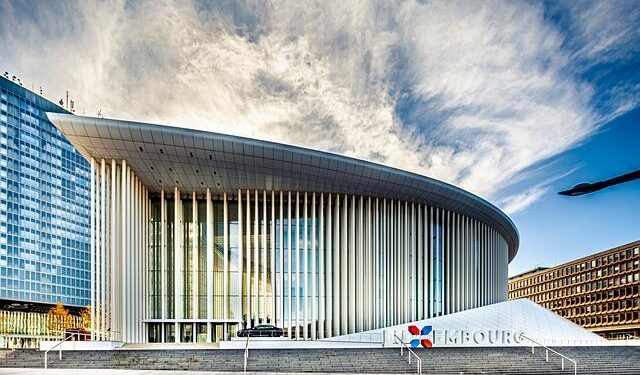

Luxembourg’s financial regulator has eased rules governing semi-transparent exchange-traded funds (ETFs), aligning its framework more closely with recent guidelines set by the Central Bank of Ireland (CBI). The move marks a significant step in harmonizing ETF regulations across European financial hubs, potentially boosting the appeal of semi-transparent ETFs for asset managers and investors alike. This regulatory adjustment reflects ongoing efforts to balance transparency requirements with market efficiency in the rapidly evolving ETF landscape.

Luxembourg Regulator Eases Semi Transparent ETF Requirements to Boost Market Flexibility

The Luxembourg financial regulator has introduced significant changes to the regulations governing semi-transparent exchange-traded funds (ETFs), aiming to enhance market flexibility and align local rules more closely with those set out by the Central Bank of Ireland (CBI). This regulatory shift is expected to foster innovation among asset managers by reducing the administrative burden and allowing for more dynamic disclosure practices. Key relaxations include eased transparency requirements concerning portfolio holdings, enabling funds to balance investor protection with strategic discretion.

Industry experts have welcomed these amendments, highlighting the benefits for both issuers and investors alike. The updated framework allows semi-transparent ETFs to:

- Disclose holdings on a less frequent basis, supporting investment strategies that rely on enhanced portfolio confidentiality.

- Benefit from streamlined reporting obligations that reduce operational complexity and costs.

- Increase market competitiveness by attracting a broader range of fund providers seeking flexible regulatory environments.

| Previous Rule | New Regulation | Impact |

|---|---|---|

| Daily disclosure of holdings | Weekly or bi-weekly disclosure | Enhanced portfolio confidentiality |

| Strict filing deadlines | Flexible reporting timelines | Lower administrative burden |

| Uniform transparency requirements | Tailored transparency regimes | Optimized investor communication |

New Alignment with CBI Rules Signals Greater Cross-Border Regulatory Harmonization

The recent adjustment by Luxembourg’s financial regulator to ease restrictions on semi-transparent ETFs marks a significant step toward aligning with the Central Bank of Ireland (CBI) guidelines. This move facilitates smoother cross-border fund operations and underscores a growing trend in European regulatory bodies striving for coherence. Fund managers can now operate with greater confidence, capitalizing on reduced compliance complexities without compromising investor protection. The recalibrated rules primarily focus on simplifying disclosure requirements and streamlining reporting obligations, fostering a more efficient market environment.

Key implications of this alignment include:

- Enhanced market accessibility: Easier fund launches and cross-border passporting.

- Improved investor transparency: Balanced disclosure fostering both openness and competitive strategy.

- Regulatory efficiency: Minimized divergences leading to cost-efficient supervision and clearer compliance pathways.

| Aspect | Previous Framework | New CBI-Aligned Rules |

|---|---|---|

| Disclosure Frequency | Monthly mandatory reporting | Quarterly with exemptions |

| Investor Access | Limited to domestic markets | Expanded EU passporting |

| Transparency Level | High, potentially restrictive | Balanced transparency |

Industry Experts Recommend Enhanced Disclosure Practices to Maximize Investor Confidence

Leading voices within the investment community have voiced strong support for adopting more rigorous disclosure standards, emphasizing transparency as a pivotal factor in boosting investor trust. Experts suggest that enhanced reporting practices – including clearer communication of portfolio composition, risk metrics, and valuation methodologies – can significantly reduce market ambiguities and foster a more informed investor base. This sentiment aligns with recent regulatory movements seen in Luxembourg, where the easing of semi-transparent ETF regulations mirrors efforts by the Central Bank of Ireland (CBI) to balance investor protection with operational flexibility.

Among the recommended disclosure improvements, specialists highlight:

- Real-time portfolio updates to offer timely insights into fund holdings

- Detailed risk disclosures that cover liquidity, credit, and market risks comprehensively

- Standardized data presentation to enhance comparability across funds and jurisdictions

Such advancements not only aim to elevate regulatory compliance but also seek to empower investors by equipping them with crucial decision-making information. The following table summarizes key transparency features advocated by industry experts:

| Disclosure Feature | Investor Benefit | Implementation Status |

|---|---|---|

| Intra-day NAV Reporting | Improved asset valuation accuracy | Emerging |

| Stress Test Results | Enhanced risk awareness | Recommended |

| Holdings Transparency | Better portfolio understanding | Partially Adopted |

Concluding Remarks

The Luxembourg regulator’s decision to ease semi-transparent ETF rules marks a significant step towards greater alignment with international standards, notably those set by the Central Bank of Ireland. This move is expected to enhance market flexibility and potentially attract increased investment within the region’s ETF landscape. As the industry continues to evolve, stakeholders will be closely watching how these regulatory adjustments influence product innovation and investor demand in Luxembourg and beyond.