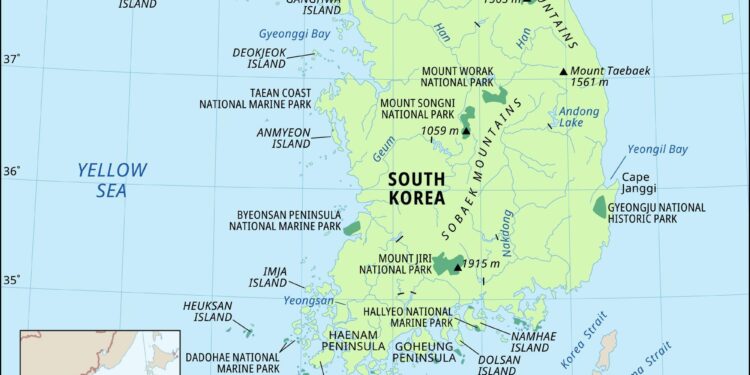

S. Korea-Andorra DoubleŌüŻ Taxation Avoidance Pact Takes Effect: ŌüóA Step Towards ŌüóEnhanced Economic Relations

In a significantŌĆī move towards strengtheningŌĆī economic ties, South Korea and Andorra have officially implemented a double taxation avoidance agreement (DTAA) designed to ŌüŻbolsterŌĆŗ bilateral trade Ōüżand investment. AsŌĆŗ theŌĆī pact takesŌüó effect, it aimsŌĆī to eliminate the risk of double taxation for individuals and businesses operating in ŌüŻboth countries, thereby enhancing Ōüżthe attractiveness of each nation as aŌĆŹ destination for foreign investment. ŌĆīThis agreement notŌüż only lays the foundation for improved fiscal cooperation but also ŌĆīreflects a growingŌüż trend amongŌüó nationsŌĆŗ toŌüż foster international economic collaboration in an increasingly ŌüŻinterconnected global landscape. The Korea Post delvesŌĆī into the implications of this agreement, analyzing its potential impact on trade dynamics and the broaderŌüż economic partnership between South KoreaŌĆŹ and the small yet strategicallyŌĆī locatedŌĆŹ European principalityŌĆŹ of Andorra.

Implications of the S. Korea-andorra Double Taxation Agreement for Businesses

The establishmentŌüó ofŌüó the double taxationŌüó agreement between South KoreaŌüż and Andorra presents numerous strategic advantages for businesses operating Ōüóin both regions. Companies can expect a reduction in Ōüżwithholding tax rates on dividends,Ōüż interest, and royalties, which not only minimizes ŌĆŹthe tax burden but also enhances cash flow. Ōüż This financial relief can substantially ŌĆŹimprove the overall profitability of enterprises engaged in cross-border transactions. The agreement also fosters Ōüóa ŌĆŹmore stable and predictable taxation ŌüŻenvironment, enabling businesses to plan long-term investments ŌĆŗwith greater confidence.

Moreover, the newŌĆī pact is ŌĆŗhighly likely to attract foreign direct investment, as ŌĆīit positionsŌĆŗ Andorra as an appealing jurisdiction for South Korean firms looking to expand their European footprint. The agreement establishes ŌĆŗa Ōüóframework that encourages openness and cooperation between ŌĆītax authorities, mitigating the risk of tax disputes. In addition, businesses can benefit from enhanced access toŌüó Andorra’s favorable business Ōüżclimate, which Ōüżincludes low corporate tax rates and a business-friendly regulatoryŌüŻ environment. ThisŌĆŹ creates an chance for diversifiedŌüó growth and competitive advantages in the global market.

Key Benefits for South Korean Investors ŌüŻin Andorra

South Korean investorsŌüŻ areŌĆŹ poised ŌüótoŌüó reap significant advantages fromŌĆī the recent double taxation avoidance agreement with Andorra, a moveŌĆŗ that Ōüżenhances ŌĆŗthe appeal of this small European ŌüżprincipalityŌüŻ asŌüó an investment destination. Firstly, the elimination ofŌĆŹ double ŌĆītaxation ensures thatŌĆŹ dividends, interest, and royaltiesŌüŻ earned in Andorra Ōüówill ŌĆŗnot be taxed again in South ŌĆīKorea, maximizing potential profit margins. This ŌüŻcreates a favorable climate for South Korean capital to flow into Andorra’s burgeoning sectors, particularly in tourism, finance, and ŌĆŗtechnology. Moreover, withŌüŻ Andorra’s competitive corporate tax ŌĆŗrates, investors from South Korea can leverage this Ōüżarrangement to ŌĆīoptimize their tax liabilities and enhanceŌüż overall returns Ōüżon Ōüóinvestment.

