In a significant move that underscores its robust financial performance and commitment to shareholder returns,Croatia’s Istarska Kreditna Banka (IKB) is set to propose a higher dividend for the fiscal year 2024. This decision reflects the bank’s positive trajectory amid a challenging economic landscape and marks a strategic effort to enhance investor confidence. As IKB continues to navigate the complexities of the banking sector, its latest dividend proposal signifies both a solid foundation and an optimistic outlook for future growth. this article delves into the implications of IKB’s announcement, examining the factors that have contributed to its financial stability and the potential impact on its stakeholders.

Croatias Istarska Kreditna Banka Pushes for Increased Dividend Yield in 2024

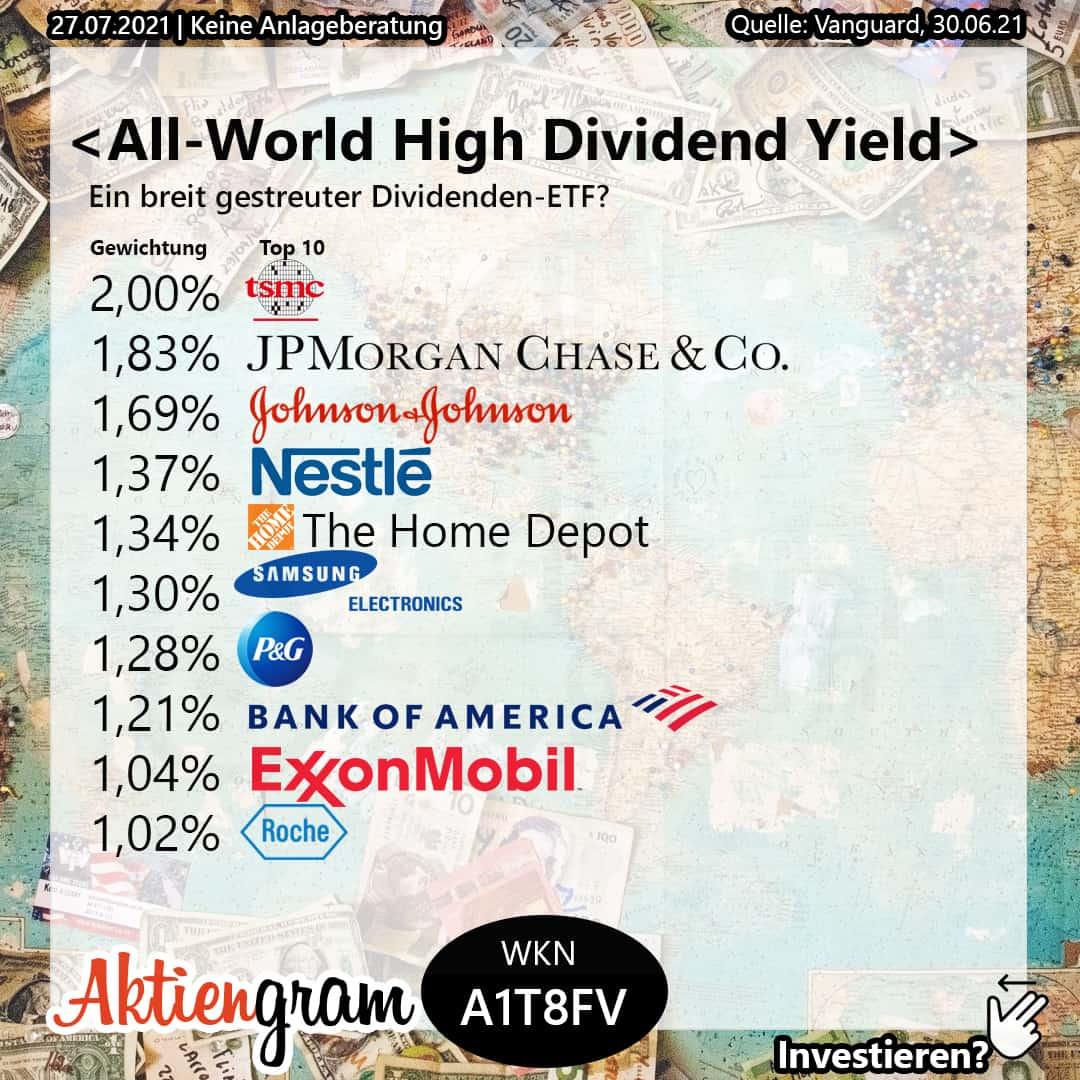

Croatia’s Istarska Kreditna Banka is setting its sights on a substantial boost in shareholder returns as it proposes an increase in dividend payouts for the fiscal year 2024. This strategic move underscores the bank’s commitment to enhancing its attractiveness to investors, reflecting a positive outlook on its financial performance and overall stability. analysts speculate that the anticipated higher dividend yield will be fueled by robust financial results and a sound capital position,paving the way for greater investor confidence.

