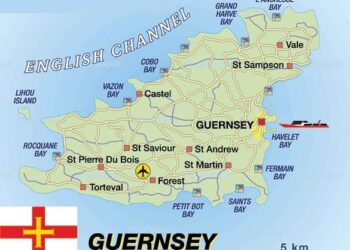

in a meaningful progress for fiscal policy in the Channel Islands, the implementation of the Goods and Services Tax (GST) in Guernsey has been postponed by six months, as reported by BBC. Originally set too be introduced in early 2024, this delay has sparked discussions among policymakers, business owners, and residents alike, raising questions about the implications for the local economy and government revenues. The decision,attributed to ongoing consultations and logistical challenges,underscores the complexities involved in overhauling the territory’s tax system.As guernsey navigates this pivotal transition, stakeholders are urged to consider the broader impact of GST on consumer behavior and economic growth in the region. This article delves into the reasons behind the delay, the expected timeline for implementation, and the potential consequences for the island’s financial landscape.

impact of Delayed GST implementation on Guernsey’s Economy

The postponement of the Goods and Services Tax (GST) in Guernsey has introduced a wave of uncertainty within the local economic landscape. Key industries, such as tourism and retail, which expected adjustments in pricing and revenue strategies, are now left in limbo. this delay coudl potentially create a ripple effect, influencing consumer behavior and business planning. with the anticipated implementation now pushed back, businesses may struggle with cash flow and financial projections as they navigate an unpredictable fiscal environment.

Moreover, the lag in implementing GST might affect Guernsey’s competitive edge in attracting foreign investment. As other jurisdictions progress with their tax reforms, Guernsey risks appearing less appealing to investors.To illustrate the potential consequences of the delay, consider the following key impacts:

| Impact Factor | Details |

|---|---|

| Consumer Confidence | Heightened uncertainty may lead to reduced consumer spending. |

| Business Investment | Investors could hesitate, impacting growth prospects. |

| Government Revenue | The delay could result in short-term revenue shortfalls. |

Understanding the Reasons Behind the Six-Month delay

The decision to postpone the Goods and Services tax (GST) rollout in Guernsey by six months stems from a complex interplay of factors that underscore the challenges of implementing such a significant economic change. Government officials have cited the need for additional time to ensure that all systems are seamlessly integrated and that stakeholders are adequately prepared. Notably, the feedback gathered from businesses highlighted concerns regarding compliance readiness and the administrative burden that could arise from a hasty implementation. These concerns prompted a reassessment of the timeline to prioritize a smoother transition.

Additionally, the postponement allows for enhanced public engagement and educational initiatives aimed at demystifying the GST for the general population. By taking the extra time, authorities are focusing on several key areas to facilitate understanding, including:

- Workshops for business owners to guide them through the GST framework.

- Facts campaigns to inform consumers about the changes and how GST will impact prices.

- Feedback mechanisms to address ongoing concerns and fine-tune processes.

These strategies aim to foster confidence among both consumers and businesses, ensuring that when GST is finally implemented, it is indeed met with a well-informed public willing to adapt to the new taxation system.

Potential Effects on local Businesses and Consumer Behavior

The delay in implementing the Goods and Services Tax (GST) in Guernsey could have significant ramifications for local businesses and the overall consumer landscape. Manny entrepreneurs had braced for the changes, investing in systems and training to comply with the new tax structure.With an extension of six months, businesses may find themselves in a position where they have to reconsider their financial forecasts and operational strategies. This postponement can lead to a temporary reprieve for small businesses that were concerned about the immediate compliance costs associated with the tax, allowing them to focus on recovery from previous economic challenges.

As consumers continue to navigate their purchasing decisions,the uncertainty surrounding GST implementation may influence their behavior in various ways. Some might continue their spending habits, anticipating that any changes will not substantially impact the prices they pay in the short term. However, others could become cautious, adjusting their spending in fear of potential price hikes once the tax is finally in place. The overall sentiment could lead to trends such as:

- Increased savings: Consumers might prioritize saving over spending, creating a temporary dip in retail sales.

- Price comparisons: Shoppers may become more diligent in comparing prices with the expectation that taxes will alter price structures.

- Support for local businesses: A community-focused mindset may emerge, encouraging consumers to support local over larger chains due to perceived value and connection.

Government Responses: Strategies for Managing the Delay

In light of the recent six-month delay in the implementation of the GST in Guernsey, government officials are actively formulating a range of strategies to mitigate the impact on the economy and public sentiment. One central approach is to enhance communication with stakeholders to ensure openness and to keep the public informed about the reasons for the postponement. This involves:

- Regular Updates: Issuing periodic bulletins that detail progress and the anticipated timeline for implementation.

- Public Consultations: Hosting forums and discussion groups to address concerns and gather feedback from residents and businesses.

- Outreach Programs: Engaging local organizations to disseminate information and support community understanding of GST benefits.