In addition to ŌüŻthe tax benefits, Andorra offers a stable ŌüŻpolitical Ōüżenvironment and a robust legal framework designed to protect foreign investments. ŌĆŹ key advantages Ōüó include streamlined ŌĆīprocessesŌüŻ for obtaining residency for investors, ŌĆŗwhich allows for easierŌüŻ managementŌüż of businesses and assets within the ŌĆīcountry. moreover,the Ōüżpact facilitates bilateral trade by promotingŌüó transparency and creating ŌĆŗaŌüŻ predictable tax landscape. Consequently, South Korean investors can not only diversify their portfolios butŌĆī also Ōüótap into the European market Ōüówith Ōüógreater ease.

| Benefit | Description |

|---|---|

| Tax Efficiency | Elimination Ōüżof double taxation on ŌĆŹprofits,enhancing net returns. |

| Investment Protection | Strong legal frameworks safeguarding foreign investments. |

| Residency ŌüŻOpportunities | Streamlined processes for investor residency and Ōüżbusiness management. |

| Market Access | FacilitatedŌĆŗ access toŌüŻ the broader European market. |

Enhancing Economic Cooperation Through Tax Treaties

TheŌĆī recent ŌüŻimplementation of the double taxation avoidance agreement between ŌĆŗSouth Korea and Andorra marks a significant step forward inŌüż fostering stronger economic ties between ŌĆŗtheŌüó two nations. By alleviating the burden of ŌĆŹdouble taxation, thisŌĆŗ pact enhances ŌĆŹinvestment opportunities, encourages trade cooperation, ŌüŻand fosters a more ŌĆŗfavorable business environment. entities operating in both ŌĆŹterritories will benefit from ŌĆīclear guidelines for tax obligations, whichŌüŻ canŌüż definitelyŌüż help minimize disputes and promote transparency. This comprehensive approach reflects aŌĆŹ shared commitment to ŌĆŗeconomic ŌĆīgrowth ŌĆīandŌĆŹ mutual ŌüŻprosperity.

Beyond its immediate benefits, the treaty ŌĆŹmayŌüż serve as a blueprint for similar ŌüŻagreements with other Ōüócountries. Key advantages include:

- IncreasedŌüż Foreign Direct InvestmentŌĆŗ (FDI): ŌĆīAttracts investorsŌüż seeking stable andŌĆī predictable tax regimes.

- BoostedŌĆī Trade Relations: Facilitates smoother transactions and collaboration between businesses.

- Enhanced Economic Stability: Provides a ŌüóframeworkŌüż that reassures both commercialŌüż and private interests.

This agreement notŌĆī only underscores the importance of international tax Ōüżcooperation but also showcases theŌüŻ willingness of ŌĆŹboth nations to engage actively on the globalŌüó economic stage.

Recommendations for Navigating theŌüó NewŌĆŹ Tax Framework in S. korea and Andorra

as businesses and individuals adjustŌĆī to the new tax landscape structuredŌĆŗ by ŌĆŗthe double taxation Ōüżavoidance agreement betweenŌüŻ South ŌüóKoreaŌĆŗ and Andorra, itŌĆÖs crucial to implementŌüó strategic measures toŌĆī maximizeŌĆŗ benefits and ensure compliance. Understanding ŌüŻthe Ōüżspecifics of ŌĆīthe treaty willŌüó help ŌĆŹtaxpayers identify eligibleŌüŻ income typesŌüŻ and understand provisionsŌĆī thatŌüó minimize tax liabilities. Recommended steps include:

- Consult Ōüówith Tax ŌüóExperts: EngageŌüó with professionals familiar with both jurisdictions ŌĆŹto ŌĆŹevaluate how the treaty Ōüóimpacts your financial situation.

- Document Income Sources: Maintain detailed records of all income sources and expenses,ensuring they align Ōüówith treaty guidelines.

- Stay Informed on Changes: Regularly review updatesŌĆŹ to ŌĆŗtax legislation in ŌüŻboth ŌüŻcountries as they evolve and may affectŌüŻ compliance and opportunities.

Additionally, developing a proactive tax planning strategy can significantly impact overall financial health. Consider establishing Ōüóa ŌĆŗ compliance checklist that covers ŌüókeyŌĆŹ requirements under the agreement, ŌĆŗsuch as reporting obligations and eligibility for reduced Ōüórate treatment. A ŌĆŹstraightforward table can help taxpayers visualize these commitments:

| Obligation | Details |

|---|---|

| report income | All ŌĆŹincome from foreign sources ŌüŻmust be declaredŌüó to ŌüŻavoid penalties. |

| Claim Relief | UtilizeŌĆŗ the tax relief Ōüżoptions ŌĆŹavailable under theŌĆŗ treaty for eligible income. |

| Monitor Deadlines | Adhere to filing deadlines in both jurisdictions to maintain compliance. |

To Wrap It up

the implementationŌĆŗ of the double taxation avoidance pact between South korea and Andorra marks a significant step in ŌĆŗfosteringŌĆī bilateralŌĆŗ economic relations. by providing clarity and reducing Ōüżthe tax Ōüżburden on individuals and businesses operating ŌĆŗin both countries, this agreement ŌüŻis set ŌĆīto encourage investment ŌĆīand enhance trade partnerships.As South Korea continuesŌüó to expand Ōüżits global ŌĆŗeconomicŌĆŹ footprint, this pact ŌĆīserves as ŌĆŹa vital mechanism to facilitate smoother financial interactions with andorra, underscoring theŌüó importance of tax cooperation in anŌüó increasingly interconnectedŌüó world. Stakeholders on both sides are expectedŌĆŗ to benefit from this arrangement, paving Ōüżthe way for a Ōüżmore prosperous economic future. For updates ŌĆīon international agreements andŌĆŹ their ŌĆīimpacts ŌĆŹonŌĆī global trade, stay tuned to The Korea Post.