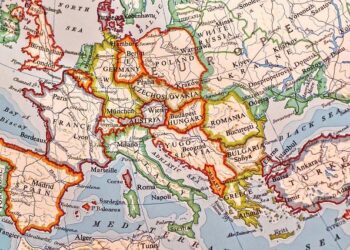

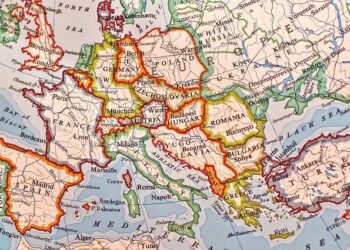

Santander has been recognized as the ‘Best Private Bank’ in both Spain and Poland, according to the latest rankings released by The Banker. This prestigious accolade underscores Santander’s commitment to excellence in private banking services across key European markets. The award highlights the bank’s robust client offerings, innovative wealth management solutions, and strong regional presence, reaffirming its position as a leading financial institution in the private banking sector.

Santander Recognized as Leading Private Bank in Spain and Poland by The Banker

Santander’s commitment to excellence in private banking has been formally acknowledged with its recent accolade from The Banker, positioning the institution as a trailblazer in Spain and Poland. This recognition highlights Santander’s innovative approach to personalized financial services, combining cutting-edge technology with a deep understanding of client needs. Its bespoke wealth management solutions have set new standards in trust, transparency, and client engagement across these two key markets.

Key factors contributing to Santander’s success include:

- Robust digital platforms enabling seamless client interactions

- Highly skilled advisors delivering tailored investment strategies

- Integrated services that span global wealth perspectives

- Commitment to sustainable and responsible banking practices

| Country | Ranking | Focus Area |

|---|---|---|

| Spain | 1st Place | Client-Centric Innovation |

| Poland | Leading Private Bank | Digital Wealth Management |

Key Strategies Behind Santander’s Success in Competitive Private Banking Markets

Santander’s remarkable standing in private banking is deeply rooted in its holistic approach to client management, combining state-of-the-art digital platforms with personalized advisory services. The bank’s investment in advanced technology facilitates seamless, secure interactions, enabling clients to access tailored portfolios and real-time market insights effortlessly. Equally vital is Santander’s commitment to nurturing trusted relationships, supported by dedicated teams of financial experts who craft strategies aligned with each client’s evolving aspirations. This dual focus on innovation and personalized care creates a competitive edge in markets where discerning clients demand both agility and attentiveness.

Another cornerstone of Santander’s success is its adaptive strategy in safeguarding and expanding wealth through diversified asset management and sustainable investing. The bank actively integrates environmental, social, and governance (ESG) criteria within its product offerings, reflecting a forward-thinking philosophy that resonates with contemporary investors. Key differentiators include:

- Customized investment vehicles that balance risk and growth tailored to individual client profiles.

- Global market access leveraging Santander’s international footprint for cross-border opportunities.

- Proactive wealth protection through strategic asset allocation and dynamic portfolio rebalancing.

- Robust compliance and transparency ensuring client confidence in a complex regulatory environment.

| Strategy | Impact | ||

|---|---|---|---|

| Digital Innovation | Enhanced client engagement and agility | ||

| Personalized Advisory | Tailored wealth solutions fostering loyalty | ||

| Sustainable Investing | | Strategy | Impact | |

| Digital Innovation | Enhanced client engagement and agility | ||

| Personalized Advisory | Tailored wealth solutions fostering loyalty | ||

| Sustainable Investing | Alignment with ESG principles enhancing long-term value | ||

| Diversified Asset Management | Risk mitigation and optimized portfolio performance | ||

| Robust Compliance | Strengthened client trust and regulatory adherence |

If you want, I can further help with styling or rewriting parts for clarity or impact. Just let me know!

Expert Recommendations for Maintaining Excellence in International Wealth Management

Leading private banks distinguish themselves through a multifaceted approach focused on personalization, innovation, and compliance. Experts emphasize the importance of developing tailored wealth strategies that cater to the unique financial goals and risk profiles of each client. This requires continuous dialogue and adaptation as global markets evolve, ensuring that wealth preservation and growth remain aligned with clients’ changing needs.

Furthermore, harnessing cutting-edge technology is essential for maintaining excellence in international wealth management. Top institutions invest heavily in secure digital platforms and data analytics to provide real-time insights and seamless client experiences. Coupled with a deep understanding of international regulatory frameworks, these elements form the foundation for maintaining trust and delivering consistent value globally.

- Personalized advisory services based on data-driven insights

- Robust compliance measures aligned with international regulations

- Investment in digital infrastructure for enhanced client engagement

- Ongoing staff training to adapt to evolving market conditions

| Key Focus Area | Impact on Client Experience |

|---|---|

| Personalization | Increased client loyalty |

| Technology | Faster decision-making |

| Compliance | Reduced risk exposure |

| Staff Expertise | Improved advisory quality |

Closing Remarks

Santander’s recognition as the ‘Best Private Bank’ in Spain and Poland by The Banker underscores its commitment to delivering exceptional wealth management services across key European markets. The award highlights the bank’s strong client-centric approach, innovative solutions, and robust financial performance. As Santander continues to expand and enhance its private banking offerings, this accolade solidifies its position as a leading institution in the competitive landscape of private banking. For more information, visit santander.com.