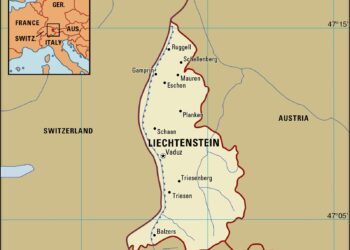

In a recent revelation that has stirred up considerable concern among consumers, SIX, a leading Swiss financial services firm, expressed deep regret regarding a meaningful debit card mishap affecting users in Switzerland and Liechtenstein. The incident, which has drawn attention from both the fintech sector and the general public, underscores the vulnerabilities inherent in digital payment systems. As the industry grapples with the implications of this dysfunction, stakeholders are keenly observing how SIX will address the fallout and implement measures to restore consumer trust. This article delves into the specifics of the mishap, its impact on users, and the broader ramifications for the fintech landscape in the region.

SIX Suffers Significant Setback with Debit Card Error in Switzerland and Liechtenstein

SIX has expressed its deep regret following a major setback related to its debit card operations across Switzerland and Liechtenstein. The mishap,which affected numerous customers,became apparent when users encountered issues at ATMs and point-of-sale terminals,leading to widespread confusion and frustration. The company has acknowledged that the error stemmed from a technical glitch in its transaction processing system, which temporarily disrupted service availability for debit card users in these regions.

To address the situation, SIX is taking immediate remedial actions, including:

- Enhancing System Security: Implementing stricter monitoring protocols to prevent future occurrences.

- Customer Dialog: Issuing timely updates to affected customers through multiple channels.

- Compensation Measures: Evaluating possible compensatory options for customers impacted by the disruption.

The financial technology company is committed to restoring full functionality and rebuilding customer trust by providing clear and clear communication moving forward. Considering the incident, it remains crucial for SIX to ensure reliability in its services to maintain its standing in the competitive fintech landscape.

Impact of the Debit Card Mishap on consumers and Merchants

The recent mishap involving Six,a prominent player in the financial technology sector,has left consumers and merchants grappling with significant disruptions. Customers who depend on debit cards for daily transactions experienced frustrations as card services were rendered temporarily unavailable. This breakdown not only led to inconvenience but also sparked a wave of distrust among users, many of whom felt vulnerable and unsure about the stability of their financial transactions. The situation escalated as consumers attempted to navigate their normal routines without reliable access to their funds, leading to a scramble for alternative payment methods. The emotional and financial stress born from this incident has highlighted the dependency of modern society on digital payment systems.

Merchants,on the other hand,faced a direct impact on their sales and customer satisfaction levels. Business owners reported an increase in abandoned transactions, particularly in smaller shops and local eateries that rely heavily on card payments. Some have had to implement temporary cash-only policies, limiting their ability to serve a wider customer base. The financial repercussions are expected to follow, as merchants may experience a drop in overall revenue during this unstable period. As businesses recover, they must also consider enhancing their systems to withstand potential future disruptions while ensuring that customer confidence is restored. Effective communication with consumers will be essential to rebuild trust and promote a seamless payment experience moving forward.

Analysis of the Root Causes behind the Payment Processing Failure

The recent payment processing failure experienced by SIX highlights several underlying factors that contributed to this mishap. An examination reveals that inadequate system integration and compliance issues with local regulations played significant roles in the incident. Many users reported transaction failures, reflecting a broader challenge of adapting to a diverse regulatory habitat across Switzerland and Liechtenstein. The interconnectivity of various payment platforms means that any weakness in one component can create a ripple effect,disrupting the entire system.

Moreover, insufficient testing before deployment seemingly exacerbated the situation. Instances of frequent updates without rigorous quality assurance may have led to unforeseen errors coming to light only during peak transaction periods. The following points summarize key areas that require attention to prevent future occurrences:

- Enhanced system testing protocols prior to software launches.

- Establishment of a dedicated compliance team fluent in local laws.

- Investments in proactive customer communication to manage expectations during outages.

| Root Cause | Impact |

|---|---|

| Inadequate system integration | Transaction failures reported. |

| compliance issues | Risk of fines and legal challenges. |

| Insufficient testing | operational disruptions during peak times. |

SIX’s Response and Customer Communication Strategies

SIX has initiated a robust communication strategy in response to the recent debit card mishap affecting customers in Switzerland and Liechtenstein. Recognizing the impact on consumer trust, the organization emphasizes transparency and clarity in its outreach efforts. Customers have been notified through multiple channels, including email alerts, official social media updates, and press releases. This multi-faceted communication aims to ensure that every impacted customer is informed about the current situation and the measures being taken to rectify the issue.

