The International Monetary Fund (IMF) has turned its spotlight on the tax wedge in Bosnia and Herzegovina, sparking renewed discussions about the country’s labor market and fiscal policies. As the tax wedge-the difference between what employers pay and what employees receive after taxes and social contributions-remains a critical factor influencing employment and economic growth, the IMF’s latest analysis offers fresh insights into its impact on Bosnia and Herzegovina’s competitiveness. This article delves into the IMF’s findings and their implications for policymakers striving to balance revenue generation with fostering a dynamic labor market.

Understanding the Current Impact of the Tax Wedge on Bosnia and Herzegovina’s Labor Market

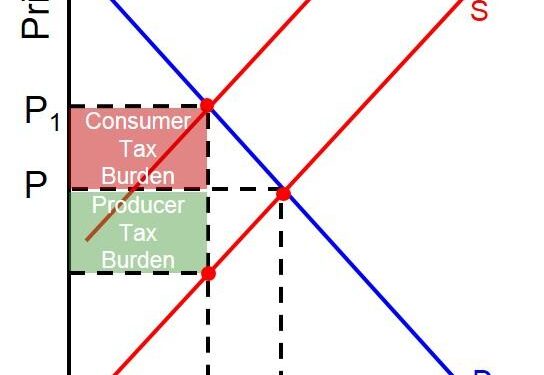

The labor market in Bosnia and Herzegovina grapples with a notably high tax wedge, which significantly influences employment dynamics and economic competitiveness. The tax wedge-the difference between total labor costs to the employer and the net take-home pay of the employee-is impacting both job creation and workforce participation. Currently, employees face heavy social security contributions and income taxes, which discourage formal employment, especially among the youth and low-income groups. This complex fiscal environment has led to a prevalent informal economy, undermining government revenues and social protection systems.

Key factors contributing to the elevated tax wedge include:

- Fragmented tax administration across the two entities complicates compliance and enforcement.

- High social security rates that, while intended to fund pensions and healthcare, discourage formal hiring.

- Limited tax incentives for small businesses and startups, stifling entrepreneurial growth.

| Indicator | Percentage (%) |

|---|---|

| Average Tax Wedge on Labor | 42 |

| Informal Employment Rate | 34 |

| Unemployment Rate (Youth) | 58 |

Addressing the tax wedge is crucial to revitalizing Bosnia and Herzegovina’s labor market. Simplifying tax regulations and aligning social contributions could create an environment conducive to formal employment and investment. Moreover, targeted reductions in labor taxation, combined with enhanced social security reforms, could help bridge gaps in social protection while encouraging workforce participation. International support, including consultation from the IMF, underscores the urgency of these reforms to boost economic growth and ensure sustainable labor market development.

Detailed Analysis of IMF Findings on Economic Growth and Employment Challenges

The IMF’s comprehensive review highlights critical obstacles in Bosnia and Herzegovina’s economic trajectory, emphasizing the dual challenge of fostering growth while tackling persistent employment issues. According to the report, the country’s tax wedge-the difference between total labor costs and take-home pay-is notably higher than regional averages, dampening labor market participation and discouraging formal employment. The Fund underscores that these disparities undermine competitiveness and contribute to a sizable informal sector, further complicating fiscal and social policy goals.

Key findings from the IMF include:

- High labor taxation limits incentives for businesses to create new jobs, particularly in small and medium enterprises.

- Segmented labor markets with uneven social security contributions exacerbate disparities between public and private sectors.

- Regulatory barriers impede the flow from informal to formal employment, reducing overall economic efficiency.

| Indicator | Bosnia & Herzegovina | Regional Average |

|---|---|---|

| Average Tax Wedge (%) | 43.5 | 35.7 |

| Informal Employment Rate (%) | 28.1 | 19.4 |

| Unemployment Rate (%) | 17.8 | 11.2 |

The IMF stresses that a targeted reform of the tax structure could improve labor market conditions and stimulate formal job creation. Reform measures would involve adjusting social contributions, aligning labor regulations, and simplifying tax procedures to reduce administrative burdens. By addressing these areas, Bosnia and Herzegovina could unlock sustainable growth pathways and create a more inclusive employment environment, positioning itself for stronger economic resilience in the coming years.

Policy Recommendations for Reducing Tax Burden and Stimulating Investment in Bosnia and Herzegovina

To alleviate the excessive tax burden deterring both domestic and foreign investors, policymakers in Bosnia and Herzegovina should prioritize simplifying the tax code and reducing marginal tax rates on labor and capital. Introducing streamlined tax brackets and lowering compulsory social security contributions can foster a more attractive business climate. Additionally, enhancing transparency and efficiency in tax collection will curb informal economic activities, broadening the tax base without increasing rates. Implementing targeted tax incentives for startups and sectors with high growth potential, such as technology and renewable energy, will further catalyze private investment and job creation.

Key policy measures include:

- Reducing the overall tax wedge on labor to align with regional averages

- Establishing stable, long-term tax policies to improve investor confidence

- Expanding tax credits for research and development activities

- Strengthening institutional capacity for tax administration and compliance

| Current Tax Rate | Recommended Rate | Potential GDP Growth Impact |

|---|---|---|

| Income tax: 40% | 30% | +1.5% |

| Corporate tax: 10% | 8% | +0.7% |

| Social security: 33% | 25% | +1.0% |

Concluding Remarks

In revisiting the tax wedge in Bosnia and Herzegovina, the International Monetary Fund’s analysis not only sheds light on the structural challenges facing the country’s labor market but also underscores the urgent need for comprehensive reforms. As policymakers grapple with balancing revenue generation and economic competitiveness, the IMF’s findings serve as a crucial roadmap for fostering a more inclusive and sustainable growth environment. Moving forward, the effectiveness of these recommendations will largely depend on the political will and coordinated efforts within Bosnia and Herzegovina’s complex administrative landscape-an undertaking that remains critical for the nation’s long-term economic stability.