The UK jobs market has shown signs of slowing once again, easing some of the inflationary pressures that have challenged the Bank of England in recent months. According to a Reuters report, the latest labour data indicates a moderation in employment growth and wage increases, providing the central bank with a potential reprieve as it balances efforts to tame inflation without stalling economic recovery. This development could influence upcoming monetary policy decisions amid ongoing economic uncertainty.

UK Jobs Market Shows Further Slowdown Raising Hopes for Inflation Control

The latest reports from the UK labor market indicate a continued deceleration in job growth, signaling a potential easing in wage pressures that have fueled inflation concerns. Data shows that hiring rates have cooled down compared to previous months, a trend that could ease the burden on the Bank of England as it navigates monetary tightening measures. Employers remain cautious amid economic uncertainties, resulting in slower recruitment across several key sectors.

Key highlights from the recent jobs data include:

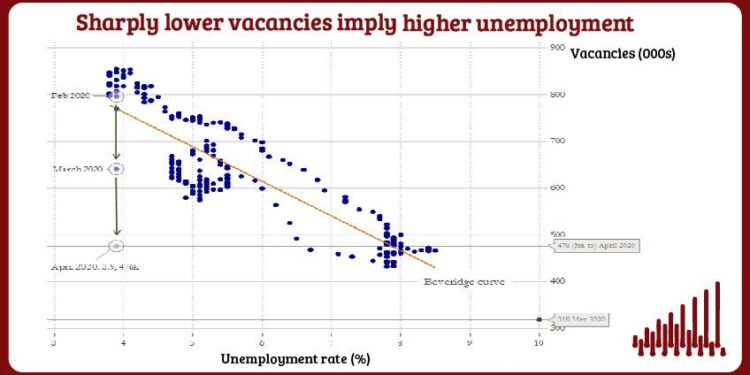

- Reduced job vacancies, particularly in retail and hospitality

- Moderation in average wage increases, aligning closer with inflation targets

- Increased unemployment claims hinting at a softening labor demand

| Sector | Vacancy Change (YoY) | Wage Growth |

|---|---|---|

| Retail | -7% | 3.1% |

| Hospitality | -5% | 3.5% |

| Manufacturing | -2% | 4.0% |

Bank of England Faces Reduced Pressure Amid Cooling Employment Growth

The latest employment data reveal a marked slowdown in UK job creation, suggesting that the labour market is beginning to ease after a period of sustained strength. The softer pace in employment growth diminishes concerns over wage-driven inflationary pressures, potentially allowing the Bank of England to step back from aggressive rate hikes. Analysts note that this cooling in the jobs market aligns with broader economic signals of moderated activity, presenting a window for monetary policy to become less restrictive.

Key indicators supporting this shift include:

- Reduction in monthly job additions: New positions grew at their slowest rate in six months.

- Stabilization of wage growth: Average earnings increases have plateaued, easing inflation concerns.

- Lower labour demand: Job vacancies have declined, indicating a softening hiring appetite among employers.

| Metric | Latest Figure | Previous Month |

|---|---|---|

| Monthly Job Growth | 15,000 | 30,000 |

| Wage Growth (YoY) | 4.2% | 4.1% |

| Job Vacancies | It looks like your table is incomplete, possibly cut off at the “Job Vacancies” row. Here’s a suggestion to complete the last row based on the context provided, formatting it similarly to the other rows: | |

| Job Vacancies | 800,000 | 850,000 |

| Indicator | Recent Trend | Policy Implication |

|---|---|---|

| Employment Growth | Moderate slowdown | Encourages pause in rate hikes |

| Inflation Rate | Still above 5% | Supports gradual tightening |

| Consumer Confidence | Marginal decline | Calls for cautious policy stance |

Concluding Remarks

As the UK jobs market shows signs of further cooling, the easing pressure on wages may provide the Bank of England with greater flexibility in its ongoing efforts to combat inflation. While a slower labor market could bring some relief to policymakers, analysts caution that underlying economic challenges remain, and close monitoring will be essential in the months ahead.