Moreover, SIX is dedicating resources to a support initiative designed to assist those affected.Customers are encouraged to reach out through a dedicated customer service hotline and are provided with FAQ resources on the company’s website. These efforts align with SIX’s commitment to maintaining customer satisfaction and confidence, ensuring that affected stakeholders receive timely updates and support. facts regarding the resolution timeline and the steps also remains accessible, allowing customers to stay informed about the evolving situation.

| Channel of Communication | Description |

|---|---|

| Email Alerts | Direct notifications to customers detailing the issue and next steps. |

| Social Media Updates | Real-time updates across various platforms to reach a broader audience. |

| Customer Service Hotline | Dedicated support line for personalized assistance and inquiries. |

| FAQ Resources | Online section with answers for common concerns related to the incident. |

Recommendations for Enhanced Risk Management Practices in FinTech

To address the recent debit card mishap reported in Switzerland and Liechtenstein, FinTech organizations are urged to adopt a multi-faceted approach to risk management. Enhancements should not only focus on compliance but also integrate comprehensive technology solutions that prioritize security. Key recommendations include:

- Regular Audits: Implement frequent internal and external audits to identify vulnerabilities in systems and processes.

- Data Encryption: Utilize advanced encryption techniques to protect sensitive customer information from unauthorized access.

- Incident Response Plans: Develop and regularly test incident response strategies to mitigate damage from security breaches.

- Education & Training: Conduct ongoing training sessions for employees to recognise fraud and maintain compliance with industry standards.

additionally,collaboration between FinTech firms,regulatory bodies,and technology partners can foster a resilient financial ecosystem. Building robust frameworks for risk assessment should focus on the following:

| Framework Component | Description |

|---|---|

| Threat Intelligence | Stay ahead of potential threats by sharing intelligence between stakeholders. |

| Regulatory compliance | Ensure all operations align with local and international regulations effectively. |

| Consumer Transparency | Enhance trust by providing clear information on security measures to customers. |

| Continuous Monitoring | utilize automated tools to monitor transactions and detect irregular activities in real-time. |

Future Implications for Payment Solutions in Switzerland and Liechtenstein

The recent debit card mishap has cast a spotlight on the future of payment solutions in Switzerland and Liechtenstein, indicating a pressing need for robust updates within the financial technology landscape. As digital consumer behaviors evolve, financial institutions must prioritize resilience and security in their payment systems. FinTech innovations could include:

- Enhanced biometric authentication to prevent fraud

- Instant transaction settlements to improve cash flow

- Integration of blockchain technologies for better transparency

Moreover, the incident emphasizes the importance of collaborative efforts between customary banking systems and emerging FinTech players. Regulators may look to introduce frameworks that not only promote competition but also encourage interoperability between various payment platforms. A shift toward consumer-centric solutions may result in:

- Greater personalization of payment experiences

- Support for cross-border transactions with lower fees

- Improved user trust through clearer data protection policies

Lessons Learned and Best Practices for the FinTech Industry

The recent mishap involving debit cards in Switzerland and Liechtenstein serves as a stark reminder of the vulnerabilities within the FinTech landscape. Companies must prioritize robust risk management systems that can swiftly identify potential flaws in their operations. Effective communication channels are crucial in ensuring that issues can be addressed proactively. Stakeholders should maintain transparency with their customers to build trust, particularly when errors occur, as this can mitigate reputational damage. Best practices include:

- Regular Audit processes: Conduct frequent assessments of systems to ensure compliance and security.

- Real-time Monitoring: implement advanced monitoring solutions that provide alerts on suspicious activities.

- Customer Education: Engage in proactive communication and education initiatives to help users understand potential risks and procedures.

Moreover, collaboration amongst FinTech firms and regulatory bodies is essential in developing industry standards that enhance customer protections. The establishment of a shared intelligence system could prove invaluable in giving real-time insights into emerging threats and vulnerabilities. Emphasis on user experience should not be overlooked either; providing intuitive, easily navigable interfaces can significantly reduce human error, a common precursor to many mishaps. A simple comparison of effective strategies could look like:

| Strategy | Benefits |

|---|---|

| Proactive Risk Assessment | Early detection of vulnerabilities |

| Customer Feedback Loops | Improved user trust and satisfaction |

| Cross-Industry Collaboration | Shared insights and enhanced security measures |

The Way Forward

the recent debit card mishap involving SIX has sparked significant conversations around the robustness of financial transaction systems in Switzerland and Liechtenstein. As the company publicly expresses its regret over the incident, the implications for consumer trust and operational integrity within the fintech sector are becoming increasingly clear. This incident serves as a critical reminder of the importance of stringent security measures and effective crisis management in the fast-evolving world of digital finance. Stakeholders are now looking to SIX for decisive actions to mitigate future risks and restore confidence among users. As the situation develops, it will be essential to monitor how this event shapes regulatory scrutiny and technological advancements in payment systems across the region.