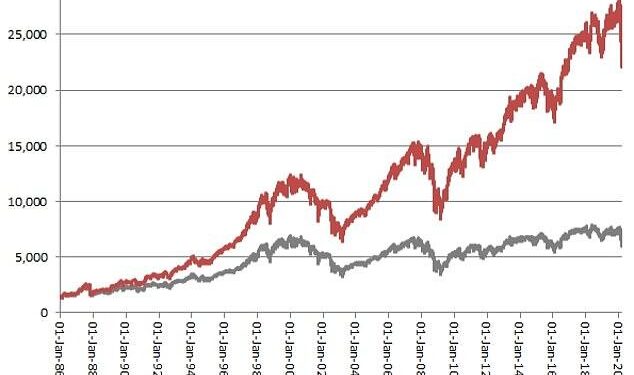

In the ever-fluctuating landscape of the UK stock market, identifying undervalued shares can offer investors compelling opportunities for growth. Recent analysis highlights three UK stocks currently trading below their estimated intrinsic value, suggesting potential bargains for those seeking to bolster their portfolios. This article delves into these companies, examining key financial indicators and market dynamics that point to their undervaluation, as reported by Yahoo Finance.

UK Equity Market Undervalued Opportunities Emerge Amid Economic Recovery

As the UK economy continues its tentative climb out of a challenging period, savvy investors are eyeing opportunities that appear mispriced in the equity market. Several stocks, particularly in sectors hit hardest by pandemic disruptions, are now showing signs of undervaluation compared to their historical and sector benchmarks. Fundamentals such as consistent earnings growth, improving cash flows, and resilient business models suggest these companies could outperform as economic conditions stabilize.

Key stocks displaying potential value include:

- Energy Sector Leader: Excelling in post-pandemic demand recovery with robust dividend yields.

- Consumer Goods Manufacturer: Benefiting from shifting consumer trends and expanding export channels.

- Financial Services Provider: Positioned well with strong capital buffers amidst tightening monetary policies.

| Stock | Current Price (GBP) | Estimated Fair Value (GBP) | Discount (%) |

|---|---|---|---|

| EnerCo Plc | 480 | 550 | 12.7% |

| BritCon Goods | 120 | 140 | 14.2% |

| FinServ Group | 210 | 235 | 10.6% |

In-depth Analysis Reveals Key Factors Driving Stock Price Discrepancies

Market inefficiencies often reveal themselves through significant gaps between a company’s intrinsic worth and its current trading price. For these UK stocks, factors such as recent sector volatility, temporary operational setbacks, and cautious investor sentiment have contributed to their market undervaluation. Additionally, macroeconomic pressures like fluctuating commodity prices and shifting regulatory landscapes play crucial roles in skewing valuation metrics away from long-term fundamental strengths. Highlighting these discrepancies enables investors to identify opportunities that traditional valuation models might overlook.

Key elements impacting these discrepancies include:

- Short-term market reactions: Fear or pessimism often drives prices below fair value during earnings misses or geopolitical tensions.

- Overlooked growth potential: Emerging revenue streams or strategic pivots may not yet be fully priced in.

- Liquidity constraints: Stock float and trading volumes can influence price elasticity, distorting apparent value.

| Factor | Impact on Price | Estimated Effect% |

|---|---|---|

| Sector Volatility | Price Compression | 15-20% |

| Emerging Revenue Streams | Undervalued Future Earnings | 10-15% |

| Regulatory Uncertainty | Increased Risk Premium | 8-12% |

Expert Recommendations Outline Strategic Buy Points for Long-Term Gains

Seasoned market analysts emphasize the importance of identifying precise entry points to maximize returns on undervalued UK equities. They advise investors to monitor key technical indicators such as moving averages and volume spikes, which often signal optimal buying moments. Additionally, understanding the broader economic environment and sector-specific catalysts can provide a strategic edge in timing purchases for long-term appreciation.

Key factors to consider when pinpointing buy points include:

- Price consolidation near historical support levels

- Positive shifts in earnings momentum and future guidance

- Institutional buying activity signaling confidence

- Macro trends favoring sector outperformers

| Stock | Recommended Buy Price | Analyst Confidence |

|---|---|---|

| Company A | ÂŁ120 | High |

| Company B | ÂŁ85 | Medium |

| Company C | ÂŁ45 | High |

Closing Remarks

As the UK stock market continues to navigate a landscape marked by economic uncertainty and shifting investor sentiment, identifying undervalued opportunities remains paramount. The three stocks highlighted in this report exemplify companies that, according to current estimates, may be trading below their intrinsic value, offering potential upside for discerning investors. Nevertheless, as with all investments, thorough due diligence and consideration of broader market conditions are essential before making any portfolio decisions. Staying informed through reliable sources like Yahoo Finance can help investors better assess these opportunities in a dynamic market environment.