Furthermore, the government plans to bolster fiscal management by reviewing its budget allocations to minimize any adverse effects from the delay. Key financial strategies may include:

| Strategy | Description |

|---|---|

| Reallocation of Funds | Shifting budget priorities to critical public services that may be affected during the transition period. |

| Emergency Financial Aid | Providing support to businesses during the delay to foster economic stability. |

| Tax Incentives | Offering temporary relief or incentives for businesses that demonstrate compliance readiness. |

Ensuring Compliance: Guidance for Businesses Ahead of Implementation

As businesses in Guernsey brace for the impending Goods and Services Tax (GST) implementation, scheduled to launch in six months, it is indeed crucial for companies to navigate the complexities of compliance effectively.This delay offers a unique prospect for businesses to refine their strategies and ensure readiness by taking proactive measures. companies should focus on enhancing their understanding of GST, evaluating current operations, and adjusting financial processes accordingly. Key areas of focus include:

- Staff Training: Equip employees with the necessary knowledge about GST regulations and compliance requirements.

- System Integration: Update accounting software to accommodate GST calculations and reporting.

- Financial Impact Assessment: Analyze how GST will affect pricing structures and profit margins.

- Client Communication: Inform customers about potential changes in pricing and invoicing processes.

Moreover, staying informed about legislative updates and seeking expert guidance can mitigate risks while fostering compliance.Businesses should also consider conducting a compliance audit to identify potential gaps and ensure that operations align with GST frameworks. Below is a simple checklist to facilitate this process:

| checklist Item | Status |

|---|---|

| Review GST guidelines | Pending |

| Assess software readiness | In Progress |

| Train staff on GST | Scheduled |

| Update pricing strategies | Pending |

By diligently preparing for the forthcoming changes, businesses can not only ensure compliance but also leverage this transition as an opportunity to enhance overall operational efficiencies.

Public Sentiment: How Residents View the GST Postponement

The decision to postpone the Goods and Services Tax (GST) implementation in Guernsey has elicited a mixed reaction from residents. Many locals express relief at the delay, emphasizing the need for more time to prepare adequately for the financial changes. Several community forums have seen discussions highlight key concerns, such as the potential impact on small businesses and the overall cost of living.The postponement is seen by some as an opportunity to re-evaluate the implications of GST, with residents advocating for a thorough public discourse on how it will affect their daily lives.

On the other hand, a segment of the population remains skeptical about the government’s intentions. Detractors argue that further delays could undermine confidence in financial governance, while others worry it may signal indecision in economic policy. Surveys conducted in recent weeks indicate a growing frustration among residents regarding transparency in the decision-making process. some key points of sentiment include:

- Concern over inflation: residents are wary of rising prices even before GST implementation.

- Small business impact: Local proprietors feel uncertain about their future compliance and adaptability.

- desire for community engagement: Many want more opportunities to voice opinions and suggestions.

| Resident Sentiment | Percentage |

|---|---|

| Support Delay | 65% |

| Oppose Delay | 25% |

| Undecided | 10% |

Comparative Analysis: Lessons from Other Regions’ GST Rollouts

The delayed rollout of GST in Guernsey provides a timely opportunity to examine the experiences of other regions that have successfully navigated similar challenges. As an example, Australia, having implemented GST in 2000, faced initial resistance and operational difficulties. Key lessons from Australia’s rollout include the importance of thorough stakeholder engagement and the establishment of robust IT systems to facilitate smooth compliance.Moreover, continuous education programs targeting businesses and consumers proved essential in building public acceptance and understanding of the tax system.

Similarly, Canada’s introduction of the Goods and Services Tax in 1991 highlighted the importance of clear communication and phased implementation. they utilized a series of public consultations and outreach initiatives,ensuring that concerns were addressed proactively. A comparative analysis of several countries reveals several factors critical for a accomplished GST rollout:

- Stakeholder Involvement: Engaging businesses, consumers, and tax professionals early in the process.

- Education and Awareness: Informing the public about benefits and obligations associated with the tax.

- Technology Infrastructure: Investing in systems that streamline tax collection and compliance for businesses.

Recommendations for a Smooth Transition to GST

As businesses prepare for the upcoming Goods and Services Tax (GST) implementation, strategic planning can ensure a frictionless transition. It is crucial for affected entities to take proactive steps to adapt to the new tax landscape. Here are some essential recommendations:

- Educate Staff: Training sessions can definitely help employees understand GST regulations and processes, which can mitigate errors and improve compliance.

- Upgrade Accounting Systems: Businesses should invest in accounting software that supports GST functionalities, ensuring accurate tracking and reporting.

- Engage with Stakeholders: Collaborate with suppliers and customers early on to discuss GST implications on pricing and invoicing, fostering transparency.

- Monitor Government Updates: Stay informed on any policy changes or detailed guidelines from the government regarding GST to ensure compliance.

