Recent Israeli acquisitions in Greek Cyprus have sparked a wave of debate across political and economic spheres, highlighting the intricate dynamics of regional cooperation and competition. According to reports from HĂĽrriyet Daily News, these transactions have prompted a mix of reactions ranging from strategic support to concern over shifting alliances and economic influence in the Eastern Mediterranean. This developing story underscores the complexities underlying Israel’s growing footprint in Cyprus and its broader implications for the region.

Israeli Property Investments in Greek Cyprus Raise Economic and Political Questions

Recent years have witnessed a significant spike in Israeli investments in Greek Cyprus, a trend that is increasingly attracting attention from both economic analysts and political observers. These acquisitions, particularly in the lucrative real estate sector, are reshaping local markets and raising complex questions regarding the long-term impact on Cyprus’s sovereignty and regional alignment. While proponents highlight the positive infusion of capital and development opportunities, critics warn of potential socio-economic imbalances and strategic vulnerabilities brought about by concentrated foreign ownership.

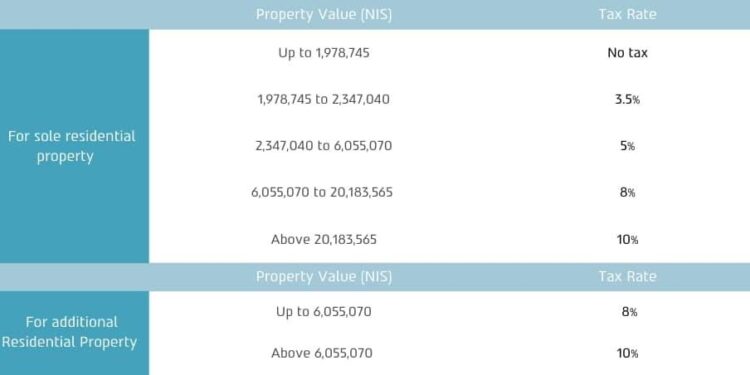

Behind the surge lies a multifaceted dynamic influenced by geopolitical shifts and economic incentives. Israeli investors are drawn by Cyprus’s favorable tax policies and strategic location at the crossroads of Europe and the Middle East, while Cyprus benefits from an influx of capital during an uncertain global market phase. However, this growing interdependence has sparked debates over national interests and the implications for Cyprus’s relations within the broader Eastern Mediterranean context.

- Economic Impact: Increased real estate prices and development projects.

- Political Concerns: Potential influence on Cypriot policy-making.

- Regional Strategy: Cyprus as a platform in Eastern Mediterranean diplomacy.

| Year | Israeli Property Purchases (€M) | Local Property Market Growth (%) |

|---|---|---|

| 2020 | 85 | 5.2 |

| 2021 | 130 | 7.8 |

| 2022 | 190 | 9.3 |

| 2023 | 250 | 11.0 |

Analysis of Regional Implications and Security Concerns Surrounding Recent Purchases

The recent acquisitions made by Israel in Greek Cyprus have triggered widespread discourse on both strategic and security dimensions across the Eastern Mediterranean. Critics argue that these purchases could signal a shift in the regional power balance, potentially escalating tensions among neighboring countries, especially Turkey and Lebanon, who view the moves as provocations. Security analysts emphasize that the deals might embolden Israel’s naval and aerial presence, granting it enhanced operational flexibility around critical maritime routes and contested zones in the Mediterranean Sea.

Several key concerns unfold as stakeholders assess the implications:

- Increased Militarization: Heightened military assets may accelerate an arms race among Eastern Mediterranean states.

- Energy Exploration Conflicts: Control over undersea gas reserves could become a flashpoint.

- Diplomatic Strains: Potential friction in trilateral relationships involving Cyprus, Israel, and Turkey.

| Country | Security Concern | Potential Response |

|---|---|---|

| Turkey | Perceived encroachment on maritime claims | Diplomatic protests and military exercises |

| Lebanon | Energy reserve disputes | Legal challenges and regional alliances |

| Cyprus | ||

| Cyprus | Security and sovereignty concerns | Strengthening defense partnerships and international diplomacy |

| Framework Element | Purpose | Expected Outcome |

|---|---|---|

| Pre-Approval Process | Screen acquisitions | Prevent hostile takeovers |

| Disclosures | Ensure transparency | Build trust with public and investors |

| Periodic Audits | Monitor compliance | Maintain long-term stability |

Wrapping Up

As Israeli investments and purchases in Greek Cyprus continue to draw attention, the debate highlights broader regional dynamics and economic interests at play. Observers suggest that the unfolding developments warrant close monitoring, as they may have significant implications for bilateral relations, energy cooperation, and regional stability in the Eastern Mediterranean. Stakeholders on all sides remain cautious as the situation evolves.