Key factors influencing this proposed increase include:

- Strong Profitability: The bank has consistently delivered remarkable earnings metrics, reinforcing its capacity to reward shareholders.

- Capital Adequacy: Strong capital ratios may enable more flexibility in re-investing profits while still providing a generous return to shareholders.

- Market Positioning: As a key player in the regional banking sector, Istarska Kreditna Banka’s growth trajectory positions it favorably to generate additional income.

| Year | Proposed Dividend (HRK) | Dividend Yield (%) |

|---|---|---|

| 2023 | 5.00 | 4.0 |

| 2024 (Proposed) | 6.00 | 5.0 |

overview of Istarska Kreditna Bankas Financial Performance

In recent fiscal years,Istarska Kreditna Banka has demonstrated a robust and steady financial performance,reflected in its increasing profitability and solid asset base. The bank reported a significant rise in net income, driven by strategic initiatives aimed at expanding its lending portfolio and enhancing customer service. Key performance metrics include:

- Net Profit Growth: The bank observed an increase of approximately 12% in net profit year-over-year, showcasing effective cost management and revenue generation strategies.

- Asset Quality: The bank maintained a low non-performing loan ratio,contributing to its overall financial stability.

- return on Equity (ROE): A strong ROE of 10.5% indicates effective management of shareholder funds.

Furthermore, Istarska Kreditna Banka’s move to propose a higher dividend for 2024 reflects its confidence in sustainable financial health and commitment to returning value to shareholders. This decision is underpinned by a solid capital base and the bankŌĆÖs strategic focus on enhancing operational efficiency. A summary of the financial indicators is presented in the table below:

| Financial Metric | 2023 Result | 2024 Projection |

|---|---|---|

| net Profit | Ōé¼15 million | Ōé¼16.8 million |

| Non-Performing Loan Ratio | 2.3% | 2.1% |

| Return on Equity | 10.5% | 11.0% |

| Dividend per Share | Ōé¼0.40 | Ōé¼0.50 |

Factors Driving the Proposal for Higher Dividends

The decision to propose higher dividends by Istarska Kreditna Banka in 2024 is influenced by a combination of strong financial performance and supportive economic factors. Over the past year, the bank has reported robust growth in its earnings, bolstered by an increase in lending activities and improved asset quality. This positive trajectory has positioned the bank as a reliable source of returns for its shareholders, leading to confidence in proposing enhanced dividends.

Several key elements contribute to the bank’s ability to sustain higher dividend payouts:

- Increased Net Profit: A year-on-year rise in net profits ensures that there is sufficient liquidity available for distribution to shareholders.

- Strong capital Base: A solid capital base allows the bank to meet regulatory requirements while still satisfying its shareholdersŌĆÖ appetite for dividends.

- Favorable Economic Conditions: The overall economic habitat in Croatia,characterized by growth and stability,creates a conducive landscape for banking operations and profitability.

| Year | Net Profit (Ōé¼ million) | Proposed Dividend (Ōé¼ per share) |

|---|---|---|

| 2022 | 10.5 | 0.50 |

| 2023 | 12.3 | 0.60 |

| 2024 | Projected 14.0 | Proposed 0.75 |

Implications for Shareholders and the Market

the decision by Istarska Kreditna Banka to propose a higher dividend for 2024 is likely to have significant implications for both shareholders and the broader market. Shareholders can expect an increase in return on their investments, which may bolster confidence in the bankŌĆÖs financial health and stability. A substantial dividend payout can communicate the bank’s robust earnings and cash flow position, encouraging potential investors to view it as a lucrative opportunity. Consequently, this could led to an uptick in stock demand, driving the share price upward and reflecting positively on the overall market sentiment.

