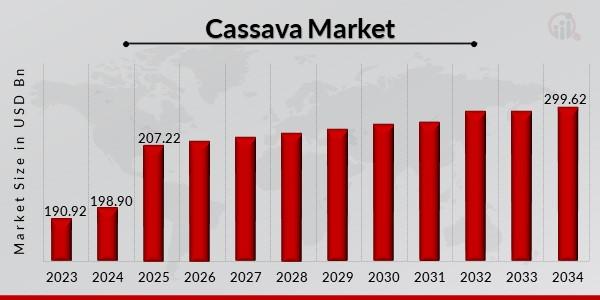

The United Kingdom’s cassava market is poised for steady growth over the coming decade, with industry analysts projecting a compound annual growth rate (CAGR) of approximately 0.8%, according to recent data from IndexBox. Despite cassava traditionally being a staple crop in tropical regions, its expanding applications in the UK-ranging from food products to industrial uses-are driving a gradual but consistent rise in demand. This upward trend reflects shifting consumer preferences and evolving supply chain dynamics that are reshaping the market landscape.

UK Cassava Market Set for Steady Growth Driven by Rising Consumer Demand

The UK cassava market is projected to experience steady expansion, supported by increasing consumer preference for gluten-free and plant-based food products. As awareness about cassava’s nutritional benefits grows, including its high fiber content and ability to serve as a wheat substitute, more households are incorporating cassava-based items into their diets. The convenience of cassava flour and snacks aligns well with current health trends, driving consistent demand particularly among millennials and health-conscious consumers.

Key factors fueling this growth include:

- Rising adoption of alternative flours in bakery and processed food sectors

- Increased import activities responding to supply chain diversification post-Brexit

- Expansion of cassava-based snack categories in retail and foodservice channels

| Year | Market Size (in £ million) | Growth Rate (%) |

|---|---|---|

| 2024 | 45.2 | 0.8 |

| 2029 (Forecast) | 53.6 | 0.8 (CAGR) |

Analysis of Key Factors Influencing Cassava Production and Import Trends

The trajectory of cassava production in the UK is being shaped by a combination of climatic adaptability, technological advancements, and shifting consumer preferences. Despite the UK’s limited arable land suitable for cassava farming, innovative agricultural practices such as greenhouse cultivation and hydroponics have begun to bridge production gaps. Moreover, an increasing demand for gluten-free and alternative starch products has spurred interest in cassava-derived goods, further amplifying production incentives. Government subsidies aimed at supporting sustainable crop diversification also play a pivotal role, encouraging farmers to incorporate cassava into their crop rotations to optimize land use and bolster soil health.

- Technological innovations driving yield improvements

- Policy incentives promoting sustainable agriculture

- Consumer health trends favoring gluten-free and natural starches

- Import dynamics influenced by trade negotiations and tariffs

Import trends mirror the UK’s evolving position within the global cassava market. Fluctuations in import volume and value highlight the country’s reliance on major exporters from Africa and Southeast Asia, with trade policies and currency exchange rates significantly impacting cost structures. Seasonal variations and supply chain disruptions have also introduced new challenges, prompting UK businesses to diversify sourcing strategies. As supply contracts are renegotiated in response to geopolitical shifts, the import market is expected to stabilize, facilitating a consistent supply to meet growing domestic processing needs.

| Factor | Impact on Production | Impact on Imports |

|---|---|---|

| Technological Advancement | High increase in yield efficiency | Moderate reduction in reliance |

| Government Policy | Encourages crop diversification | Variable, depending on trade agreements |

| Consumer Demand | Drives innovative product development | Increases volume of specialty imports |

| Global Supply Stability | Minimal direct effect | Strong influence on pricing and availability |

Strategic Recommendations for Stakeholders to Capitalize on Market Opportunities

To effectively leverage the projected growth in the UK’s cassava market, stakeholders should prioritize innovation in product development and diversify their portfolio to include cassava-based alternatives and derivatives. Investing in advanced processing technologies can enhance product quality and shelf life, addressing evolving consumer preferences for health-conscious and gluten-free options. Additionally, forging strategic partnerships between farmers, manufacturers, and retailers will be crucial to streamline supply chains and reduce costs, thereby boosting competitive advantage in an increasingly crowded marketplace.

Market players are also advised to capitalize on emerging export opportunities by aligning with international quality standards and sustainability certifications, which can open doors to premium global markets. Below is a summary of targeted actions that could drive growth:

| Stakeholder | Key Strategy | Expected Impact |

|---|---|---|

| Producers | Adopt sustainable farming practices | Improved yield and market reputation |

| Manufacturers | Introduce value-added cassava products | Higher profit margins and product differentiation |

| Retailers | Enhance product visibility and customer education | Increased consumer demand and loyalty |

Wrapping Up

As the UK’s cassava market is projected to grow at a modest CAGR of 0.8% over the next decade, industry stakeholders are closely monitoring emerging trends and consumer preferences that could influence this steady expansion. With its versatility and increasing applications in food and industrial sectors, cassava is poised to maintain its role in the UK’s agricultural landscape. Continued investment and innovation will be key factors shaping the market’s trajectory moving forward.