In the ongoing global debate over taxation, few systems ignite as much controversy and scrutiny as that of the United States. In its latest analysis, The American Prospect delves into the intricacies of what some experts are calling “the best tax system on Earth.” This provocative claim invites readers to explore the unique features, strengths, and shortcomings of the American tax framework, shedding light on how it compares to models worldwide. As tax policy remains a cornerstone of economic and social discourse, understanding the nuances behind this assertion is crucial for policymakers, economists, and citizens alike.

Evaluating the Core Principles Behind America’s Tax Framework

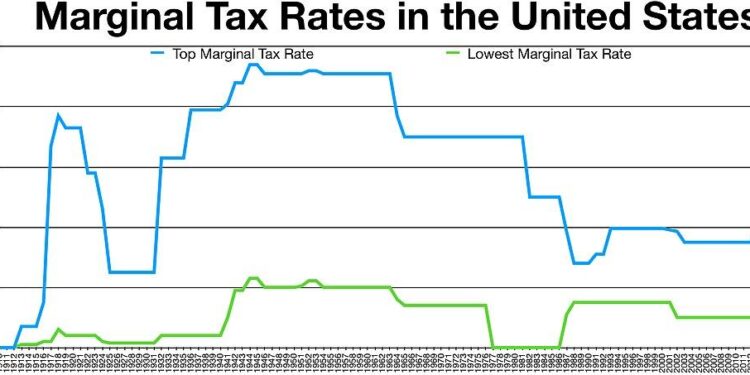

The American tax framework is anchored in several fundamental principles designed to balance equity, efficiency, and simplicity. Central to this structure is the concept of progressivity, where tax rates increase with higher income brackets, ensuring that those with greater financial capacity contribute a fairer share. Additionally, the system emphasizes transparency to foster public trust, making tax codes and processes accessible and understandable to citizens. Equally important is the principle of economic growth stimulation, where tax incentives and deductions aim to encourage investment, innovation, and job creation.

- Fairness: Addressing income inequality through graduated tax brackets.

- Simplicity: Striving for straightforward filing processes despite complex regulations.

- Revenue Sufficiency: Maintaining government funding without stifling economic mobility.

- Adaptability: Evolving tax laws in response to socioeconomic changes.

To illustrate how these principles manifest, consider the comparison between different tax types in terms of their burden and effectiveness.

| Tax Type | Primary Purpose | Progressivity | Economic Impact | ||||

|---|---|---|---|---|---|---|---|

| Income Tax | Revenue & Equity | High | Moderate | Sales Tax | Revenue | Low | Mild Negative |

| Corporate Tax | Revenue & Regulation | Moderate | Negative | ||||

| Property Tax | Local Revenue | Moderate | Neutral |

Understanding these dimensions helps in crafting balanced tax policies that meet fiscal needs while minimizing adverse effects on the economy and ensuring fairness across different income groups.

How Progressive Taxation Drives Economic Fairness and Growth

By imposing higher tax rates on those with greater ability to pay, progressive taxation ensures a more equitable distribution of wealth across society. This system reduces the widening income gap by funding essential public services such as education, healthcare, and infrastructure, which disproportionately benefit lower and middle-income groups. Through this redistribution mechanism, progressive taxes create a foundation for social mobility and economic opportunity, enabling millions to contribute more productively to the economy.

Beyond fairness, progressive taxation actively fuels economic growth. When wealthier individuals contribute a larger share, governments gain the resources necessary to invest in innovation and public goods that stimulate long-term prosperity. For example, research shows that increased public spending in targeted areas correlates with higher employment rates and rising GDP. Consider the simplified impact below:

| Tax Bracket | Investment in Public Services | Impact on GDP Growth |

|---|---|---|

| Low Income | 10% | 1.2% increase |

| Middle Income | 25% | 2.8% increase |

| High Income | 65% | 5.5% increase |

Additionally, progressive tax systems incentivize reinvestment into the economy rather than hoarding of wealth. Key benefits include:

- Greater consumer spending among lower and middle classes, driving demand.

- Enhanced funding for social safety nets, reducing poverty-induced economic uncertainty.

- Encouragement of innovation by financing public research institutions.

Policy Recommendations to Strengthen Equity and Simplify Compliance

To create a tax system that truly serves all Americans, lawmakers must focus on equity and simplicity as cornerstone principles. This includes expanding the earned income tax credit and adjusting brackets to better reflect income inequality without making the filing process more burdensome. Simplified tax codes with clear language and fewer deductions can empower taxpayers to navigate their responsibilities without costly accountants or confusing software. Crucially, revising corporate tax rules to ensure larger entities pay their fair share would tackle loopholes that currently undermine public trust in fairness.

Effective reform also demands technological modernization paired with user-centric design. Proposed measures include:

- Pre-filled tax returns leveraging IRS data for instant accuracy and reduced errors

- Unified digital portals integrating federal and state filings for seamless compliance

- Enhanced support via virtual tax assistants, online chat, and multi-language guidance

Below is a snapshot comparison demonstrating the potential impact of such reforms on filing efficiency:

| Filing Scenario | Current Average Time | Estimated Time Post-Reform |

|---|---|---|

| Individual W-2 Wage Earner | 12 hours | 1.5 hours |

| Small Business Owner | 35 hours | 12 hours |

| Investor with Capital Gains | 20 hours | 5 hours |

To Conclude

As debates over tax reform continue to shape economic policy, The American Prospect offers a critical examination of what constitutes the best tax system on earth. By highlighting the strengths and shortcomings of the current framework, the publication invites readers and policymakers alike to reconsider how tax structures can promote equity, efficiency, and growth. The conversation is far from over, but The American Prospect’s insights provide a valuable foundation for shaping the future of taxation in America.