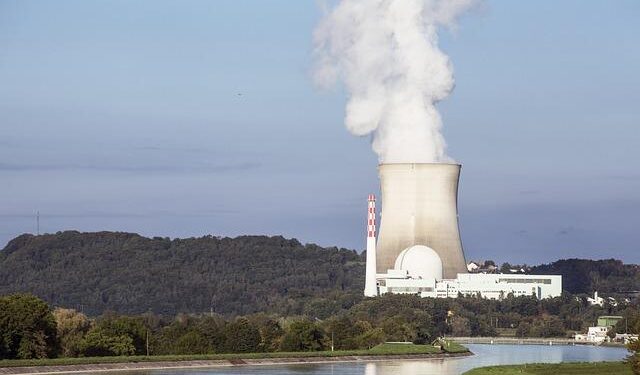

Poland’s ambitious plan to build its first nuclear power plant has sparked intense debate, as the project promises to transform the nation’s energy landscape while raising serious financial concerns. As the government pushes forward with the construction aimed at reducing carbon emissions and boosting energy security, experts warn that escalating costs could turn the venture into a fiscal nightmare. This article examines the potential economic risks behind Poland’s nuclear dream, exploring why the price tag for the atomic plant is under increasing scrutiny.

Poland’s Nuclear Ambitions Face Rising Financial Challenges

Poland’s ambitious plan to build its first nuclear power plant is becoming increasingly entangled in escalating costs and budgetary concerns. Initially estimated at around ‚ā¨25 billion, experts now warn that the final price tag could far exceed this figure due to inflation, supply chain disruptions, and the rising costs of advanced technology imports. Financial analyses reveal that delays in procurement and project management inefficiencies may push the completion date further into the future, compounding expenses and undermining investor confidence.

Key financial pressures include:

- Rising global prices for nuclear-grade materials

- Increased labor costs linked to specialized workforce shortages

- Currency fluctuations affecting foreign contracts

- Stricter regulatory requirements demanding costly safety upgrades

| Cost Factor | Estimated Impact (‚ā¨ Billion) | Risk Level |

|---|---|---|

| Material Prices | 5 | High |

| Labor | 3 | Medium |

| Regulatory Compliance | 2 | Medium |

| Currency Exchange | 1.5 | Low |

Analyzing the Factors Driving Cost Escalations in the Atomic Project

Several intertwined factors are propelling the soaring expenses associated with Poland’s inaugural nuclear power plant. Foremost among these is the global surge in raw material costs, notably steel and concrete, spurred by ongoing supply chain disruptions and heightened demand for energy infrastructure worldwide. Additionally, regulatory compliance and heightened safety standards specific to nuclear energy impose stringent requirements, often leading to extended timelines and unexpected engineering challenges. These elements, combined with the complexity inherent in cutting-edge nuclear technology, contribute significantly to budget overruns and unpredictable financial strain.

Key contributors to the cost escalation include:

- Inflationary pressures: Increasing prices for labor, materials, and equipment.

- Geopolitical tensions: Disruptions in supply chains caused by international conflicts.

- Project delays: Prolonged timelines leading to mounting overheads.

- Technical complexity: Challenges integrating novel nuclear technology with national grid infrastructure.

| Factor | Impact | Estimated Cost Increase |

|---|---|---|

| Material Price Surge | Delays & higher procurement costs | +12% |

| Enhanced Safety Protocols | Extended project timelines | +8% |

| Labor Market Shortages | Increased wages & slower progress | +7% |

| Technological Upgrades | Additional integration expenses | +5% |

Recommendations for Managing Poland’s Nuclear Investment Risks

To keep Poland’s nuclear ambitions from becoming a fiscal quagmire, authorities must prioritize transparency and stringent oversight. Establishing an independent regulatory body tasked exclusively with monitoring project expenditures can prevent budget overruns and delays. Additionally, adopting a phased investment approach allows for informed decision-making at each stage, reducing the risk of unforeseen financial burdens. Engaging with international experts and leveraging lessons from countries with established nuclear programs can also provide vital safeguards against common pitfalls.

Strategic partnerships and diversified financing are equally essential. Poland should carefully select contractors with proven track records and incorporate contractual clauses that tie payments to milestones achieved, incentivizing efficiency and accountability. To mitigate economic risks, the government could explore a mix of public funds, private investments, and EU grants designed to support clean energy transitions. The table below outlines key risk management strategies and their potential impact on project stability:

| Risk Management Strategy | Expected Impact |

|---|---|

| Independent Oversight | Enhanced financial accountability |

| Phased Investment | Risk minimization and adaptive planning |

| International Expertise | Reduced technical unforeseen costs |

| Performance-based Contracts | Increased contractor accountability |

| Diversified Financing | Balanced economic exposure |

- Regular risk audits to identify emerging threats early.

- Robust contingency funds to absorb cost spikes.

- Public engagement initiatives to maintain transparency and trust.

In Retrospect

As Poland moves forward with its ambitious plan to build its first nuclear power plant, the nation faces a critical balancing act between energy security and financial prudence. While the promise of a stable, low-carbon energy source aligns with broader European climate goals, the potential for soaring costs casts a shadow over the project’s viability. Stakeholders and citizens alike will be watching closely as the government navigates these complex challenges, with the future of Poland’s energy landscape-and its economy-hanging in the balance.