In addition,establishing clear timelines for the transition period is paramount. Organizations should set milestones that include:

| Milestone | Action Required | Deadline |

|---|---|---|

| Team Training | Conduct workshops and Q&A sessions | 2 months before implementation |

| Software Update | Install and test new systems | 1 month before implementation |

| Stakeholder Communication | Send out notifications and updates | 3 months before implementation |

With these strategies in place, businesses can navigate the complexities of GST while minimizing disruptions to their operations, ensuring a seamless transition in the coming months.

Future Projections: What Does the Delay mean for fiscal Policy?

The six-month delay in the implementation of GST in Guernsey raises significant implications for fiscal policy and government financial planning. initially anticipated to bolster public revenue and streamline tax processes, this postponement could necessitate a reevaluation of budgetary priorities. Policymakers may need to consider choice revenue sources or adjust spending plans to mitigate any potential deficits. This delay could consequently affect various sectors that depend on stable fiscal arrangements, leading to uncertainty among business owners and investors alike.

The impact is likely to be multifaceted, with key considerations including:

- Revenue Shortfalls: The postponement may lead to short-term financial gaps that the government might need to fill.

- Economic Growth: Businesses may hesitate to expand, leading to slower economic growth in the interim.

- long-term Tax Strategy: The delay could prompt a reassessment of the overall tax strategy, including potential tax reforms.

To illustrate the anticipated financial scenarios that could arise from the GST implementation delay, the following table outlines projected impacts on key financial metrics:

| Metric | Before Delay | After Delay |

|---|---|---|

| Projected Revenue Increase | 10% growth | 5% Impact |

| Business Confidence Index | 75% | 65% |

| Budget deficit Forecast | 2% of GDP | 3% of GDP |

As stakeholders navigate these uncertainties, the need for clear communication from the government will be paramount. Clear strategies must be devised to reassure the public and maintain economic stability while awaiting the eventual rollout of the GST.

Engaging Stakeholders: The Role of Community Input in GST Planning

In the context of the recent six-month delay in implementing the Goods and Services Tax (GST) in Guernsey, engaging local stakeholders has become more crucial than ever.Community input not only enhances transparency but also fosters trust between the government and its citizens. By actively involving residents in the planning process, authorities can better understand the diverse perspectives and concerns regarding the new tax system.This collaborative approach allows for the identification of key issues that may affect local businesses and consumers, ensuring that the GST framework is tailored to the unique needs of the community.

Moreover, incorporating stakeholder feedback can streamline the implementation process, as it provides a platform for constructive dialog. Citizens are encouraged to share their thoughts through various avenues, such as public forums, surveys, and focus groups, allowing decision-makers to address potential challenges proactively. Some essential themes in this dialogue might include:

- Fairness: Ensuring the GST does not disproportionately impact low-income families.

- Clarity: making sure that businesses understand how to implement the tax effectively.

- Communication: Keeping the community informed throughout the GST rollout process.

The incorporation of community suggestions can lead to outcomes that are not only more equitable but also more practical for everyday implementation. A systematic approach to gathering and analyzing this input would benefit from establishing a dedicated task force or working group that focuses on stakeholder engagement and feedback. This proactive stance can ultimately result in a more robust GST system that reflects the will of the people it serves.

Navigating Challenges: Key Considerations for the Government Moving Forward

The six-month delay in the implementation of GST in Guernsey presents a pivotal moment for the government to reevaluate its strategy and address potential challenges. key considerations must be taken into account to ensure a smooth transition once the GST is introduced.These include:

- Stakeholder Engagement: Proactively involving businesses and residents in discussions around GST will foster transparency and gather valuable feedback.

- Public Awareness Campaigns: Launching comprehensive campaigns to educate the public on how GST will work, its implications, and benefits will be crucial in gaining acceptance.

- System Readiness: Assessing the readiness of technological infrastructure and training staff within the tax administration to effectively handle the new system.

Additionally, it’s essential that the government plans for potential economic impacts stemming from the delayed rollout. Maintaining economic stability will depend on careful monitoring and responsive strategies addressing:

| Area | Key Risk | Mitigation Strategy |

|---|---|---|

| Business confidence | Uncertainty about the future tax landscape | Regular updates and stakeholder consultations |

| Revenue Generation | Lower than expected tax collection | Robust forecasting and feedback mechanisms |

| Public Sentiment | Resistance from consumers to new taxes | Engagement through community forums and Q&A sessions |

The Way Forward

the six-month delay in the implementation of the Goods and Services Tax (GST) in Guernsey marks a significant development in the island’s fiscal landscape. As the government seeks to address concerns raised by residents and businesses during the consultation process, this postponement provides a crucial window for further discussions and refinements. Stakeholders will be watching closely as officials work to ensure that the eventual roll-out of GST aligns with the needs of the community while maintaining the island’s economic stability. As we continue to follow this evolving story, it is essential for both the government and the public to engage in open dialogue, ensuring that the final framework of the GST is transparent, equitable, and beneficial for all.