The United Kingdom remains a pivotal player on the global trade stage, with its exports and imports reflecting a dynamic economic landscape shaped by shifting international partnerships. As the country navigates post-Brexit realities and evolving market demands, understanding the intricacies of its trade flows offers valuable insights into its economic health and strategic priorities. Drawing on data from The Observatory of Economic Complexity, this article explores the UK’s key export and import commodities, examines its main trading partners, and analyzes trends that are redefining its role in the worldwide economy.

United Kingdom’s Leading Export Commodities Reveal Shifts in Global Demand

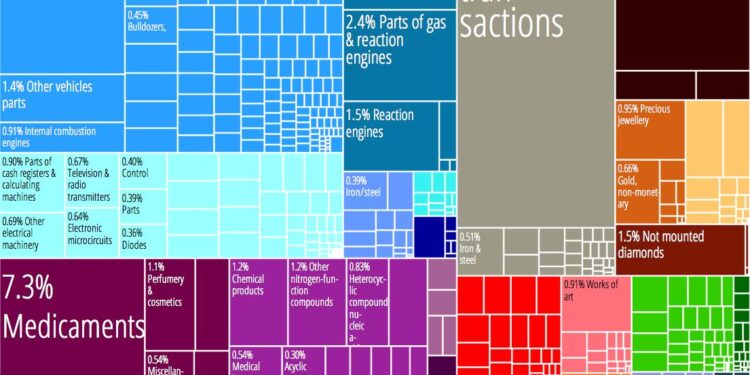

Recent data on the United Kingdom’s export commodities underscore a palpable shift in global demand patterns. Traditional strongholds such as petroleum products and machinery continue to dominate, but there’s a rising prominence of pharmaceuticals and electric vehicles, reflecting the UK’s strategic pivot towards high-value, technology-driven goods. This evolution not only mirrors global trends towards sustainability and advanced healthcare but also highlights the growing diversification of Britain’s export portfolio amid changing geopolitical landscapes.

Key export categories for the UK in the past fiscal year include:

- Pharmaceuticals: Driven by innovation and increased global health awareness.

- Automotive (Electric Vehicles): Growth fueled by green initiatives.

- Petroleum Products: Still significant but gradually declining.

- Machinery and Equipment: Essential for industrial sectors worldwide.

- Financial Services: Increasingly traded as digital products and expertise.

| Export Commodity | 2023 Export Value (Billion GBP) | Year-over-Year Change |

|---|---|---|

| Pharmaceuticals | 35.4 | +12.3% |

| Electric Vehicles | 15.8 | +28.7% |

| Petroleum Products | 42.1 | -5.1% |

| Machinery & Equipment | 29.9 | +3.6% |

| Financial Services | 18.5 | +7.4% |

Analyzing Import Patterns Highlights Critical Dependencies and Supply Chain Vulnerabilities

The United Kingdom’s current import trends reveal a concentration of reliance on a handful of key suppliers, underscoring potential fragilities within its supply chains. Essential commodities such as machinery, electronics, and pharmaceuticals predominantly flow in from countries like Germany, China, and the Netherlands. While this focus streamlines procurement, it also exposes the UK to disruptions, whether from geopolitical tensions, trade policy shifts, or unforeseen global events. Supply chain resilience is increasingly tested as these dependencies could lead to significant bottlenecks, impacting manufacturing sectors and consumer markets alike.

Examining the volume and diversity of imports highlights critical areas where the UK economy remains vulnerable. For instance, rare earth metals and semiconductor components, integral to technology and defense industries, come from a limited number of sources. This situation is compounded by logistical challenges and increasing transportation costs. Key insights include:

- High dependency on the EU for automotive parts and machinery.

- Significant exposure to Asian suppliers for electronics and pharmaceuticals.

- Limited diversification in sources for raw materials critical to advanced manufacturing.

| Import Category | Main Supplier Countries | Dependency Risk Level |

|---|---|---|

| Automotive Parts | Germany, France, Italy | High |

| Pharmaceuticals | Switzerland, India, China | Medium |

| Electronics | China, South Korea, Taiwan | High |

| Raw Materials | Brazil, Australia, South Africa | Medium |

Strategic Trade Partnerships Offer Opportunities for Diversification and Economic Resilience

In today’s interconnected global economy, the United Kingdom’s engagement in diverse trade agreements plays a critical role in strengthening its economic foundation. By fostering strategic partnerships across multiple regions, the UK is actively minimizing reliance on single markets and enhancing its ability to absorb shocks from global disruptions. This multi-faceted approach not only opens new avenues for British exporters but also attracts a wider range of imported goods, supporting domestic industries and consumers alike.

Key areas of opportunity emerging from these partnerships include:

- Access to Emerging Markets: Expanding trade links with fast-growing economies to tap into new demand sectors.

- Technological Collaboration: Sharing innovation and expertise to boost high-value exports.

- Supply Chain Diversification: Reducing vulnerability by sourcing inputs from multiple reliable partners.

| Trade Partner | Key Export Goods | Trade Growth (2022-2023) |

|---|---|---|

| United States | Machinery, Pharmaceuticals | +7.5% |

| China | Automotive Parts, Electronics | +5.3% |

| India | Textiles, Chemicals | +9.1% |

| EU (27) | Financial Services, Machinery | +3.8% |

To Conclude

In summary, the United Kingdom’s trade landscape remains dynamic and multifaceted, reflecting its strategic economic alliances and evolving global partnerships. As the data from The Observatory of Economic Complexity illustrates, GBR continues to diversify its exports and imports, adapting to shifting market demands and geopolitical developments. Monitoring these trends will be crucial for policymakers and businesses alike as the UK navigates the complexities of international trade in an increasingly interconnected world.