In the ever-evolving landscape of investment opportunities, staying current is crucial for both seasoned investors and newcomers alike. The recent developments at Monetary Metals and Andorra Capital, as highlighted in the latest Family Wealth Report, signal important shifts in how wealth can be managed and grown in today’s economic climate. With a focus on innovative investment strategies and the emerging relevance of alternative assets, this article delves into the newest trends within investments and funds, offering insights into how these changes could reshape portfolio management. Join us as we explore the vital takeaways from this report, shedding light on what investors should watch for in the near future.

Emerging Trends in Investment Strategies for 2024

As we move into 2024, companies and investors are increasingly focusing on sustainability and ESG (Environmental, Social, and Governance) factors as integral parts of their investment strategies. The push for social responsibility is influencing not only individual investment decisions but also the operations of large funds. Financial institutions are now more inclined to allocate assets to companies that prioritize lasting practices, thereby creating a ripple effect that enhances their overall viability and appeal to new investors. The emergence of innovative green bonds and ESG-compliant ETFs offers investors a wealth of options that align financial incentives with ecological and social outcomes.

Additionally, technological advancements are reshaping the landscape of investment strategies.The rise of artificial intelligence and machine learning tools enables investors to analyze vast datasets more efficiently, providing enhanced predictive analytics and risk assessment capabilities. Together, the popularity of decentralized finance (DeFi) continues to grow, offering alternative investment opportunities that challenge traditional banking systems.

| Investment Trend | description |

|---|---|

| ESG Integration | Incorporating environmental, social, and governance factors into investment decisions. |

| AI and Machine Learning | Utilizing advanced technologies to enhance analytics and risk management. |

| Decentralized finance | Offering peer-to-peer financial services without traditional financial intermediaries. |

Monetary Metals: A Look at Gold-Backed Financing Solutions

In recent years, the financial landscape has witnessed the emergence of gold-backed financing solutions, offering investors a unique blend of security and adaptability. Monetary Metals, a key player in this space, has positioned itself as a pioneer, allowing clients to leverage gold as collateral for loans and other financial instruments. This approach not only mitigates the risks associated with fiat currency fluctuations but also taps into the intrinsic value of precious metals to enhance wealth management strategies. By facilitating this type of financing, investors can access liquidity without liquidating their gold holdings, thus maintaining their investment in a traditionally appreciating asset.

Gold-backed financing serves various purposes, appealing to diverse investor profiles. Some of the benefits include:

- Asset Preservation: Investors can secure loans against their gold holdings while retaining ownership.

- Reduced Volatility: The inherent stability of gold can protect investments from unpredictable market movements.

- Tax Efficiency: some financing solutions may offer tax advantages compared to standard asset sales.

To illustrate the mechanics of gold-backed financing,consider the following table:

| Aspect | Gold-Backed Financing | Traditional Financing |

|---|---|---|

| Collateral Used | Gold | Real Estate/Stocks |

| Liquidity Access | quick | Lengthy Process |

| Ownership Retention | Yes | No |

This innovative financing method is reshaping the ways families and investors approach their wealth,marking a significant shift in the global financial ecosystem.

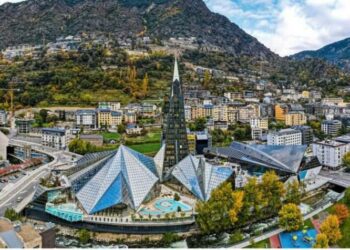

Andorra Capital’s Unique Approach to Asset Management

Andorra capital distinguishes itself in the asset management landscape through a combination of personalized service and innovative strategies tailored to meet the distinct needs of each client. Their emphasis on relationship-driven investing fosters an environment in which portfolio managers collaborate closely with clients, ensuring that financial goals align seamlessly with investment choices. The firm’s approach incorporates a hybrid model that blends traditional investment principles with cutting-edge technology to offer extensive insights into market trends and asset performance. This commitment to openness not only enhances client trust but also empowers investors to make informed decisions backed by data.

