S. Korea-Andorra Double Taxation Avoidance Pact Takes Effect: A Step Towards Enhanced Economic Relations

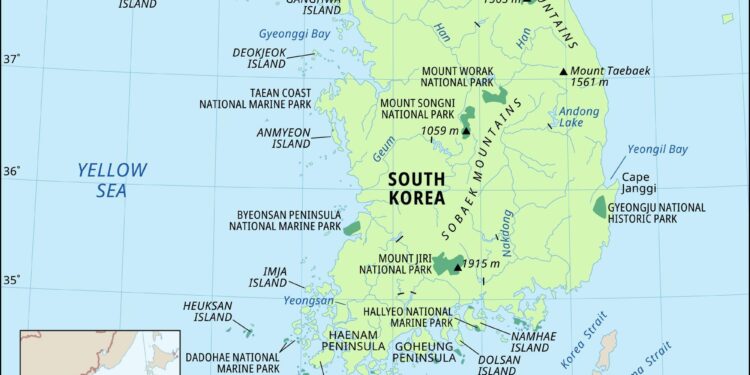

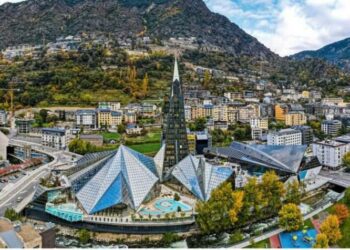

In a significant move towards strengthening economic ties, South Korea and Andorra have officially implemented a double taxation avoidance agreement (DTAA) designed to bolster bilateral trade and investment. As the pact takes effect, it aims to eliminate the risk of double taxation for individuals and businesses operating in both countries, thereby enhancing the attractiveness of each nation as a destination for foreign investment. This agreement not only lays the foundation for improved fiscal cooperation but also reflects a growing trend among nations to foster international economic collaboration in an increasingly interconnected global landscape. The Korea Post delves into the implications of this agreement, analyzing its potential impact on trade dynamics and the broader economic partnership between South Korea and the small yet strategically located European principality of Andorra.

Implications of the S. Korea-andorra Double Taxation Agreement for Businesses

The establishment of the double taxation agreement between South Korea and Andorra presents numerous strategic advantages for businesses operating in both regions. Companies can expect a reduction in withholding tax rates on dividends, interest, and royalties, which not only minimizes the tax burden but also enhances cash flow. This financial relief can substantially improve the overall profitability of enterprises engaged in cross-border transactions. The agreement also fosters a more stable and predictable taxation environment, enabling businesses to plan long-term investments with greater confidence.

Moreover, the new pact is highly likely to attract foreign direct investment, as it positions Andorra as an appealing jurisdiction for South Korean firms looking to expand their European footprint. The agreement establishes a framework that encourages openness and cooperation between tax authorities, mitigating the risk of tax disputes. In addition, businesses can benefit from enhanced access to Andorra’s favorable business climate, which includes low corporate tax rates and a business-friendly regulatory environment. This creates an chance for diversified growth and competitive advantages in the global market.

Key Benefits for South Korean Investors in Andorra

South Korean investors are poised to reap significant advantages from the recent double taxation avoidance agreement with Andorra, a move that enhances the appeal of this small European principality as an investment destination. Firstly, the elimination of double taxation ensures that dividends, interest, and royalties earned in Andorra will not be taxed again in South Korea, maximizing potential profit margins. This creates a favorable climate for South Korean capital to flow into Andorra’s burgeoning sectors, particularly in tourism, finance, and technology. Moreover, with Andorra’s competitive corporate tax rates, investors from South Korea can leverage this arrangement to optimize their tax liabilities and enhance overall returns on investment.

In addition to the tax benefits, Andorra offers a stable political environment and a robust legal framework designed to protect foreign investments. key advantages include streamlined processes for obtaining residency for investors, which allows for easier management of businesses and assets within the country. moreover,the pact facilitates bilateral trade by promoting transparency and creating a predictable tax landscape. Consequently, South Korean investors can not only diversify their portfolios but also tap into the European market with greater ease.

| Benefit | Description |

|---|---|

| Tax Efficiency | Elimination of double taxation on profits,enhancing net returns. |

| Investment Protection | Strong legal frameworks safeguarding foreign investments. |

| Residency Opportunities | Streamlined processes for investor residency and business management. |

| Market Access | Facilitated access to the broader European market. |

Enhancing Economic Cooperation Through Tax Treaties

The recent implementation of the double taxation avoidance agreement between South Korea and Andorra marks a significant step forward in fostering stronger economic ties between the two nations. By alleviating the burden of double taxation, this pact enhances investment opportunities, encourages trade cooperation, and fosters a more favorable business environment. entities operating in both territories will benefit from clear guidelines for tax obligations, which can definitely help minimize disputes and promote transparency. This comprehensive approach reflects a shared commitment to economic growth and mutual prosperity.

Beyond its immediate benefits, the treaty may serve as a blueprint for similar agreements with other countries. Key advantages include:

- Increased Foreign Direct Investment (FDI): Attracts investors seeking stable and predictable tax regimes.

- Boosted Trade Relations: Facilitates smoother transactions and collaboration between businesses.

- Enhanced Economic Stability: Provides a framework that reassures both commercial and private interests.

This agreement not only underscores the importance of international tax cooperation but also showcases the willingness of both nations to engage actively on the global economic stage.

Recommendations for Navigating the New Tax Framework in S. korea and Andorra

as businesses and individuals adjust to the new tax landscape structured by the double taxation avoidance agreement between South Korea and Andorra, it’s crucial to implement strategic measures to maximize benefits and ensure compliance. Understanding the specifics of the treaty will help taxpayers identify eligible income types and understand provisions that minimize tax liabilities. Recommended steps include:

- Consult with Tax Experts: Engage with professionals familiar with both jurisdictions to evaluate how the treaty impacts your financial situation.

- Document Income Sources: Maintain detailed records of all income sources and expenses,ensuring they align with treaty guidelines.

- Stay Informed on Changes: Regularly review updates to tax legislation in both countries as they evolve and may affect compliance and opportunities.

Additionally, developing a proactive tax planning strategy can significantly impact overall financial health. Consider establishing a compliance checklist that covers key requirements under the agreement, such as reporting obligations and eligibility for reduced rate treatment. A straightforward table can help taxpayers visualize these commitments:

| Obligation | Details |

|---|---|

| report income | All income from foreign sources must be declared to avoid penalties. |

| Claim Relief | Utilize the tax relief options available under the treaty for eligible income. |

| Monitor Deadlines | Adhere to filing deadlines in both jurisdictions to maintain compliance. |

To Wrap It up

the implementation of the double taxation avoidance pact between South korea and Andorra marks a significant step in fostering bilateral economic relations. by providing clarity and reducing the tax burden on individuals and businesses operating in both countries, this agreement is set to encourage investment and enhance trade partnerships.As South Korea continues to expand its global economic footprint, this pact serves as a vital mechanism to facilitate smoother financial interactions with andorra, underscoring the importance of tax cooperation in an increasingly interconnected world. Stakeholders on both sides are expected to benefit from this arrangement, paving the way for a more prosperous economic future. For updates on international agreements and their impacts on global trade, stay tuned to The Korea Post.