In a positive turn for the financial markets, U.K. stocks concluded trading on a high note, with the Investing.com United Kingdom 100 index rising by 0.34%. This uptick comes amid a backdrop of fluctuating economic signals and global market trends,reflecting investor optimism in various sectors. As market participants assess the implications of recent economic data and corporate earnings reports, this boost in the index highlights a resilient market sentiment. This article delves into the key factors influencing today’s trading session and provides a extensive overview of the sectors contributing to the upward momentum in U.K. equities.

U.K. Stock Market Overview Highlights Positive Trajectory

In today’s trading session, the U.K. stock market demonstrated a sustained positive momentum, closing higher as investors responded to a mix of economic indicators and corporate earnings reports.The Investing.com United Kingdom 100 index saw a gain of 0.34%, reflecting optimism among traders. Key sectors such as technology and finance led the way, buoyed by robust earnings that exceeded market expectations. This upward trend is attributed to a favorable economic environment and strategic shifts within major corporations.

Market analytics suggest several factors contributing to this bullish momentum:

- Solid corporate earnings: Many companies reported better-than-expected quarterly results.

- Adaptive economic policies: Policymakers continue to enact measures that foster growth and stability.

- Investor sentiment: A growing appetite for equities as inflation concerns stabilize.

| Sector | Performance |

|---|---|

| Technology | +0.45% |

| Finance | +0.30% |

| Energy | +0.25% |

| Healthcare | +0.20% |

Investing.com Index Shows Resilience Amid Economic Challenges

Despite heightened economic uncertainties, the recent performance of U.K. stocks signals a noteworthy resilience in the market. The Investing.com United Kingdom 100 index has recorded a modest increase of 0.34%, indicating that investor sentiment remains cautiously optimistic. Key factors contributing to this upward momentum include:

- Strong corporate earnings reports that have exceeded expectations.

- Encouraging economic indicators, such as improved consumer spending.

- Global market trends showing stability despite geopolitical tensions.

This positive trend is complemented by various sectors showing strength, particularly in technology and healthcare. As companies continue to adapt to the changing economic landscape, analysts suggest that investors should closely monitor these sectors for future growth opportunities.The following table summarizes the performance of top sectors within the index:

| Sector | Change (%) |

|---|---|

| Technology | +1.25% |

| Healthcare | +0.80% |

| Financials | +0.50% |

| Consumer Goods | -0.10% |

Key Sectors Driving Gains in the United Kingdom Stock Market

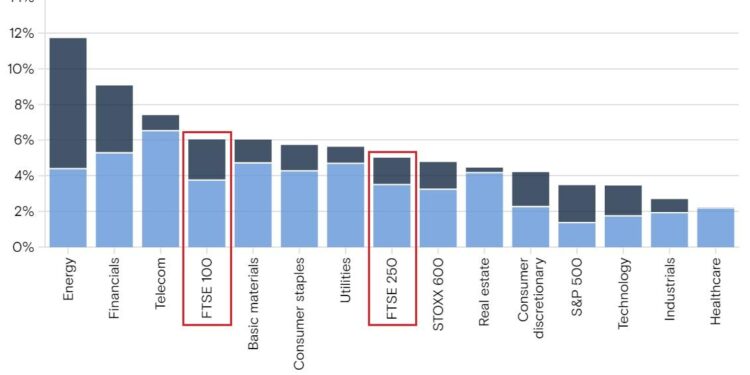

The recent uptick in the United Kingdom’s stock market can be closely attributed to the strong performance across key sectors. Notably, sectors such as technology, energy, and financial services have played a pivotal role in driving gains.Investors have shown increasing confidence in the tech industry as companies continue to innovate and expand their market presence.Innovative solutions in artificial intelligence and cloud computing have attracted ample investments, propelling tech stocks to higher valuations.

Moreover, the energy sector has experienced a resurgence, fueled by rising global oil prices and a renewed focus on enduring practices. Companies involved in renewable energy sources have garnered interest from environmentally conscious investors, further solidifying their position in the market. Additionally,the financial services sector benefits from favorable economic conditions,including rising interest rates,which enhance profit margins for banks and lending institutions. Together, these sectors illustrate a diversified portfolio demonstrating resilience and growth potential, attracting both institutional and retail investors alike.

