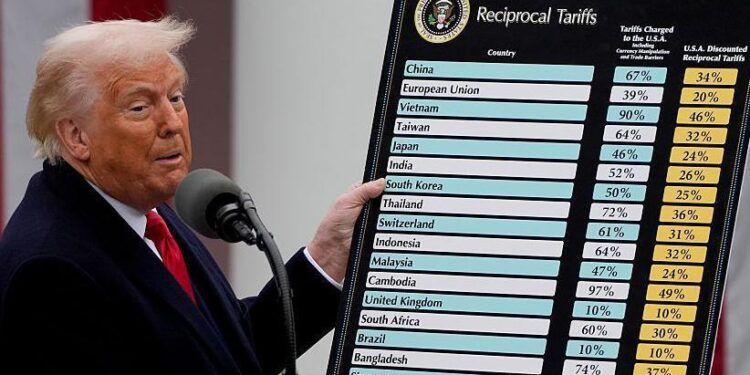

In an unexpected move that has sent ripples through transatlantic trade relations, the Trump administration announced a sweeping 39% tariff on Swiss imports. This unprecedented tariff, targeting key sectors of Switzerland’s export economy, marks a significant escalation in U.S. trade policy under the current administration. As businesses and policymakers scramble to assess the implications, questions mount about the motivations driving this aggressive stance and the potential fallout for both nations. This article delves into the factors behind Washington’s shock decision, exploring its economic and diplomatic ramifications.

Trump’s Unprecedented Tariff Measures Target Swiss Exports and Financial Services

In an unprecedented move, the Trump administration announced a sweeping 39% tariff targeting a broad range of Swiss exports, sending shockwaves through global markets. This sweeping measure primarily affects luxury goods, precision instruments, and pharmaceuticals-key pillars of Switzerland’s export economy. Critics argue that this aggressive stance intends to pressure Switzerland over longstanding trade imbalances and perceived unfair financial practices. Swiss exporters, particularly those in the luxury watch industry, are now grappling with the immediate fallout, which threatens to disrupt established supply chains and global demand patterns.

Moreover, the financial services sector stands at the epicenter of this trade conflict. With Switzerland’s private banking and asset management services under scrutiny, Washington aims to curtail practices it views as facilitating tax avoidance and money laundering. The tariffs include fees on a spectrum of financial transactions, formulating a new front in the escalating trade tensions. Analysts warn that this could prompt a recalibration of international finance flows and increase market volatility.

- Targeted industries: Luxury watches, pharmaceuticals, precision instruments, financial services

- Tariff rate: 39%, the highest imposed on Switzerland to date

- US goals: Address trade imbalance, combat tax avoidance

- Swiss response: Immediate calls for negotiations, threat of WTO dispute

| Sector | Export Value (USD Billions) | Tariff Impact |

|---|---|---|

| Luxury Watches | 15.2 | High |

| Pharmaceuticals | 22.5 | Moderate |

| Financial Services | 30.1 | Significant |

| Precision Instruments | 8.4 | High |

Analyzing the Economic and Diplomatic Impacts of the 39 Percent Tariff on Switzerland

The unexpected imposition of a 39 percent tariff on Swiss imports marks a significant shift in U.S. trade policy, with profound economic reverberations on both sides. Swiss exporters are now facing higher barriers, particularly in industries like precision machinery, pharmaceuticals, and luxury watches-a sector that accounts for a substantial share of Switzerland’s GDP. Market analysts predict potential disruptions in supply chains and increased costs for American consumers, who could bear the brunt of price inflations on Swiss-made goods. Swiss companies may be compelled to reconsider their production strategies, possibly relocating parts of their manufacturing to circumvent the steep tariffs.

Diplomatically, this move strains the traditionally amicable relationship between Switzerland and the United States. The tariff, perceived by some Swiss officials as an unprovoked economic aggression, risks triggering retaliatory measures. It complicates ongoing negotiations on various bilateral agreements and could dampen collaboration in areas beyond trade-such as finance and technology. Key diplomatic concerns include:

- Potential retaliation: Switzerland might impose counter-tariffs or pursue disputes in international trade forums.

- Alliance challenges: The tariff disrupts the longstanding neutrality and cooperative stance that Switzerland has maintained with the U.S.

- Investor confidence: Uncertainty over trade policies may lead to reduced foreign direct investment on both sides.

| Sector Impacted | Estimated Export Decline | US Consumer Effect |

|---|---|---|

| Precision Machinery | 15% | Moderate Price Increase |

| Pharmaceuticals | 10% | Low Price Impact |

| Luxury Watches | 25% | High Price Increase |

Strategic Recommendations for Swiss Businesses to Navigate New US Trade Barriers

Swiss companies are now confronted with a rapidly evolving trade environment requiring decisive strategic adjustments. To mitigate the impact of the unprecedented 39% tariff, businesses should diversify their supply chains by seeking alternative manufacturing or sourcing locations outside the US. This approach not only reduces dependency on the American market but also shields companies from future geopolitical shocks. Additionally, firms are advised to intensify their focus on digital transformation and e-commerce, leveraging online platforms to access new markets and maintain revenue streams amid restricted physical trade channels.

Key strategic actions include:

- Exploring Free Trade Agreements (FTAs): Engage with countries offering favorable trade terms to offset US market barriers.

- Investing in local US partnerships: Establishing joint ventures or alliances that can help circumvent tariff costs through localized production.

- Enhancing product innovation: Developing higher value-added goods that withstand tariff pressures through differentiation.

- Lobbying and advocacy: Coordinated efforts by Swiss business associations to influence trade policy and negotiate tariff relief.

To assist in prioritizing these strategies, companies can evaluate potential gains versus costs using a simple risk-reward matrix.

| Strategy | Cost | Potential Benefit | Timeframe |

|---|---|---|---|

| Diversify supply chains | Medium | High | 6-12 months |

| Develop US partnerships | High | Medium | 12-18 months |

| Expand e-commerce | Low | Medium | 3-6 months |

| Lobby for tariff relief | Low | Uncertain | Ongoing |

Future Outlook

As the implications of President Trump’s unexpected 39% tariff on Swiss goods continue to unfold, stakeholders on both sides of the Atlantic are closely monitoring the evolving trade landscape. Analysts suggest that beyond immediate economic impacts, this move signals a broader recalibration of U.S. trade policy priorities, with potential ripple effects for global markets. For now, businesses and policymakers alike await further clarity on the administration’s strategy, as Washington and Bern brace for what may become a defining chapter in their bilateral economic relations.