Moreover, the anticipated dividend raise could set a positive precedent among other financial institutions, prompting a shift in industry standards regarding shareholder remuneration. This action may inspire competitors to enhance their own dividend policies in response,creating a ripple effect in the market. The potential ripple effects could include:

- Increased investor interest in banking stocks,notably within the region.

- A reassessment of valuations for other banks as they may adjust their strategies to remain competitive.

- Potential shifts in portfolio allocation among institutional investors in favor of higher yield securities.

Expert Opinions on Dividend Strategy and Future Outlook

Analysts are viewing the proposal from Istarska Kreditna Banka to increase its dividend payout for 2024 as a significant indicator of the bank’s robust financial health and strategic direction. Experts believe that a higher dividend not only rewards shareholders but also signals confidence in sustained earnings growth and resilience against economic headwinds. This potential increase is happening at a time when many financial institutions are adopting a more cautious approach, adding further weight to the optimistic sentiment surrounding the bank’s future. Key points underscored by analysts include:

- Strengthened Balance Sheet: The bank’s solid capital position is poised to support dividend growth.

- Market Trends: A favorable economic climate in Croatia is expected to enhance banking sector performance.

- Strategic Investments: Investments in digitalization and new services are projected to drive revenue streams.

Looking ahead, many financial experts are positive about the future of dividend strategies within the region’s banking sector. Several analysts anticipate that other financial institutions in Croatia may follow suit, possibly creating a ripple effect that could elevate overall market confidence. As market dynamics shift, the ability to maintain or grow dividends amidst fluctuating interest rates and a global economic landscape will be critical for banks. To further evaluate the competitive landscape, the following table summarizes dividend growth proposals from key banks in the region:

| Bank | 2023 Dividend (Ōé¼) | Proposed 2024 Dividend (Ōé¼) | Growth (%) |

|---|---|---|---|

| Istarska Kreditna Banka | 0.50 | 0.70 | 40% |

| Banco Popular | 0.60 | 0.65 | 8.33% |

| Raiffeisen bank | 0.70 | 0.80 | 14.29% |

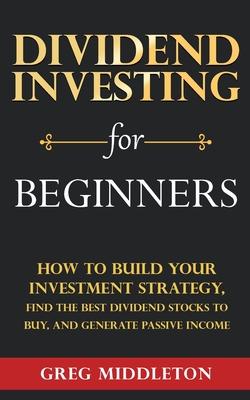

Recommendations for Investors Following Dividend Announcements

Investors should approach the recent announcement of a proposed higher dividend from istarska Kreditna Banka with strategic insight. Such developments can indicate a stable financial position and a commitment to returning value to shareholders. It’s essential to enhance portfolio performance by considering the following factors before making any decisions:

- Evaluate Ancient Trends: Analyze the bankŌĆÖs dividend history to gauge sustainability and growth.

- Market Reaction: Monitor how the market responds post-announcement; fluctuations may present buying opportunities.

- Sector Performance: Compare performance metrics against peers in the banking sector to ensure competitive advantages.

- Economic Indicators: Keep an eye on broader economic indicators that could affect the bank’s operational performance.

Furthermore, itŌĆÖs prudent for investors to reassess their risk tolerance in light of this announcement. While higher dividends are appealing, itŌĆÖs essential to consider the overall financial health of the bank and the macroeconomic environment. Investors might find it useful to construct a simple comparative table of relevant financial metrics:

| Metric | Istarska Kreditna Banka | Industry Average |

|---|---|---|

| Dividend Yield | 4.2% | 3.5% |

| P/E Ratio | 12.5 | 15.0 |

| Debt to Equity | 1.5 | 2.0 |

informed decision-making hinges on meticulous analysis. investors should weigh the benefits of increased dividends against potential risks and broader market conditions to optimize their investment strategy effectively.

in Summary

the proposal by Croatia’s Istarska Kreditna Banka to increase the dividend for 2024 underscores the bank’s robust financial performance and commitment to returning value to its shareholders. As economic conditions continue to evolve, stakeholders will keenly monitor the bank’s strategic initiatives and operational efficiency, which have positioned it favorably in the competitive banking landscape. This decision not only reflects management’s confidence in the bank’s ongoing profitability but also signals a positive outlook for investors. With the upcoming shareholder meeting, all eyes will be on how this proposition unfolds and its potential implications for the bank’s future growth trajectory.