Analysis of Market Drivers Behind the 0.34% Increase

The recent uptick in the U.K.stock market, highlighted by a 0.34% gain in the Investing.com United Kingdom 100 index, can be attributed to several key market drivers. strong corporate earnings reports released this week have instilled confidence among investors, suggesting that many companies are performing better than anticipated despite economic uncertainties. This positive corporate outlook is driving increased buying activity, particularly in sectors such as technology and consumer goods, which have shown resilience and adaptability in a changing economic landscape.

Furthermore, a series of favorable macroeconomic indicators has also played a role in this modest market rise.Recent data reflecting a slight dip in unemployment rates and an uptick in consumer spending has buoyed investor sentiment. As traders closely observe these trends, their optimism is further supported by indications of central bank policies aiming to maintain liquidity in the market.The combination of these factors—strong earnings, a favorable economic backdrop, and supportive monetary policies—creates a conducive environment for sustained market growth.

Investor Sentiment Boosted by Positive Economic Indicators

Recent economic indicators have painted a favorable picture for the U.K. economy, contributing to renewed investor confidence. Key metrics, such as strong employment figures and rising consumer spending, have driven optimism among market participants. This positive sentiment is reflected in the performance of major stock indices, with the United Kingdom 100 index showing an increase of 0.34% at market close. Investors are encouraged by signs of stability and growth, which may signal a broader recovery in the region.

Among the notable highlights influencing this upward trend are:

- Robust GDP growth reports for the last quarter, indicating a steady expansion.

- Decreased unemployment rates,which have bolstered consumer confidence.

- Positive manufacturing output, suggesting resilience in key sectors.

These factors have collectively underpinned the momentum in equity markets,creating a favorable environment for both institutional and retail investors. Analysts are closely monitoring these developments, as sustained positive economic performance could imply further gains on the horizon.

top Performers of the Day: Stocks that Made Headlines

Today’s trading session witnessed several stocks soaring to new heights, captivating investors and analysts alike. Among the prominent gainers in the U.K. market, AstraZeneca led the pack, driven by positive developments in its latest clinical trials. Its share price surged by 2.5%, reflecting investor confidence in the pharmaceutical giant’s robust pipeline. Other notable performers included Rolls-Royce Holdings, which saw a significant uptick of 1.8% as it continues to benefit from increased demand in the aerospace sector. the market buzz around these companies underlines a broader optimism in the British economy, with a potential rebound on the horizon.

Along with AstraZeneca and Rolls-Royce, the tech sector also made a strong showing today, with Sage Group rallying by 3.2% after announcing impressive quarterly results that outpaced analyst expectations. The stock has become a darling among investors, reflecting growing interest in digital transformation solutions. The following table highlights the standout performers of the day:

| Company | Change (%) | Sector |

|---|---|---|

| AstraZeneca | +2.5% | Pharmaceuticals |

| Rolls-Royce Holdings | +1.8% | Aerospace |

| Sage Group | +3.2% | technology |

Expert Insights: What the Latest Trends Mean for Investors

The recent upward movement in U.K.stocks, particularly illustrated by the Investing.com United Kingdom 100 index’s increase of 0.34%, reflects a broader economic trend that investors should carefully consider. Analysts point to various factors driving this momentum, including strong corporate earnings, robust consumer spending, and a stable inflation outlook. In the wake of these trends, investors may find opportunities in sectors that are demonstrating resilience and adaptability, such as technology, renewable energy, and health care. Understanding how these sectors react to changing economic conditions can provide insights into where to allocate resources for maximum returns.

Moreover, the way geopolitical dynamics play out could also influence market trajectories. Key areas to monitor include:

- Interest Rates: As central banks adjust policies, the potential for rate hikes could impact stock valuations.

- Supply Chain Stability: Continued improvements here may bolster growth across multiple industries.

- Regulatory changes: Upcoming legislation could affect specific markets, especially in technology and finance.

