TĂŒrkiye is set to commence imports of liquefied natural gas (LNG) from the United States valued at $43 billion starting in 2027, marking a significant milestone in the country’s energy strategy. The agreement, hailed by Bayraktar as a cost-efficient deal, aims to diversify TĂŒrkiye’s energy sources and strengthen its energy security amid fluctuating global markets. This landmark import deal underscores TĂŒrkiye’s efforts to reduce dependency on traditional suppliers while fostering closer economic ties with the U.S. energy sector.

TĂŒrkiye to Commence $43 Billion US LNG Imports in 2027 Strengthening Energy Security

TĂŒrkiye is set to embark on a significant energy partnership with the United States, initiating a $43 billion Liquefied Natural Gas (LNG) import agreement starting in 2027. This move is widely seen as a strategic step to diversify the country’s energy sources and reduce dependency on traditional suppliers. The deal, praised by prominent officials including Bayraktar, highlights the cost-efficiency and sustainability aspects, aligning with TĂŒrkiye’s broader vision for bolstering its energy security while managing economic impacts effectively.

The agreement promises several benefits for TĂŒrkiye’s energy landscape, including:

- Enhanced supply stability through long-term contracts

- Access to competitively priced LNG from the U.S. market

- Strengthened geopolitical ties between TĂŒrkiye and the U.S.

- Increased capacity to meet rising domestic energy demand

| Year | Projected LNG Volume (Billion cubic meters) | Estimated Cost (Billion USD) |

|---|---|---|

| 2027 | 6.5 | 7.2 |

| 2028 | 7.0 | 7.8 |

| 2029 | 7.5 | 8.1 |

| 2030 | 8.0 | 8.6 |

| 2031 | 8.5 | 9.0 |

Bayraktar Highlights Cost Efficiency and Long-Term Benefits of New LNG Deal

TĂŒrkiye’s ambitious $43 billion LNG import agreement with the United States marks a strategic move toward securing affordable and reliable energy for the coming decades. Minister Bayraktar emphasized that this partnership not only strengthens bilateral relations but also ensures long-term supply stability amid fluctuating global energy markets. By locking in prices and volumes now, TĂŒrkiye is poised to shield its economy from future market volatility while supporting a cleaner energy transition.

The deal’s cost efficiency stems from several key factors, including:

- Fixed-price contracts that reduce exposure to price spikes.

- Volume flexibility catering to TĂŒrkiye’s dynamic energy demands.

- Integrated supply chain solutions that minimize transportation and storage costs.

Below is a summary of projected benefits over the first five years of imports:

| Benefit | Impact | Timeframe |

|---|---|---|

| Cost Stabilization | Up to 15% savings annually | 2027-2032 |

| Energy Security | Continuous supply guarantee | Long-term |

| Market Competitiveness | Improved pricing leverage | Immediate and ongoing |

Strategic Recommendations for Optimizing TĂŒrkiye’s LNG Infrastructure and Market Integration

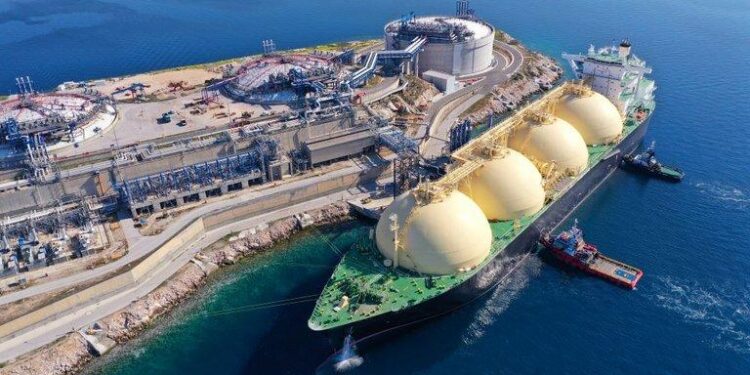

To fully capitalize on the imminent $43 billion LNG import agreement with the US, TĂŒrkiye must prioritize enhancing its existing LNG infrastructure while simultaneously accelerating market integration efforts. Investments should focus on expanding regasification capacities and upgrading pipeline networks to ensure seamless distribution across key industrial hubs. Optimizing storage facilities to handle fluctuating import volumes will also be critical in preventing bottlenecks and reducing operational costs. Additionally, fostering public-private partnerships can facilitate technological innovation and improve supply chain resilience, paving the way for a more agile LNG market.

Market integration requires a multi-faceted approach, combining regulatory reforms with strategic stakeholder collaboration. Simplifying licensing procedures and introducing transparent pricing mechanisms will strengthen investor confidence and attract further capital. Meanwhile, developing robust trading platforms can enhance liquidity and support dynamic demand-supply balancing. The table below outlines key strategic priorities and their expected impact on TĂŒrkiye’s LNG market:

| Strategic Priority | Expected Outcome |

|---|---|

| Infrastructure Expansion | Increased import capacity and distribution reach |

| Regulatory Reforms | Enhanced market transparency and investment appeal |

| Storage Optimization | Operational flexibility and cost-efficiency |

| Trading Platform Development | Improved liquidity and demand-supply balance |

In Retrospect

As TĂŒrkiye prepares to commence its $43 billion LNG imports from the United States in 2027, the landmark agreement marks a significant step in diversifying the nation’s energy sources. Officials, including Bayraktar, have praised the deal for its cost efficiency and strategic importance, highlighting TĂŒrkiye’s commitment to securing stable and affordable energy supplies amid a shifting global market. The forthcoming partnership is set to bolster TĂŒrkiye’s energy security while further strengthening economic ties between the two countries.