The methodology utilized by Andorra Capital encompasses a range of investment vehicles designed to mitigate risk while maximizing returns. Clients can enjoy access to diversified portfolios that include:

- Equity Investments: carefully curated stock picks focused on growth potential.

- Fixed Income Options: Bonds that ensure steady income and lower volatility.

- Alternative Assets: Unique opportunities in real estate and commodities.

This strategic diversity enables the firm to adapt to fluctuating market conditions, while their commitment to ongoing education keeps clients informed and engaged. By continually reassessing and optimizing strategies, Andorra Capital positions itself as a forward-thinking leader in the asset management sector.

Navigating Risks in Contemporary Fund Investments

In the current landscape of fund investments, understanding and navigating risks has become increasingly vital for investors seeking to optimize their portfolios. As new opportunities emerge, so too do potential pitfalls that can impact returns. Investors must focus on due diligence and incorporate both macroeconomic and microeconomic analyses into their strategies. Some key considerations include:

- Market Volatility: The unpredictability of financial markets can lead to rapid changes in asset values.

- Regulatory Changes: new laws and regulations can significantly affect investment strategies and fund performance.

- Liquidation Risks: The ability to quickly sell assets without loss is crucial, especially in downturns.

- Manager Performance: Assessing the track record and strategies of fund managers is essential to mitigate risks.

Moreover, allocating investments across diverse asset classes can help cushion the impacts of unforeseen market shifts. Establishing a clear risk tolerance and constantly reviewing investment strategies help ensure that funds remain aligned with personal financial goals. Leveraging technology for real-time analytics can provide valuable insights, allowing investors to make informed decisions on whether to hold or divest from certain funds. Below is a simple overview of common investment risks that funds may face:

| Type of Risk | Description |

|---|---|

| Market Risk | The risk of losses due to changes in market conditions. |

| Credit Risk | the risk that issuers may default on their obligations. |

| Operational Risk | Losses due to inadequate or failed internal processes. |

Key Recommendations for Diversifying Your Portfolio

In the ever-evolving landscape of investments, diversifying your portfolio is more crucial than ever. By considering an array of asset classes, investors can mitigate risks and seize new opportunities. Key strategies to enhance diversification include:

- Incorporate alternative Investments: Explore avenues such as real estate, commodities, and private equity to hedge against stock market volatilities.

- Geographic diversification: Invest in international markets to benefit from global growth trends and reduce exposure to domestic economic fluctuations.

- Utilize Technology: Consider fintech platforms that offer innovative investment options, allowing you to access diverse funds with ease.

- Regular Rebalancing: periodically review and adjust your portfolio to maintain your desired risk level and investment goals.

Moreover, understanding the specific characteristics and performance of each asset class can lead to more informed decisions. Here’s a brief overview of potential investment classes to consider:

| Investment Class | Potential Returns | Risk Level |

|---|---|---|

| Stocks | High | High |

| Bonds | Moderate | Low to Moderate |

| Real Estate | Moderate to High | Moderate |

| Commodities | Variable | High |

In Retrospect

the investment landscape continues to evolve, driven by innovative financial products and strategic management approaches that cater to the varying needs of investors. As outlined in this review of Monetary Metals and Andorra Capital, the integration of alternative assets and modern wealth management strategies like those offered by these firms is clearly gaining traction among affluent families and institutions.

With the increasing complexity of financial markets, understanding these emerging opportunities is critical for investors aiming to optimize their portfolios and enhance their wealth. As more individuals and families seek tailored solutions to navigate economic uncertainties, firms that prioritize transparency, sustainability, and strategic diversification are poised to lead the way.

Staying informed about these developments not only empowers investors to make sound decisions but also enables them to align their financial goals with the changing dynamics of the economic environment. As we move forward, it will be essential to keep an eye on how these trends unfold and what new strategies will emerge in the realm of investments and funds.