Investors are advised to conduct thorough analyses and stay updated on these developments,which could shape the investment landscape in the coming months.

Strategic Recommendations for Navigating the current Market

As the U.K. stock market shows signs of resilience, investors should consider diversifying their portfolios to manage risk effectively in the current economic landscape. Focusing on sectors that demonstrate growth potential, such as technology and renewable energy, could yield substantial returns. Additionally, it’s crucial to keep a close eye on macroeconomic indicators like inflation rates and employment figures, which can influence market performance. Strategies may include:

- Investing in ETFs: Exchange-traded funds can offer exposure to a basket of stocks, minimizing individual stock risk.

- Dividend Stocks: Focusing on companies with a strong history of paying dividends may provide a steady income stream.

- Sector Rotation: Shifting investments between sectors based on market cycles can capitalize on emerging opportunities.

moreover, the importance of research and market analysis cannot be overstated. Investors should consider leveraging technology-driven tools for real-time insights and trend analysis. Collaboration with financial advisors and utilizing comprehensive market reports can guide decision-making. It might potentially be beneficial to explore the following insights:

| Focus Area | Action Item |

|---|---|

| Market Indicators | Monitor key economic data releases. |

| Technical Analysis | Utilize charts to identify market trends. |

| Global events | Stay aware of geopolitical developments affecting markets. |

Potential Risks to Watch as the Market Continues to Rise

As the upward momentum of U.K. stocks continues to attract attention, investors should remain vigilant about several potential hazards lurking beneath the surface. While the current market sentiment may seem overwhelmingly positive, there are underlying factors that could precipitate volatility. inflationary pressures remain a major concern, possibly prompting the Bank of England to adjust interest rates more aggressively than anticipated.This could lead to reduced consumer spending, affecting corporate earnings and stock valuations. Additionally, geopolitical tensions and economic uncertainties outside the U.K. may create ripples that can impact market performance in unforeseen ways.

Another aspect to consider is the overextension of valuation metrics in a rapidly rising market. If stocks become excessively inflated, even slight dips in growth or earnings may trigger significant corrections. the presence of market sentiment-driven bubbles, particularly in certain sectors, can spotlight risks that may seem intangible until they become reality. Investors should also keep an eye on the global supply chain disruptions that could hinder economic recovery. With these potential headwinds, maintaining a diversified portfolio and exercising caution when evaluating investment opportunities will be crucial for navigating the forthcoming market landscape.

Future Outlook: What Lies Ahead for U.K. Stocks in 2024

As we look toward 2024, several factors are poised to shape the trajectory of U.K. stocks. Analysts predict that various economic indicators will considerably impact market trends, including:

- Inflation Trends: A decrease in inflation may bolster consumer confidence and spending.

- Interest Rates: The Bank of england’s decisions regarding interest rates will be crucial in influencing investment decisions.

- Geopolitical Stability: Political events, both locally and internationally, will have lasting effects on market dynamics.

Investors are also keeping a close eye on key sectors that are anticipated to perform well in this evolving landscape. With the shift towards sustainable energy and technology, sectors that focus on innovation and environmental sustainability are becoming more attractive. Notably,sectors to watch include:

| Sector | Growth Potential |

|---|---|

| Renewable Energy | High |

| Technology | Moderate to High |

| Healthcare | Steady |

while the outlook for U.K. stocks appears mixed with both chance and uncertainty, strategic investments in promising sectors could yield significant returns as the market stabilizes and adapts to evolving conditions in 2024.

Future Outlook

the U.K. stock market concluded the trading session on a positive note,reflecting a gain of 0.34% in the Investing.com United Kingdom 100 index. This upward movement highlights the resilience of key sectors amid ongoing economic challenges, demonstrating continued investor confidence. As market dynamics evolve, stakeholders will be closely monitoring developments that could impact future trading sessions. Whether fueled by corporate earnings reports or shifts in global economic sentiment, the performance of U.K. stocks serves as a vital indicator for investors navigating the complexities of the current financial landscape. As we move forward, it will be essential to keep an eye on these trends for a comprehensive understanding of the U.K. economy and its stock market’s trajectory.