementation of uniform standards across jurisdictions to minimize discrepancies that may lead to overregulation.

- Regular Training: Invest in ongoing education for fund managers and compliance officers on the evolving landscape of ELTIF regulations.

Furthermore, an effective monitoring system can play a critical role in balancing compliance with innovation. By creating a feedback loop that captures industry insights regarding regulatory impact, authorities can adjust initiatives accordingly.The following table summarizes potential monitoring approaches:

| monitoring Approach | Description | Expected Outcome |

|---|---|---|

| Stakeholder surveys | Regular feedback collection from fund managers and investors. | Identifying pain points and regulatory burdens. |

| Performance Benchmarks | Establishing kpis to measure compliance efficiency. | Streamlining regulatory processes based on data-driven insights. |

| Public Consultations | engaging the public in discussions regarding regulatory changes. | Enhancing clarity and trust in regulatory decisions. |

Recommendations for stakeholders to Navigate Compliance Challenges

In light of the Luxembourg regulator’s concerns regarding the gold plating of Eltif 2.0 regulations, stakeholders need to adopt a proactive approach to ensure compliance without compromising operational efficiency. To effectively navigate thes challenges, stakeholders should focus on the following key strategies:

- Conduct Continuous Training: Regularly educate teams about the intricacies of Eltif 2.0 regulations to foster a culture of compliance.

- Engage with Regulatory bodies: Actively participate in discussions with regulators to voice concerns and receive guidance on implementation.

- Implement Robust Monitoring Systems: Establish internal systems to track compliance adherence and quickly identify any deviations from regulations.

- Utilize Compliance Technology: Invest in technology solutions that can automate compliance tasks and provide real-time reporting.

Moreover, stakeholders should consider forming alliances to strengthen their positions. Collaborative efforts can be beneficial in sharing best practices, resources, and insights. As a notable exmaple, forming an industry group can lead to more effective lobbying for reasonable compliance measures. Below is a swift comparison of potential collaborative approaches:

| approach | Advantages | Challenges |

|---|---|---|

| Industry group Formation | Shared resources and knowledge | Possibility of conflicting interests |

| Joint Compliance Training | Cost-effective learning solutions | Standardization issues |

| Collaborative technology Investments | Improved compliance tracking | Integration complexities |

The Future of Eltif 2.0: Balancing Regulation and Market Needs

The evolving landscape of ELTIF 2.0 has sparked significant dialogue among regulators and the investment community.Concerns surrounding gold platingŌĆöwhere national regulators impose stricter rules than those set at the EU levelŌĆöhave emerged as a pivotal issue. Industry stakeholders argue that while rigorous regulatory frameworks are essential for investor protection, excessive burdens could stifle innovation and deter investment in long-term assets. Balancing the protective measures of regulation with the dynamic needs of the market is crucial for the future viability of ELTIFs. Key elements of this balance include:

- Streamlined compliance: Simplifying regulatory requirements can encourage more players to enter the ELTIF market.

- Flexible investment strategies: Allowing for a variety of asset classes can enhance the appeal of ELTIF products.

- Ongoing dialogue with industry: Regulators must engage with market participants to understand their needs and refine regulations accordingly.

In this vein, the Luxembourg regulator’s remarks highlight the necessity of collaboration between regulatory bodies and market actors. This collaboration can lead to frameworks that not only meet compliance standards but also reflect the practical realities faced by those in the investment sector. For a successful enactment of ELTIF 2.0, a strategic approach is essential, ensuring that the regulation serves as a foundation for growth rather than a hindrance.Crucially, the future of eltifs depends on fostering a regulatory environment that prioritizes both safeguarding investors and encouraging market innovation.

| Challenges | Potential Solutions |

|---|---|

| gold Plating | Harmonized regulations across EU member states |

| Regulatory Burdens | Streamlined compliance processes |

| Market Access | Diverse asset class inclusion |

The Conclusion

the Luxembourg regulator’s concerns regarding the gold plating of the new ELTIF 2.0 framework underscore the complexities that come with the implementation of enhanced investment structures. As financial markets continue to evolve, the need for balance between regulatory compliance and innovation becomes paramount. The potential for inconsistent application of rules across jurisdictions not only poses risks for investors but also complicates the broader objectives of creating a harmonized European investment landscape. As stakeholders engage in dialogue to address these challenges, the ultimate effectiveness of ELTIF 2.0 will depend on a collaborative approach that prioritizes clarity and simplicity, ensuring that the regulatory environment supports growth while safeguarding market integrity. as the situation develops,the industry will be watching closely to see how these regulatory discussions unfold and what implications they hold for the future of option investment funds in Europe.