At the recent Funds Europe Luxembourg conference, industry leaders turned the spotlight on European Long-Term Investment Funds (ELTIFs) and the expanding role of private assets in the region’s investment landscape. As regulatory frameworks evolve and investor appetite for diversified, long-duration assets grows, ELTIFs are emerging as a key vehicle to channel capital into private markets. This development signals a potential shift in fund strategies and opportunities, underscoring the importance of understanding how ELTIFs can unlock access to private assets amid changing market dynamics. The conference provided a timely forum for experts to debate trends, challenges, and future prospects shaping the ELTIF ecosystem across Europe.

ELTIFs Gain Momentum as Key Drivers for Private Asset Growth

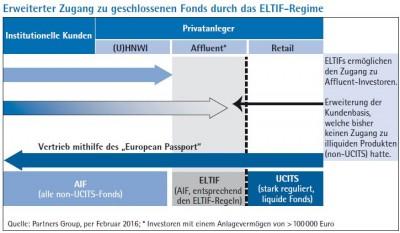

The rise of European Long-Term Investment Funds (ELTIFs) is reshaping the landscape of private asset investments, reflecting a broader shift towards sustainable, long-duration capital deployment. At the Funds Europe Luxembourg conference, industry leaders highlighted ELTIFs as pivotal instruments in channeling institutional and retail investor interest into private equity, infrastructure, and real estate. This renewed momentum stems from regulatory enhancements, increased transparency, and a growing appetite for alternatives that offer stable cash flows and diversification benefits in an era marked by market volatility.

Speakers emphasized several key drivers behind ELTIFs’ growing appeal:

- Regulatory support: Recent amendments have streamlined fund structures and eased investor access.

- Long-term focus: Proven ability to finance projects with extended horizons such as infrastructure and renewable energy.

- Retail participation: Expanded eligibility criteria now allow a broader range of investors to harness private market opportunities.

- Enhanced transparency: Improved reporting standards build investor trust and confidence.

| Asset Class | Expected Growth 2024 | Investor Segment |

|---|---|---|

| Private Equity | 12% | Institutional & Retail |

| Infrastructure | 15% | Institutional |

| Real Estate | 9% | Retail & High Net Worth |

Insights from Funds Europe Luxembourg Conference on Regulatory Advances

The conference spotlighted significant strides in regulatory frameworks influencing ELTIFs and private assets, underscoring the evolving landscape of investment vehicles in Europe. Industry leaders emphasized how the recent updates aim to enhance transparency and investor protection, while simultaneously promoting market accessibility. Discussions highlighted the balancing act between fostering innovation and maintaining robust oversight, particularly as private assets increasingly gain traction among institutional and retail investors alike.

Key regulatory themes emerged among attendees, including:

- Alignment with Sustainable Finance Goals: Integration of ESG criteria within ELTIF offerings to meet evolving investor demand and policy directives.

- Simplification of Cross-Border Distribution: Measures designed to streamline access for funds across multiple EU member states.

- Enhanced Reporting and Disclosure: Stricter requirements to increase transparency and mitigate systemic risks.

| Regulatory Focus | Impact on Market |

|---|---|

| Investor Protection Measures | Greater confidence and participation |

| ESG Integration | Boost in sustainable asset flows |

| Cross-Border Simplification | Expanded fund distribution reach |

Strategies for Maximizing Investor Returns in ELTIF-Focused Fund Structures

To unlock the full potential of ELTIF-focused fund structures, managers must prioritize targeted asset selection combined with strategic diversification. Focusing on private assets such as infrastructure, real estate, and SME financing can provide investors with enhanced yield profiles, but success hinges on rigorous due diligence and proactive management. Employing a dynamic asset allocation approach allows funds to adapt to market fluctuations and sector-specific risks, ensuring steady income streams while mitigating downside exposure. Furthermore, establishing clear exit timelines aligned with investors’ liquidity preferences enhances value realization and investor satisfaction.

Key tactics driving superior investor returns in ELTIFs include:

- Harnessing co-investment opportunities to align interests and amplify upside potential

- Leveraging tax-efficient structures tailored to Luxembourg’s regulatory landscape

- Implementing robust ESG integration, increasingly critical for attracting institutional capital

- Utilizing active portfolio monitoring supported by advanced analytics to optimize performance

| Strategy | Impact on Returns | Implementation Priority |

|---|---|---|

| Asset Diversification | Moderate volatility, increase risk-adjusted returns | High |

| Co-investments | Boosts upside participation, reduces fees | Medium |

| ESG Integration | Attracts institutional capital, improves long-term outlook | High |

| Data-driven Monitoring | Optimizes exit timing and portfolio rebalancing | Medium |

Insights and Conclusions

As the Funds Europe Luxembourg conference draws to a close, the spotlight on ELTIFs and private assets underscores a growing momentum within Europe’s investment landscape. Industry leaders and policymakers alike emphasized the critical role that ELTIFs play in channeling capital towards long-term, real economy projects, while addressing regulatory challenges to foster greater investor access and market transparency. With collaboration between public and private sectors gaining traction, the discussions at Funds Europe have set the stage for a more vibrant and resilient ecosystem for private asset investment. Market participants will be watching closely as these developments continue to shape the future of European fund structures in the months ahead.