Norway’s latest oil and gas exploration round has attracted significant interest from the industry, with 20 firms submitting bids to secure new offshore licenses. The announcement underscores the continued appetite for exploration in the North Sea and Norwegian Sea regions, despite global energy market uncertainties. Offshore Engineer Magazine provides an in-depth look at the companies vying for a stake in Norway’s hydrocarbon potential and the strategic implications for the country’s energy landscape.

Norway Sees Strong Interest as 20 Companies Submit Bids in Oil and Gas Exploration Round

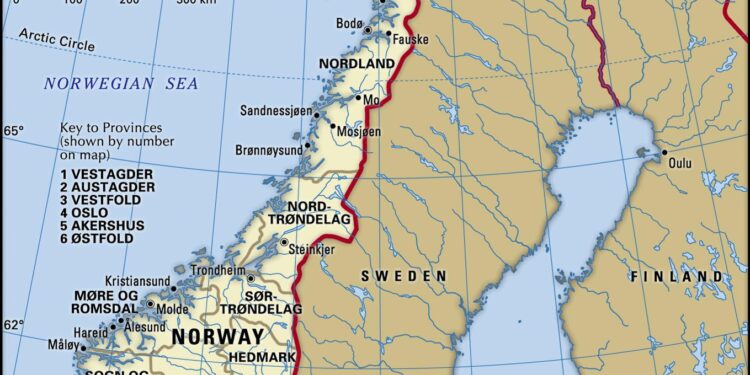

The latest oil and gas exploration round in Norway has garnered significant attention from the industry, with 20 companies submitting bids for various offshore blocks. This reflects the ongoing confidence in Norway’s hydrocarbon potential despite the global energy transition challenges. Notably, both established oil majors and emerging players have expressed interest, aiming to capitalize on Norway’s vast untapped reserves in the North Sea and Barents Sea regions.

Among the bidders, several international firms have partnered with local operators to strengthen their proposals, highlighting a collaborative approach within the sector. The Norwegian government has emphasized that the round prioritizes areas with promising geological prospects and environmentally responsible development. Below is a summary of key details from the submitted bids:

| Region | Number of Bids | Notable Participants |

|---|---|---|

| North Sea | 12 | Equinor, Shell, Aker BP |

| Barents Sea | 5 | ConocoPhillips, Wintershall Dea |

| Norwegian Sea | 3 | Spirit Energy, Repsol |

- Focus Areas: Mature basins and frontier zones with high exploration potential

- Environmental Standards: Strict adherence to Norway’s carbon management and emission reduction guidelines

- Economic Impact: Expected boost for local supply chains and job creation over the coming years

Key Opportunities and Challenges Facing Bidders in Norway’s Offshore Energy Sector

Competing in Norway’s offshore energy sector requires navigating a complex landscape marked by both promising prospects and significant challenges. Among the notable opportunities is Norway’s commitment to advancing its energy transition, where bidders can capitalize on the government’s support for new technologies such as carbon capture and storage (CCS) and offshore wind integration. Additionally, access to well-established infrastructure and relatively stable regulatory frameworks gives firms a competitive edge compared to other regions in the North Sea. The potential for discovering untapped hydrocarbon reserves, especially in frontier areas, continues to attract a diverse pool of international and domestic companies eager to leverage their expertise in exploration and production.

However, bidders must also contend with evolving environmental regulations and the increasing pressure to reduce emissions, which demands greater operational efficiency and environmental due diligence. The rising costs associated with offshore projects and fluctuating global oil prices add layers of financial uncertainty, necessitating robust risk management strategies. Moreover, the competitive intensity has increased, as the recent round saw participation from 20 diverse firms, ranging from multinational giants to nimble independent operators. Below is a snapshot comparing key opportunity and challenge factors bidders face:

| Factors | Opportunities | Challenges |

|---|---|---|

| Regulatory Environment | Stable licensing rounds, government support for innovation | Stricter environmental standards, permit delays |

| Market Conditions | High demand for cleaner energy solutions, skilled workforce | Volatile oil prices, increased project costs |

| Technical Factors | Advanced offshore infrastructure, access to cutting-edge tech | Challenging weather conditions, complex reservoir geology |

Strategic Recommendations for Firms Navigating Norway’s Competitive Exploration Landscape

To gain an edge in Norway’s fiercely competitive exploration environment, firms must prioritize strategic agility and innovation. Emphasizing collaborative partnerships can unlock access to complementary assets and local expertise critical for overcoming geological and regulatory challenges. Additionally, investing in cutting-edge seismic imaging and digital reservoir modeling tools enhances prospect evaluation accuracy, reducing financial risk while accelerating decision-making timelines.

Understanding the evolving regulatory landscape and aligning with Norway’s stringent environmental standards is equally vital. Companies should cultivate robust stakeholder relationships, particularly with government agencies and local communities, to secure social license to operate. Below is a snapshot of key focus areas for firms seeking to optimize their exploration bids:

- Technological Advancements: Leverage AI-driven data analytics and automation to streamline operations.

- Joint Ventures: Form alliances to share risk and boost capital efficiency.

- Environmental Compliance: Implement proactive measures to meet offshore emission targets.

- Local Engagement: Prioritize community investment and transparent communication.

| Strategic Focus | Expected Benefit | Implementation Tip |

|---|---|---|

| Digital Exploration Tools | Improved subsurface understanding | Adopt scalable software platforms |

| Joint Venture Collaborations | Risk sharing and capital pooling | Target firms with complementary expertise |

| Environmental Sustainability | Regulatory compliance and reputation | Embed ESG goals into core strategies |

| Community Relations | Social license and operational continuity | Engage early and maintain transparency |

The Conclusion

As Norway’s latest oil and gas exploration round closes with bids from 20 companies, the industry signals continued interest in the North Sea’s energy potential despite evolving market dynamics. Stakeholders now await regulatory decisions that will shape the sector’s trajectory amid growing emphasis on sustainability and energy transition. This round marks a significant chapter in Norway’s ongoing role as a key player in offshore exploration and production.